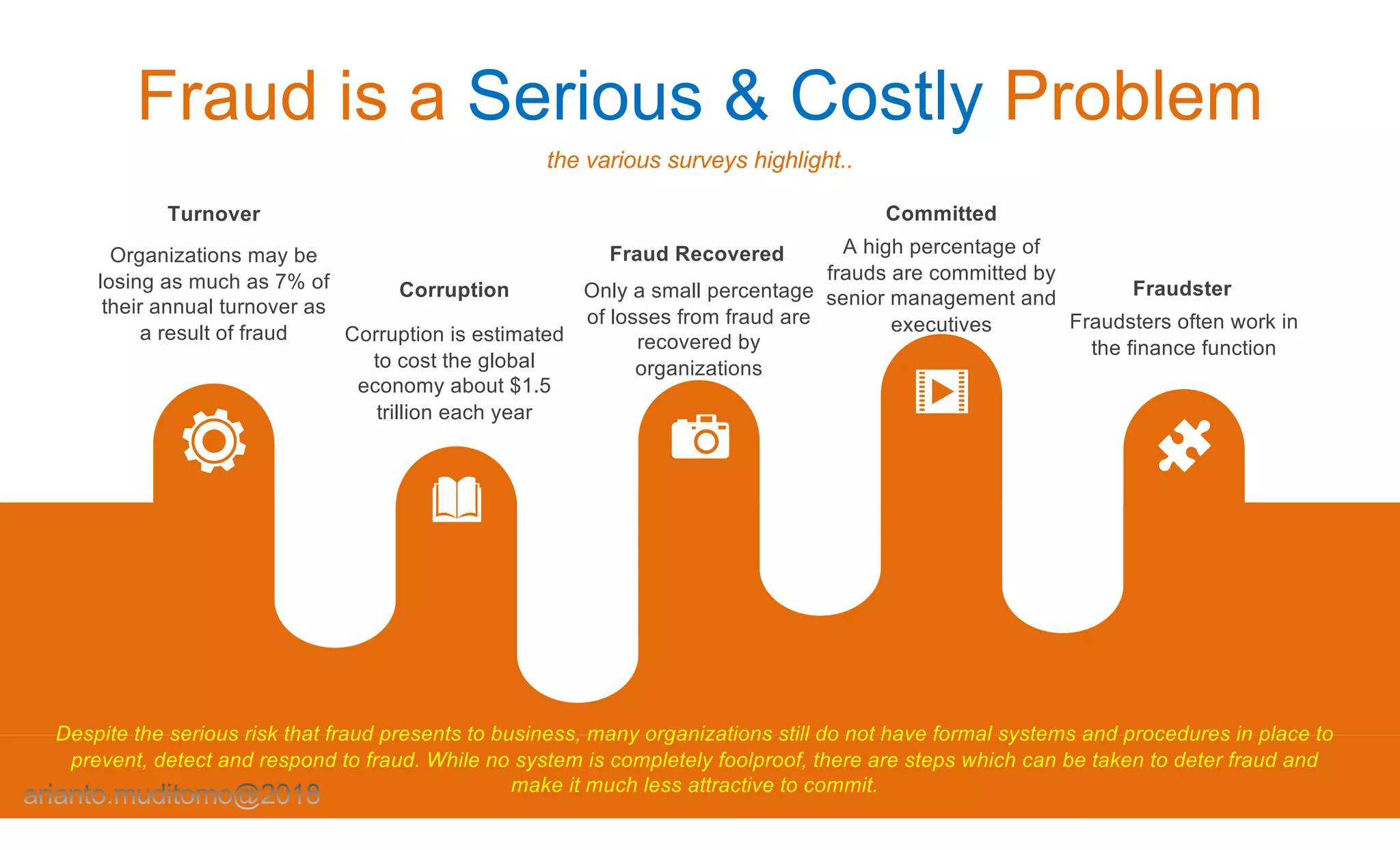

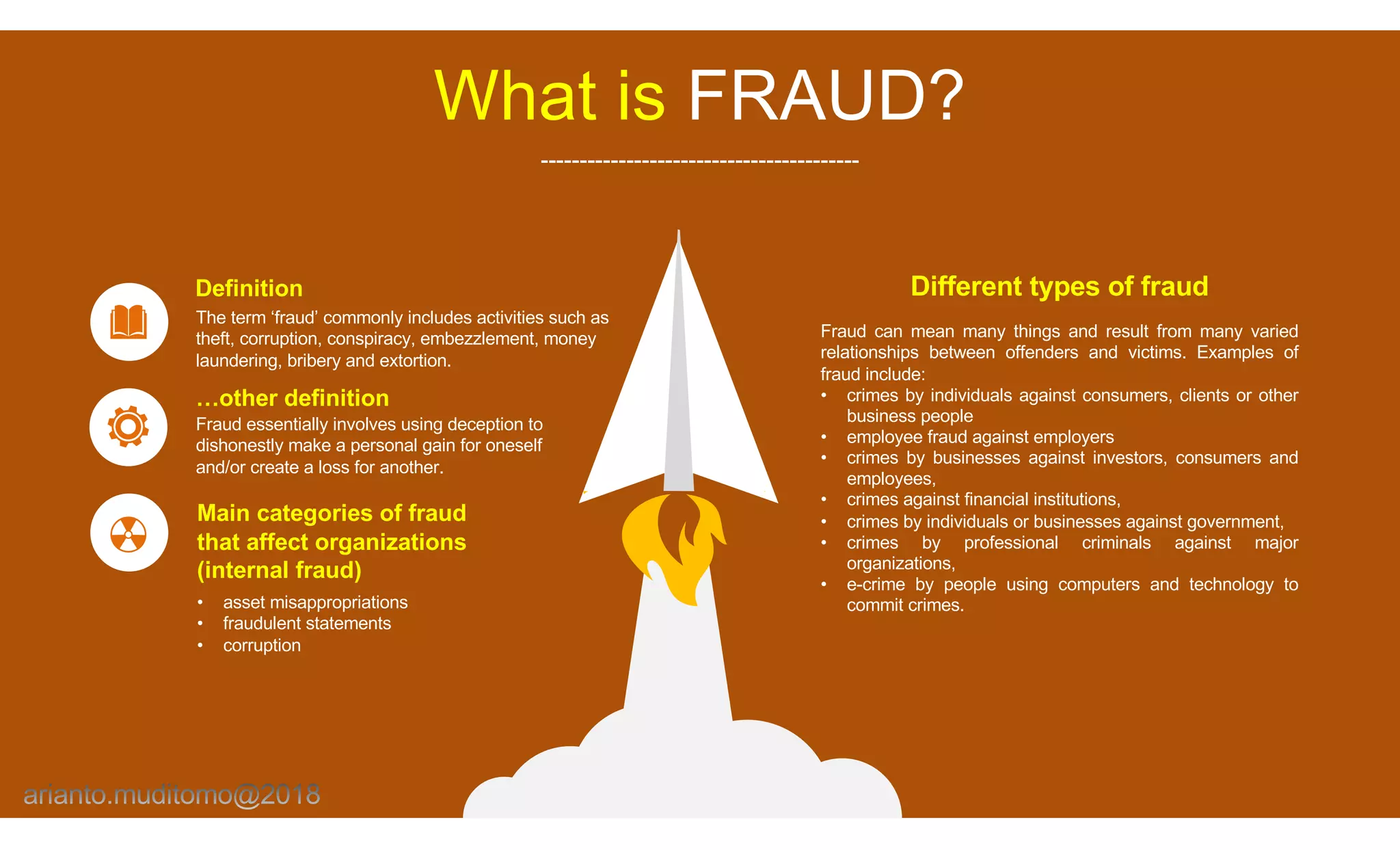

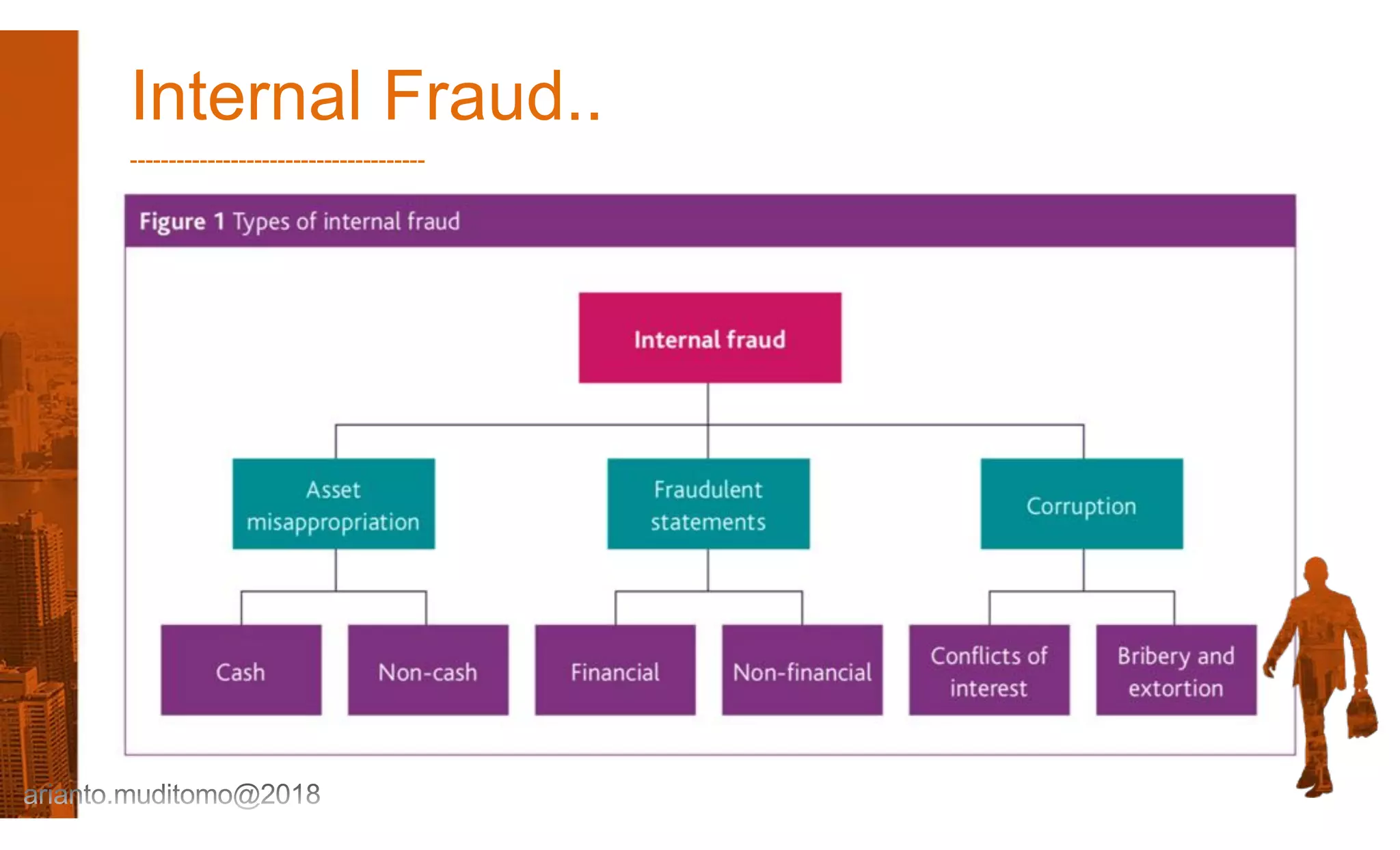

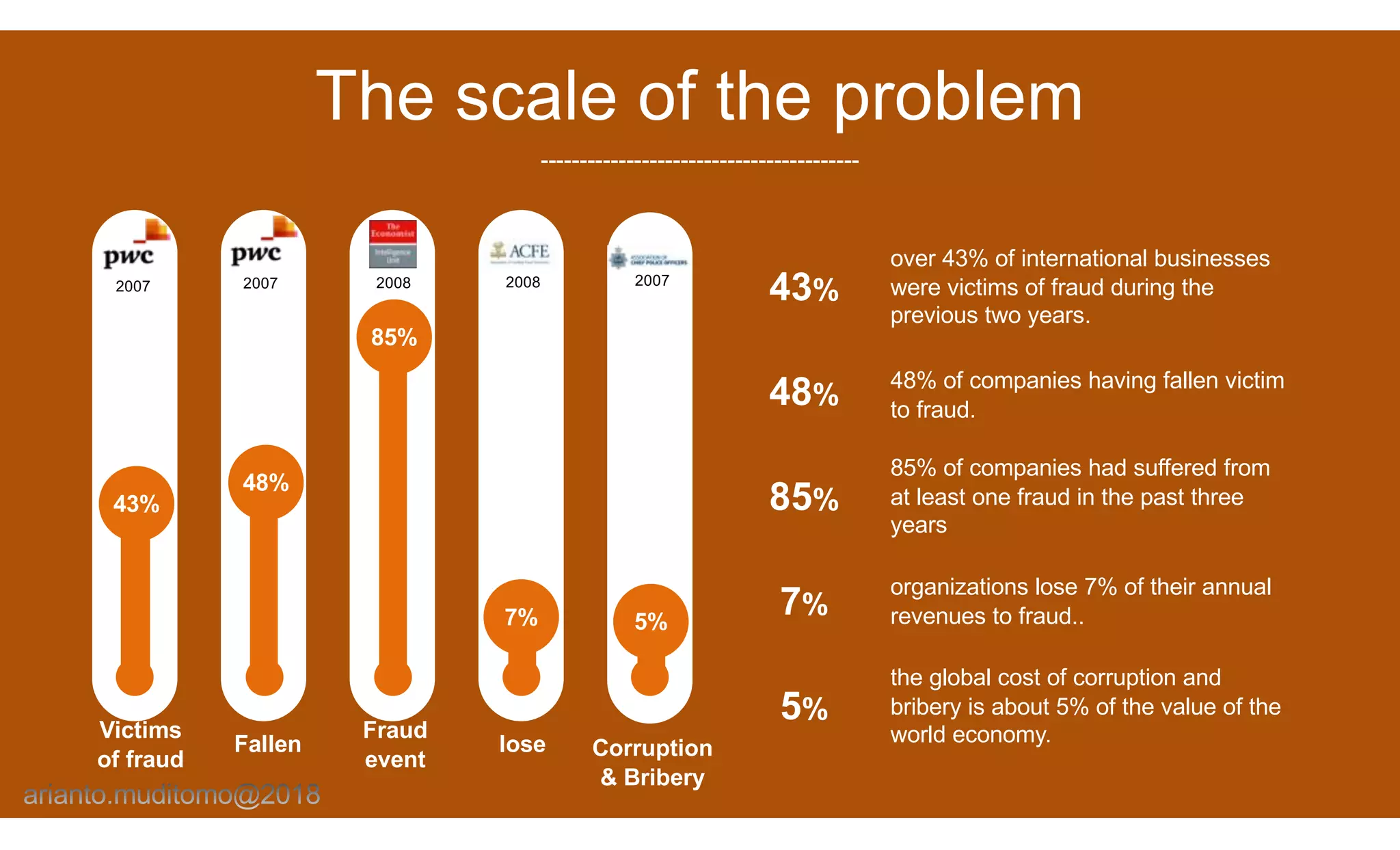

