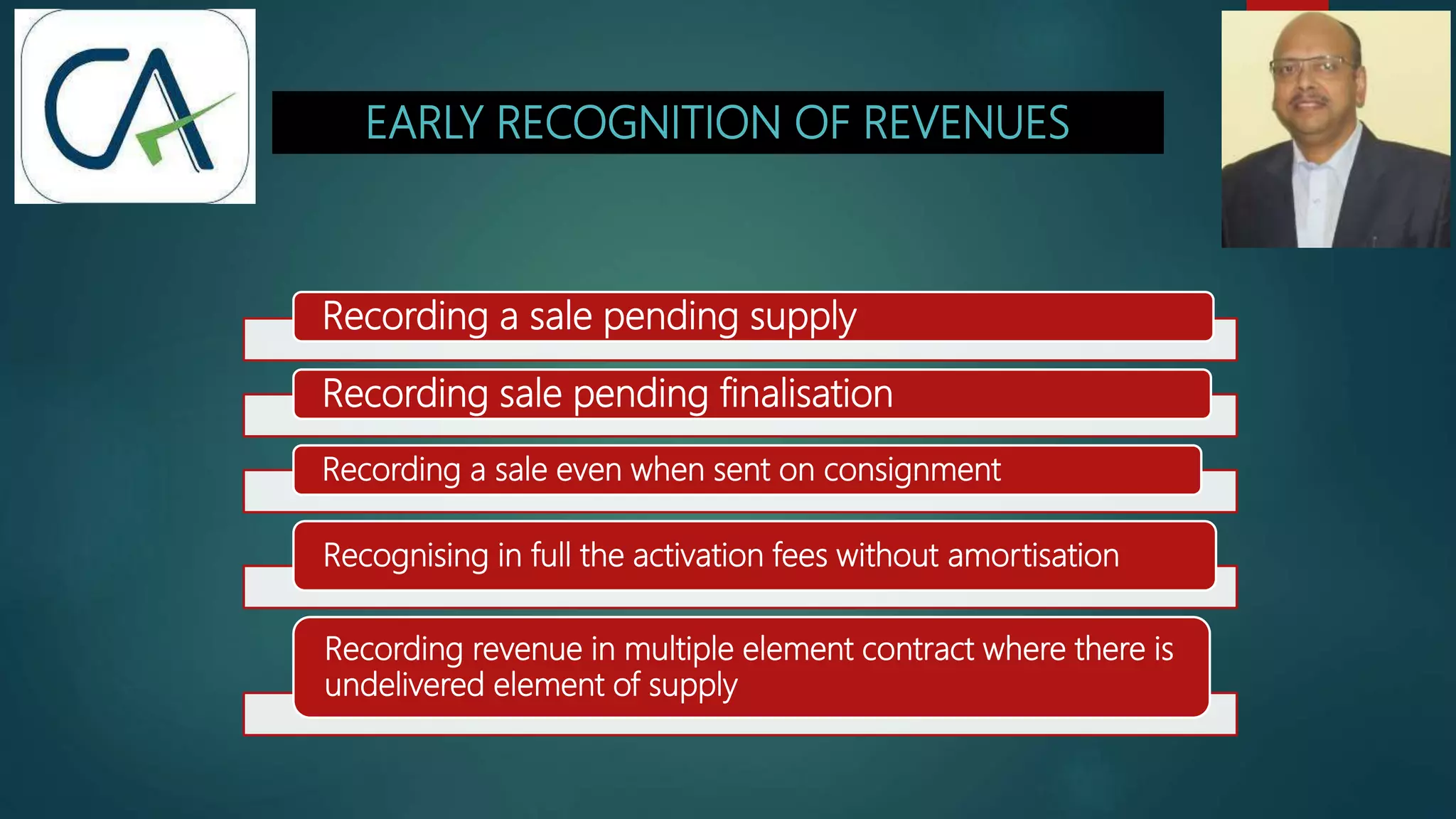

