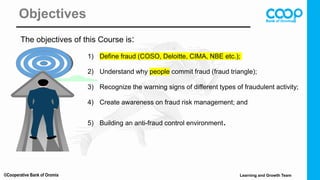

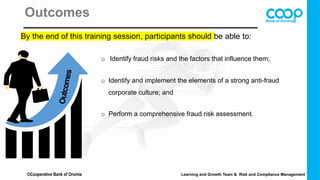

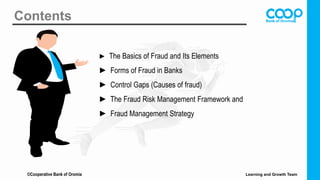

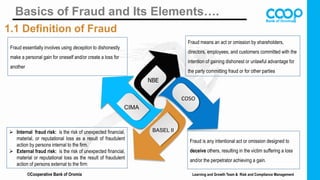

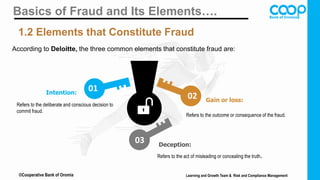

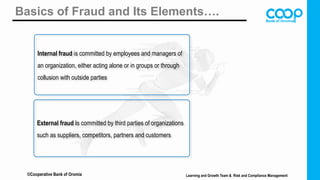

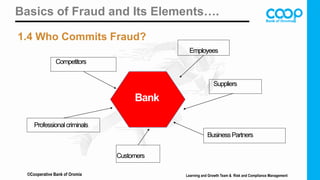

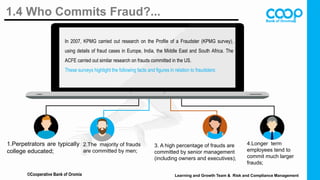

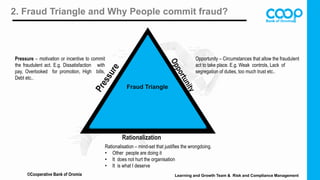

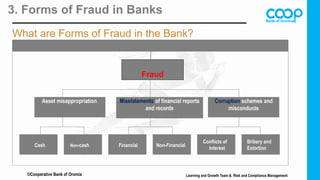

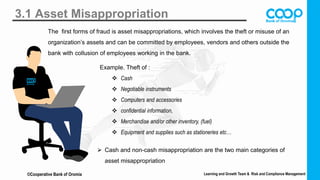

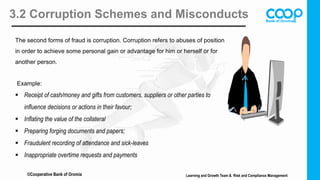

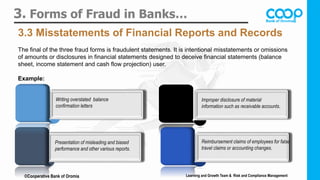

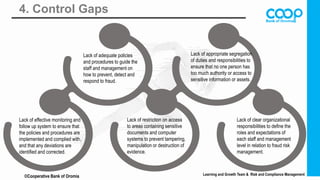

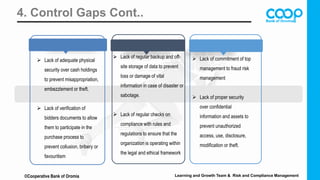

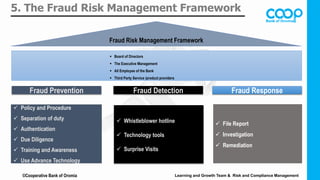

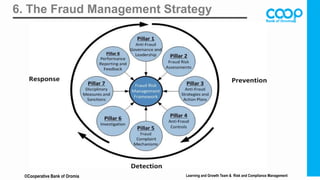

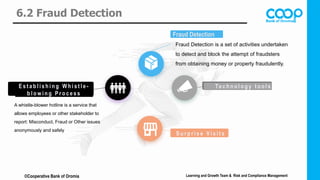

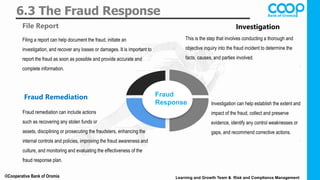

The document outlines a fraud management course by the Cooperative Bank of Oromia, focusing on defining fraud, understanding its causes via the fraud triangle, recognizing warning signs, and building an anti-fraud control environment. Key outcomes include identifying fraud risks, implementing strong anti-fraud culture, and conducting comprehensive fraud risk assessments. The course emphasizes the importance of awareness, effective controls, and a structured framework for fraud prevention, detection, and response in banking operations.