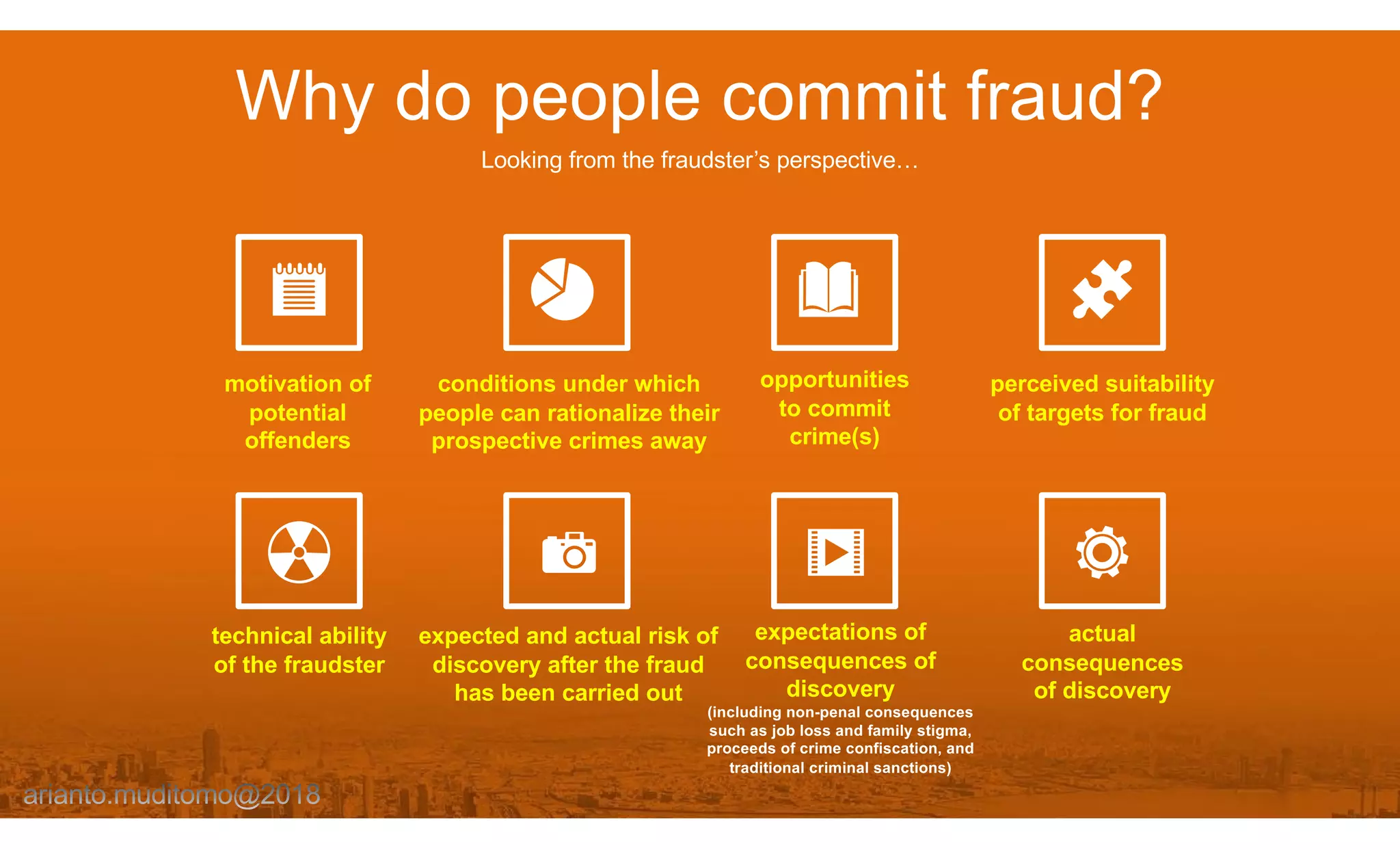

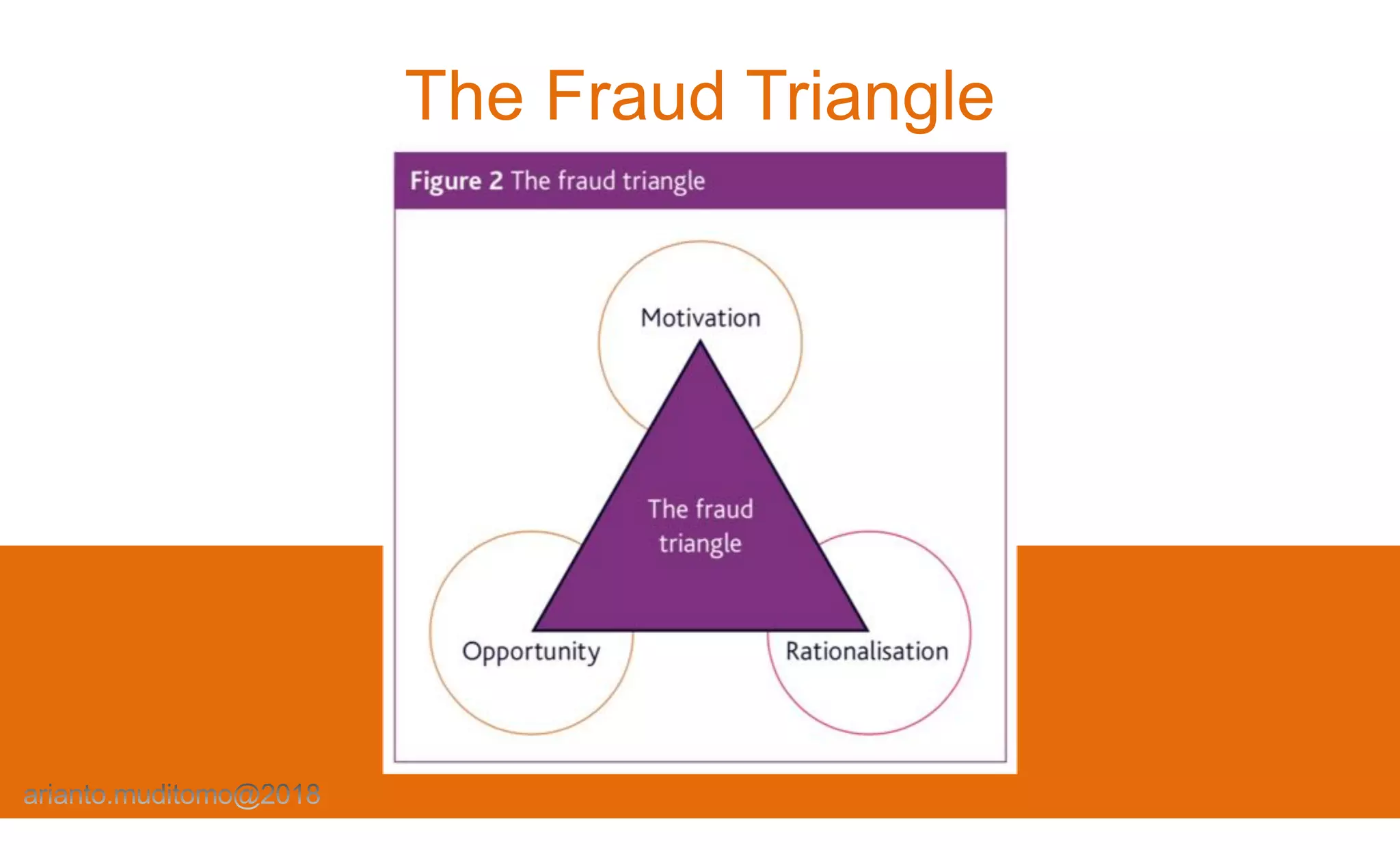

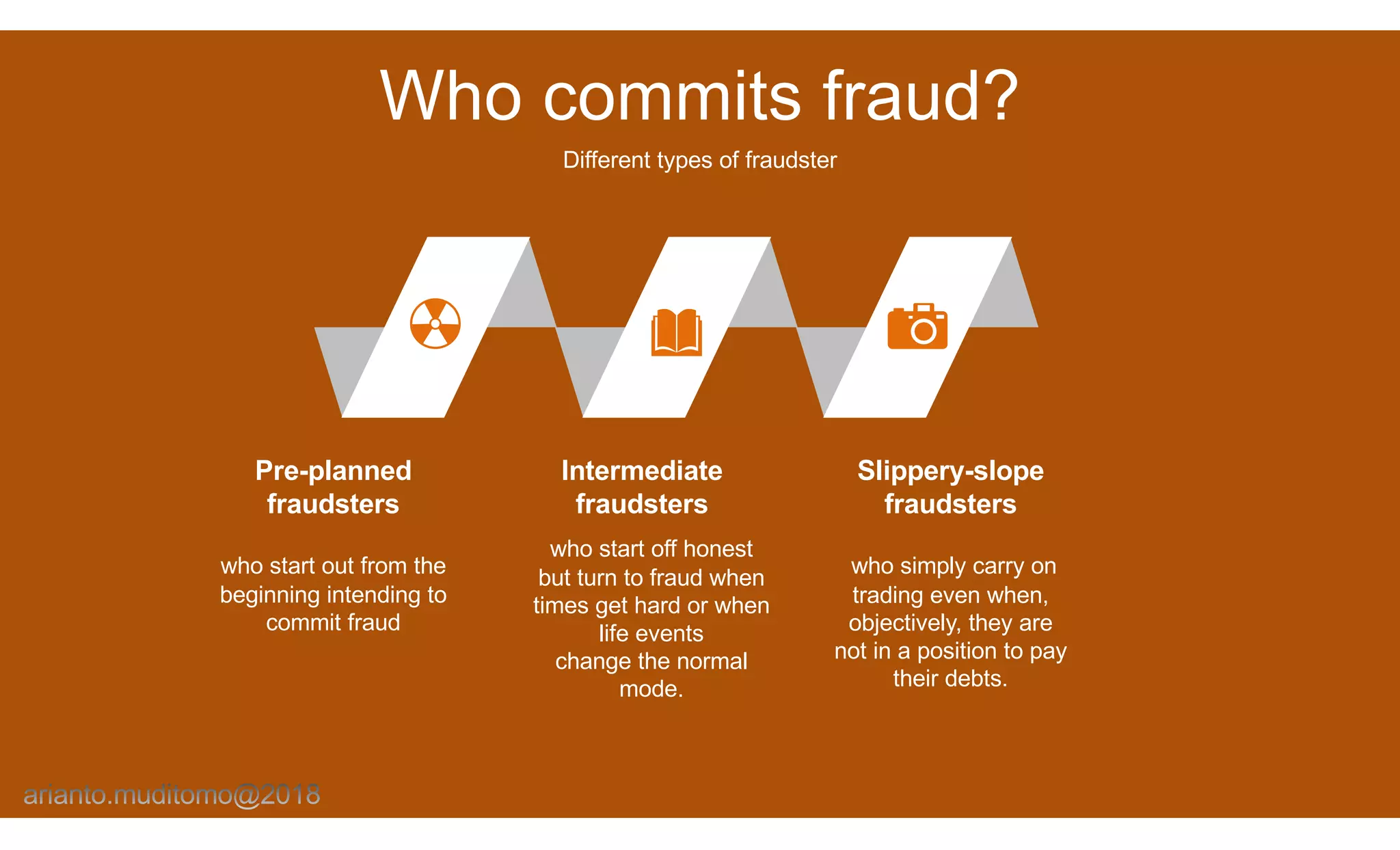

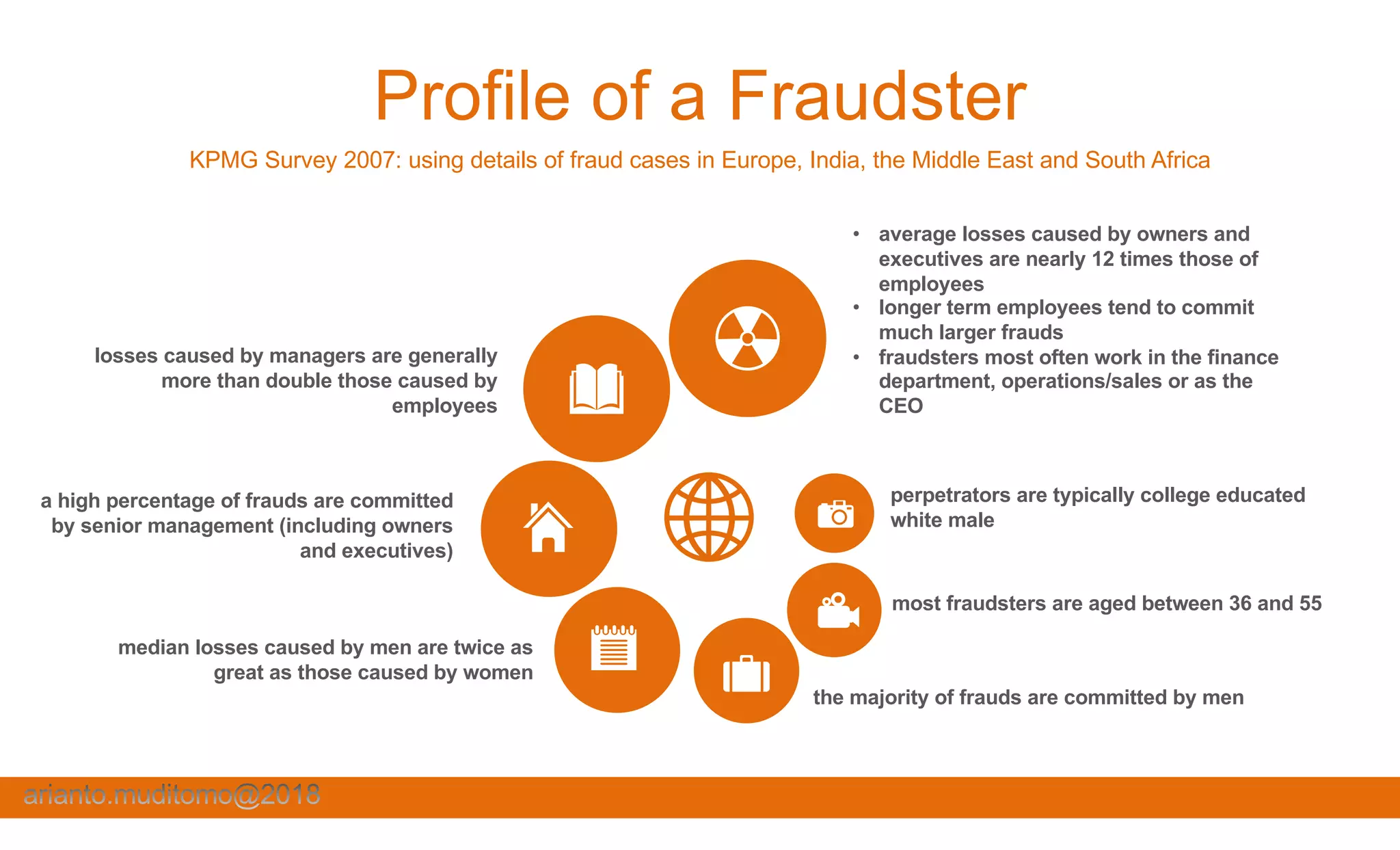

