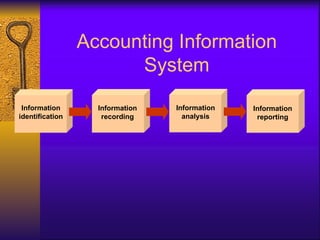

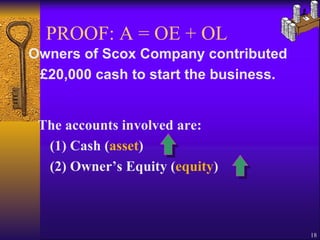

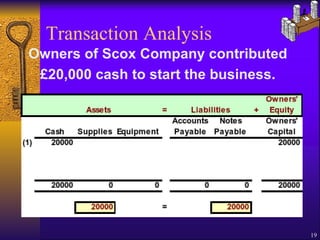

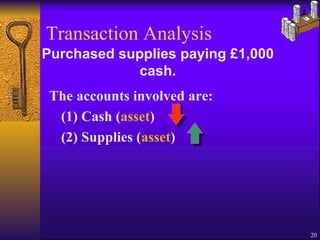

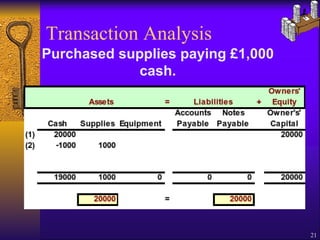

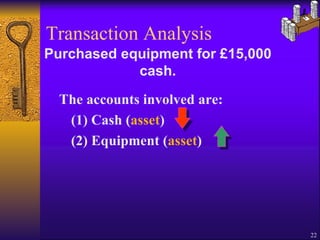

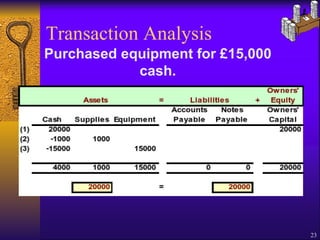

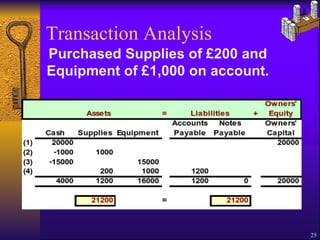

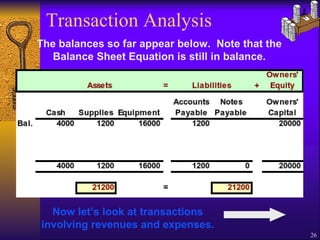

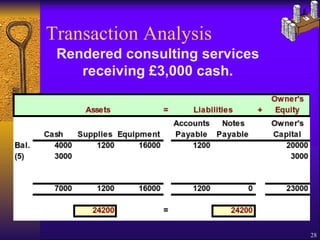

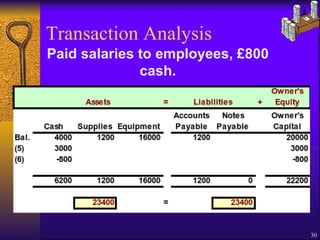

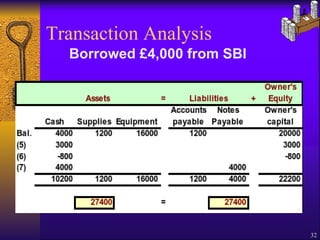

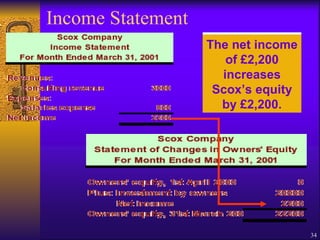

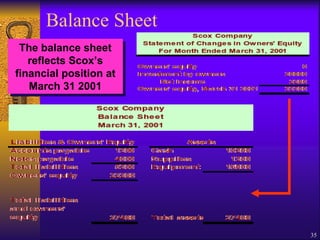

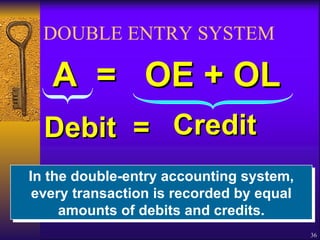

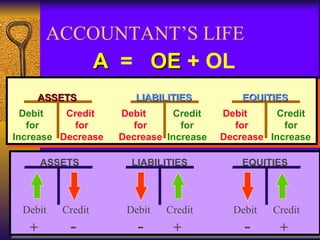

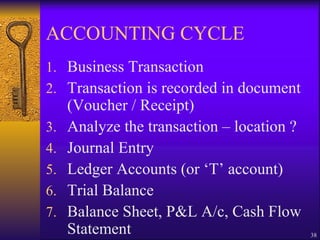

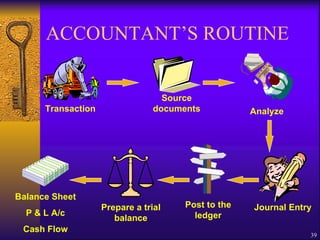

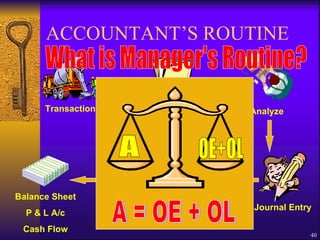

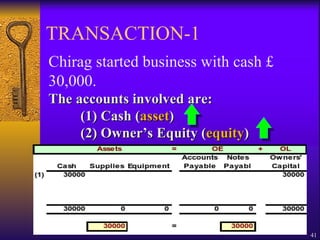

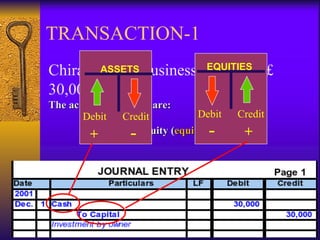

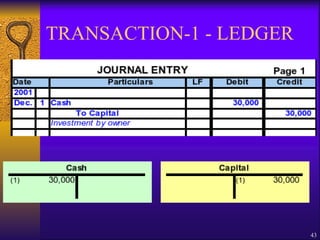

This document provides an overview of key accounting concepts, conventions, principles and the accounting cycle. It discusses the accrual basis, going concern concept, matching principle and other fundamental accounting concepts. It also explains accounting equations, debits and credits, journals, ledgers and how to record basic business transactions.