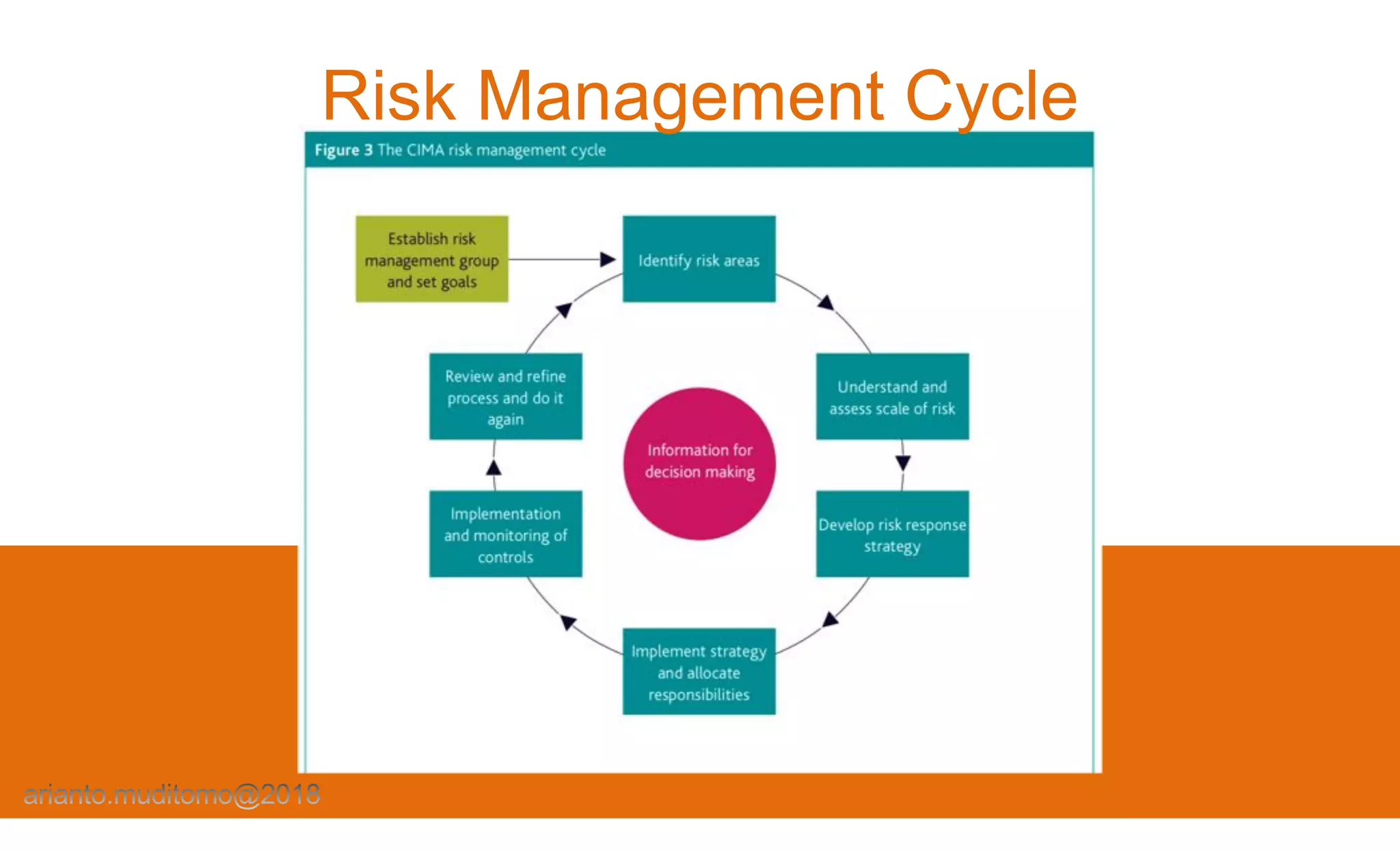

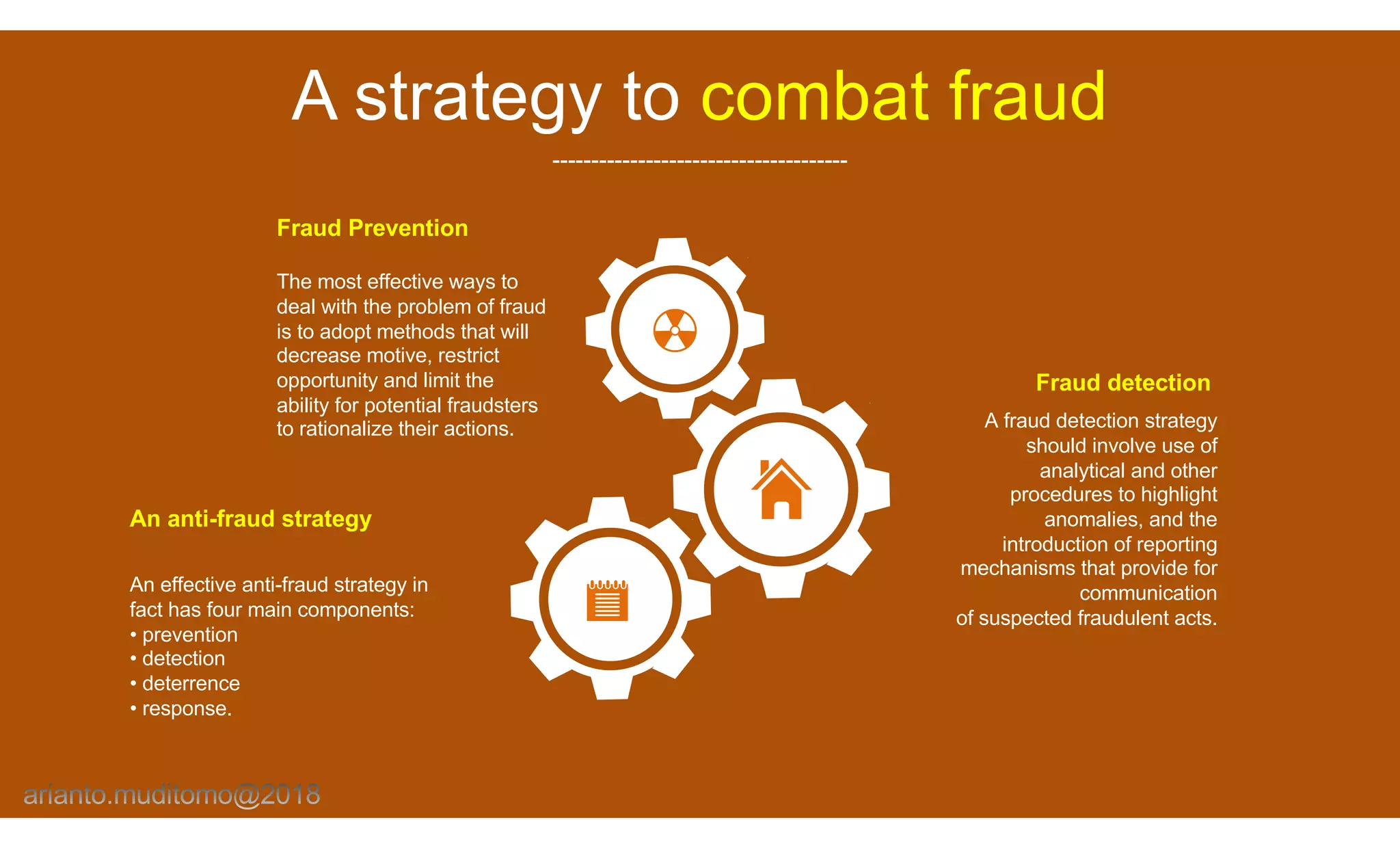

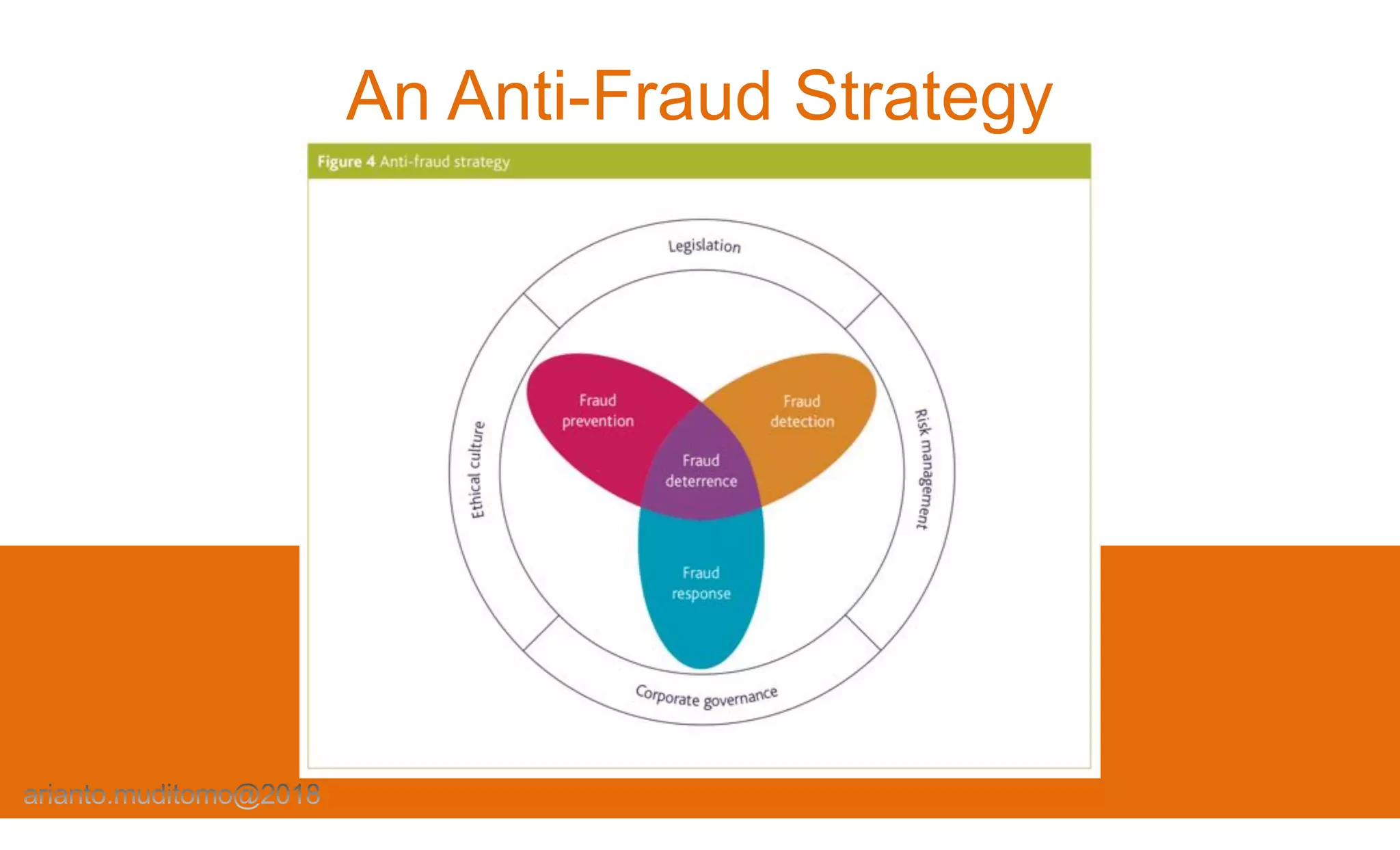

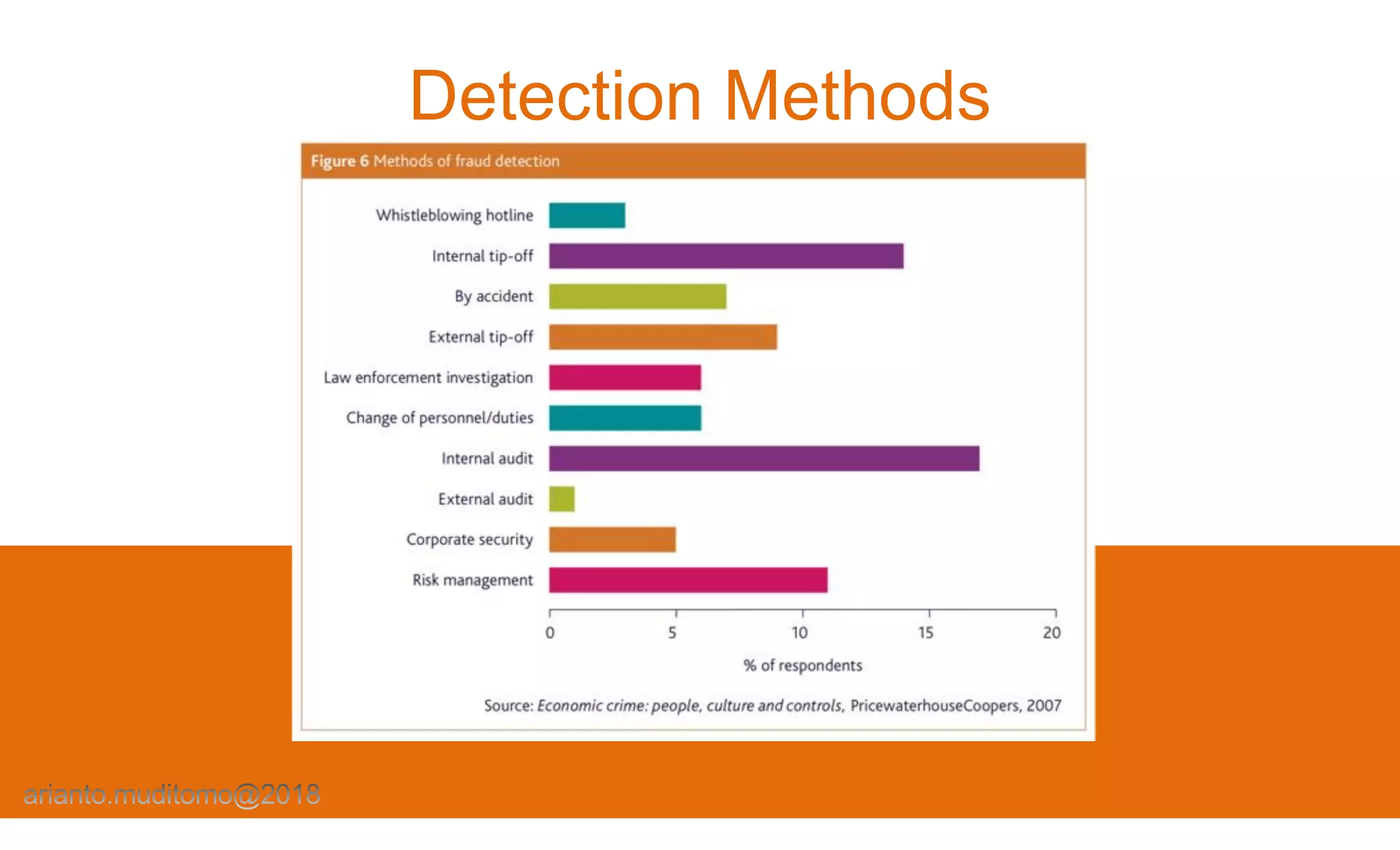

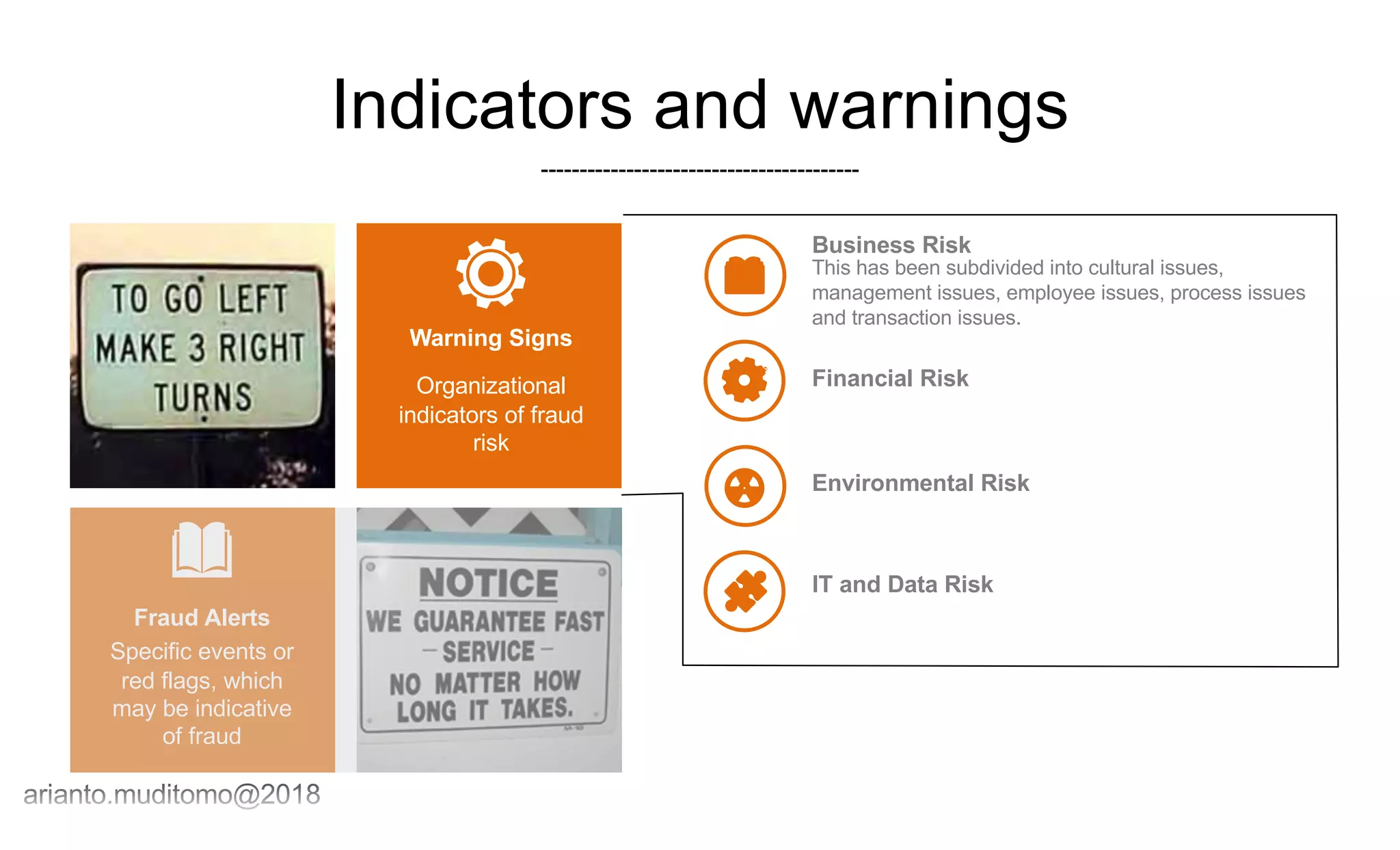

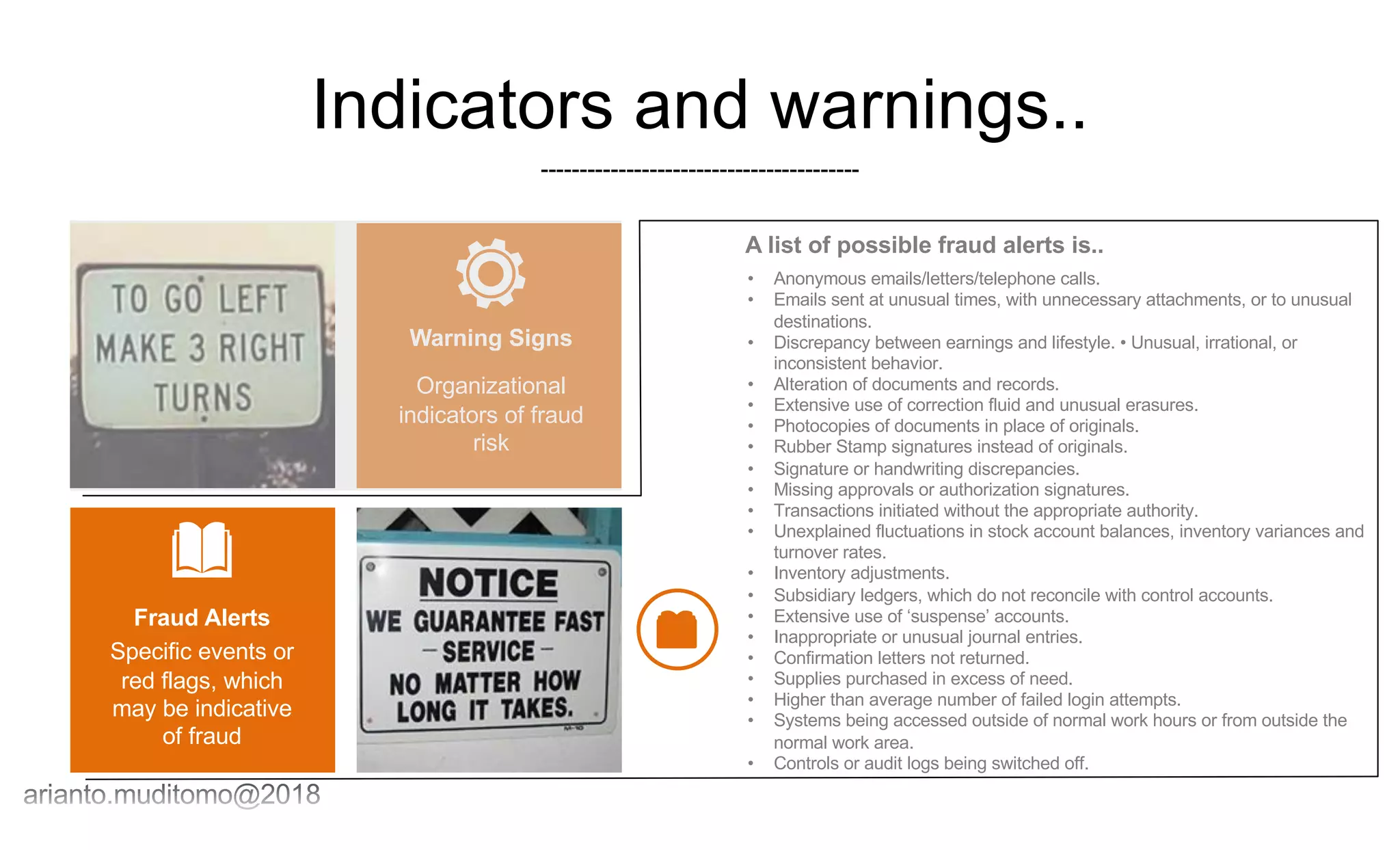

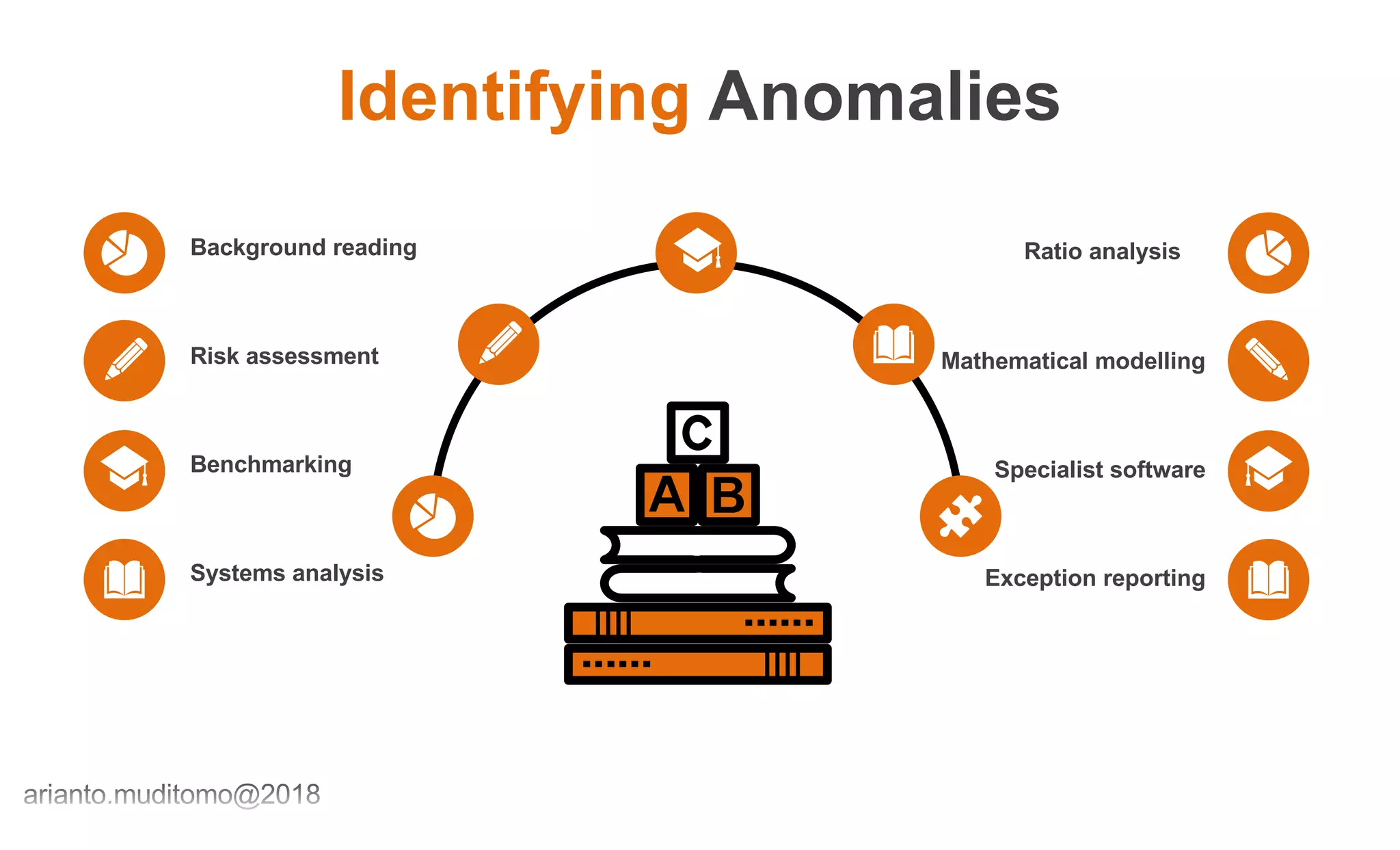

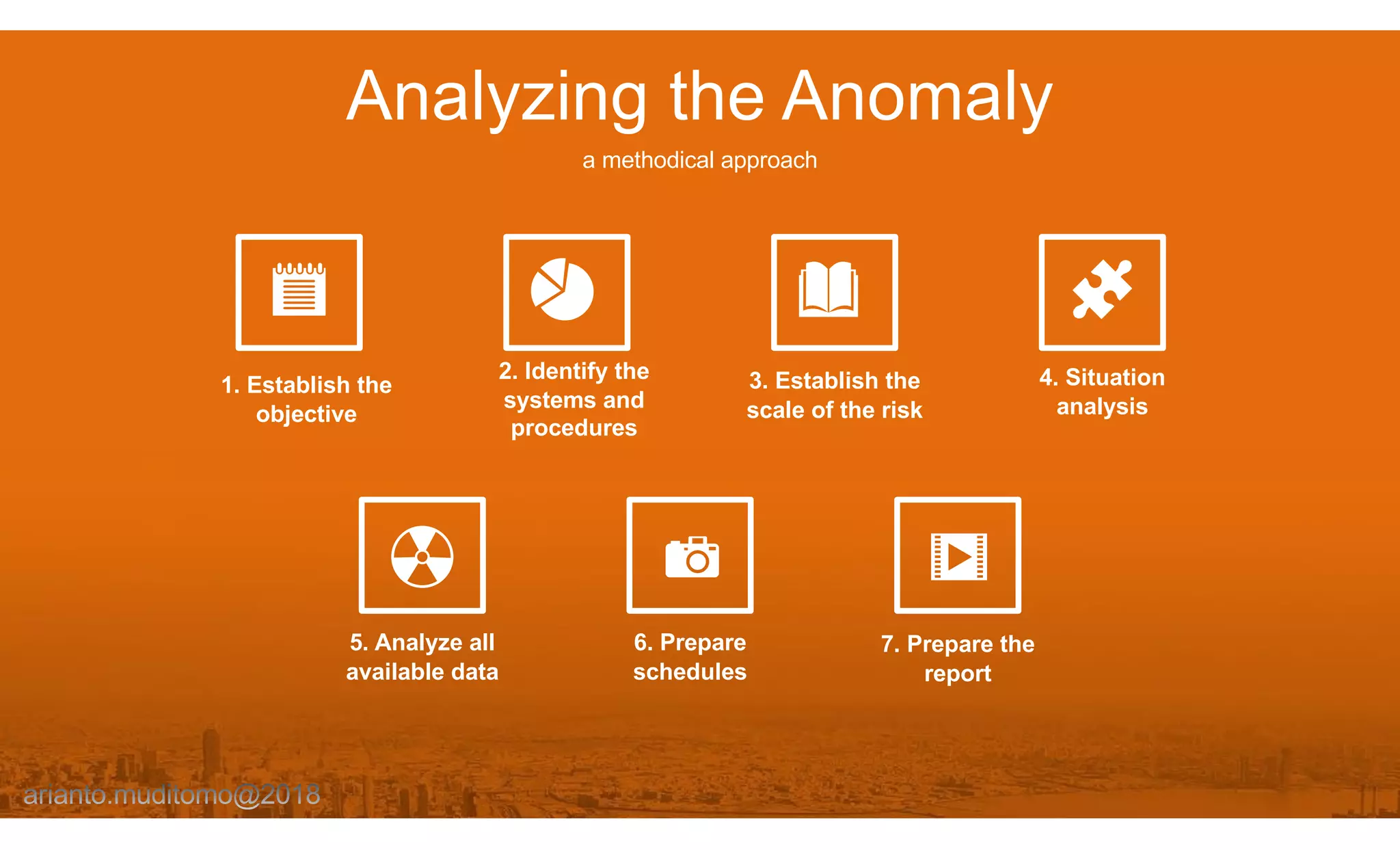

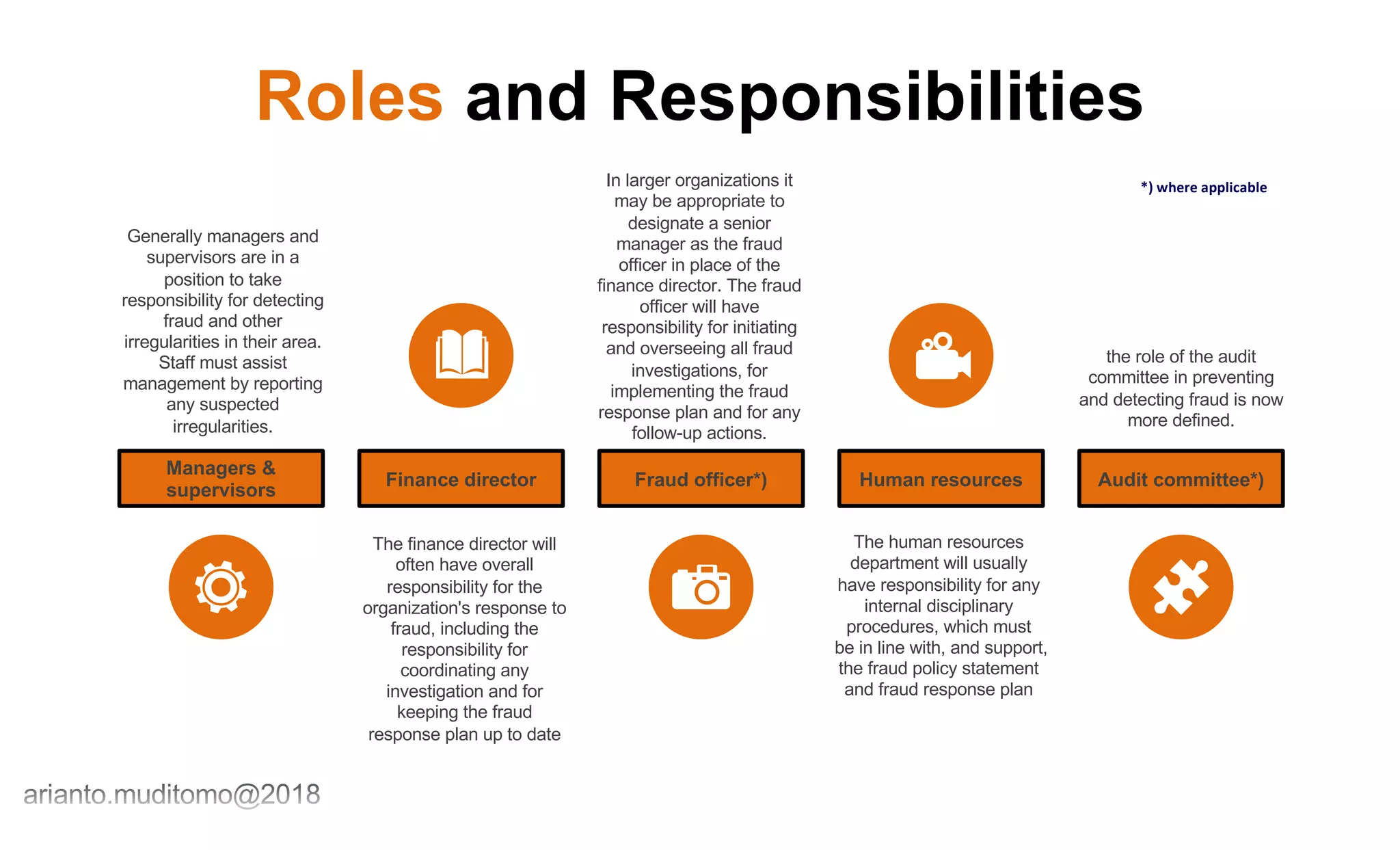

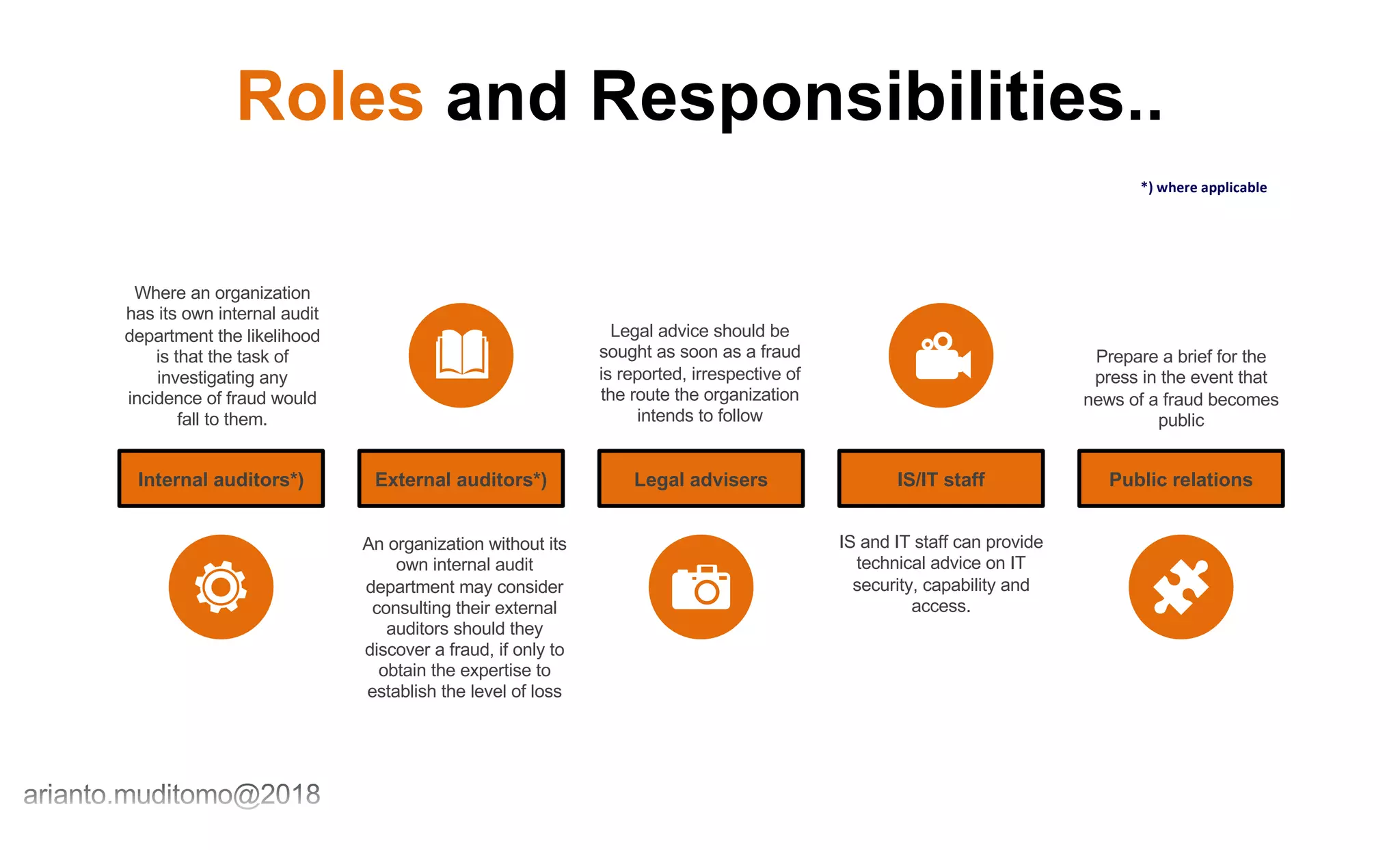

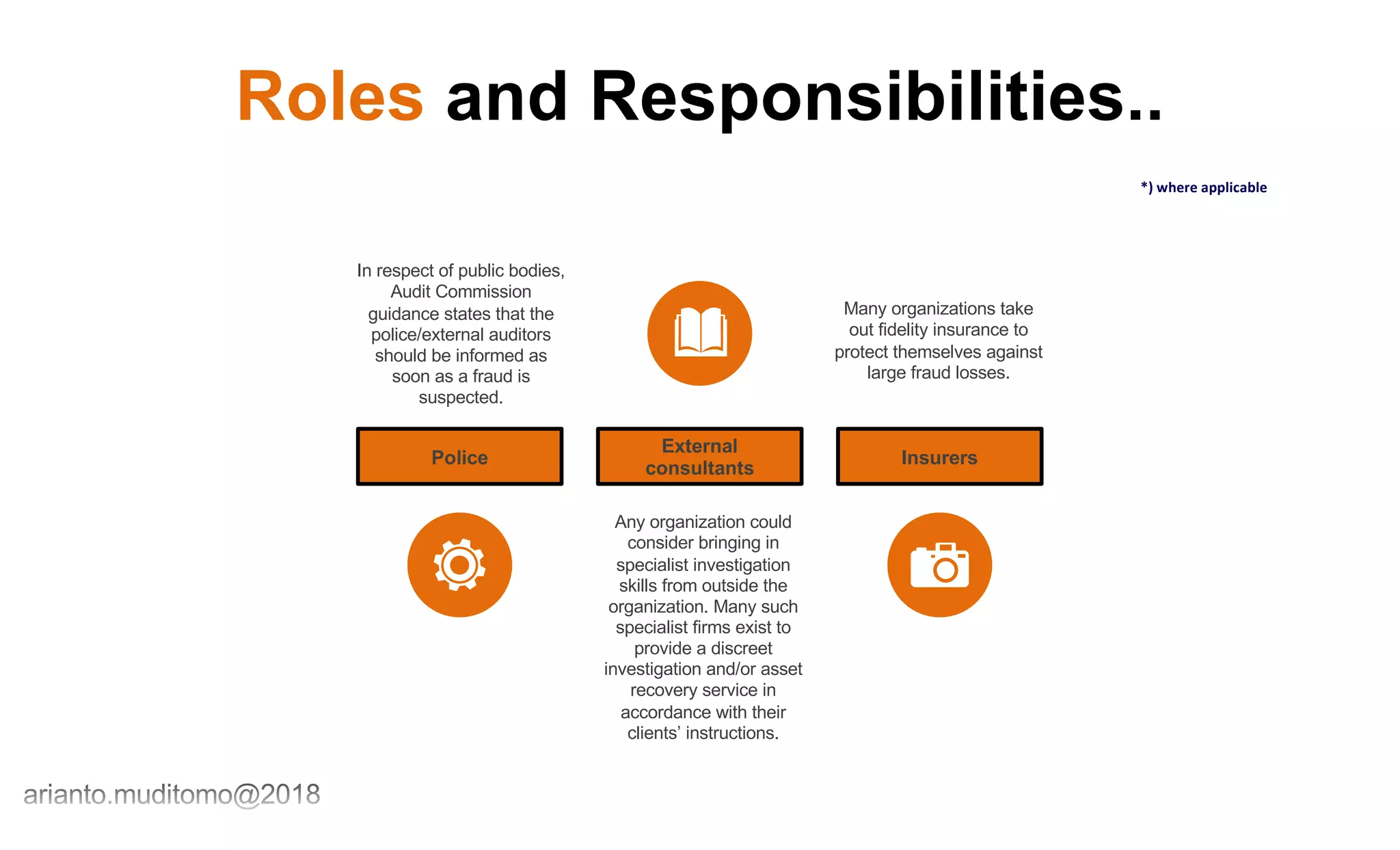

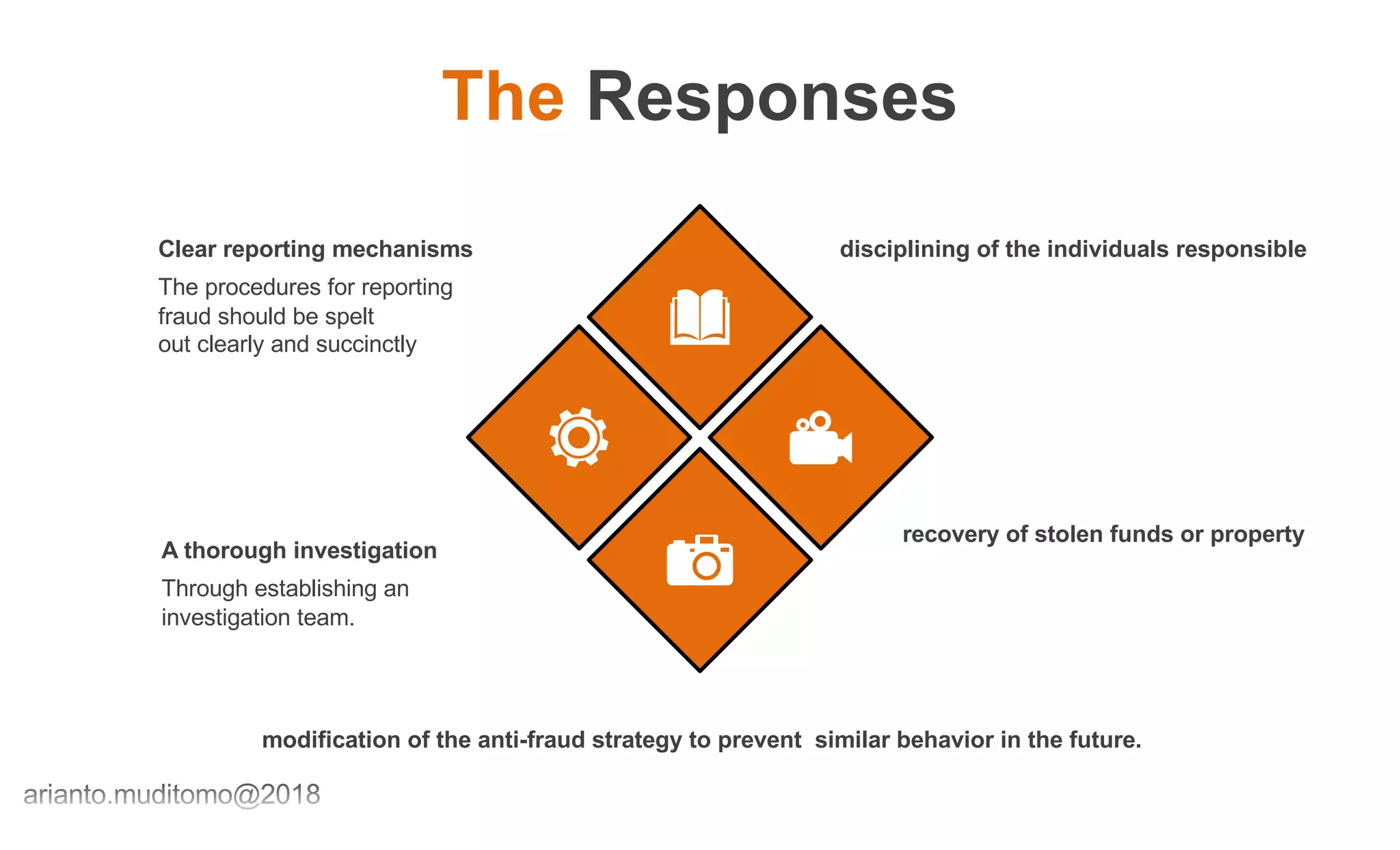

The document is a guide on fraud risk management, detailing the extent, patterns, and causes of fraud, along with strategies for prevention, detection, and response. It highlights that organizations lose significant revenue to fraud each year and emphasizes the importance of establishing robust internal controls and an anti-fraud culture. Additionally, it outlines the characteristics of fraudsters and the necessary frameworks that organizations should adopt to manage and mitigate fraud risks effectively.