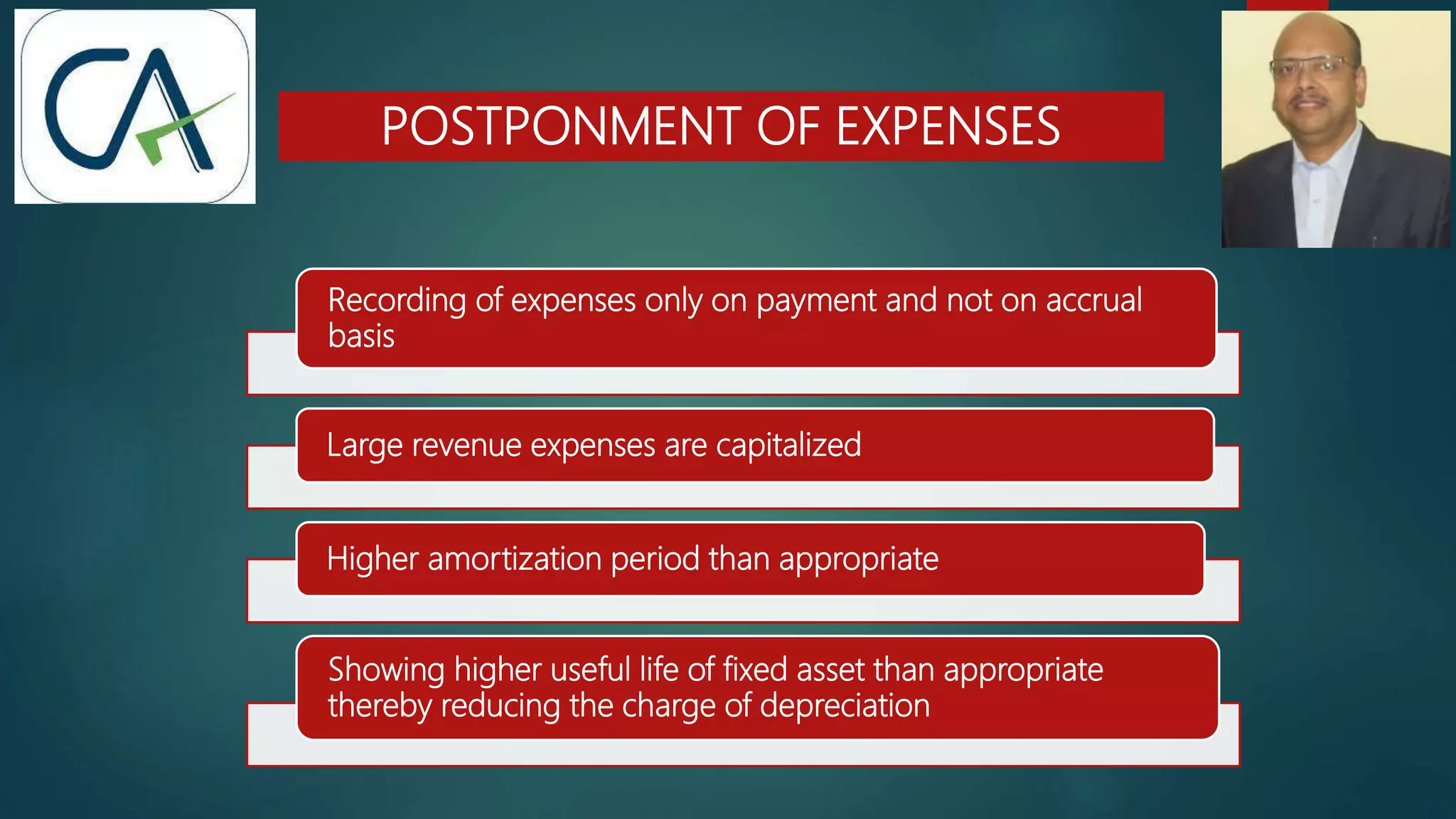

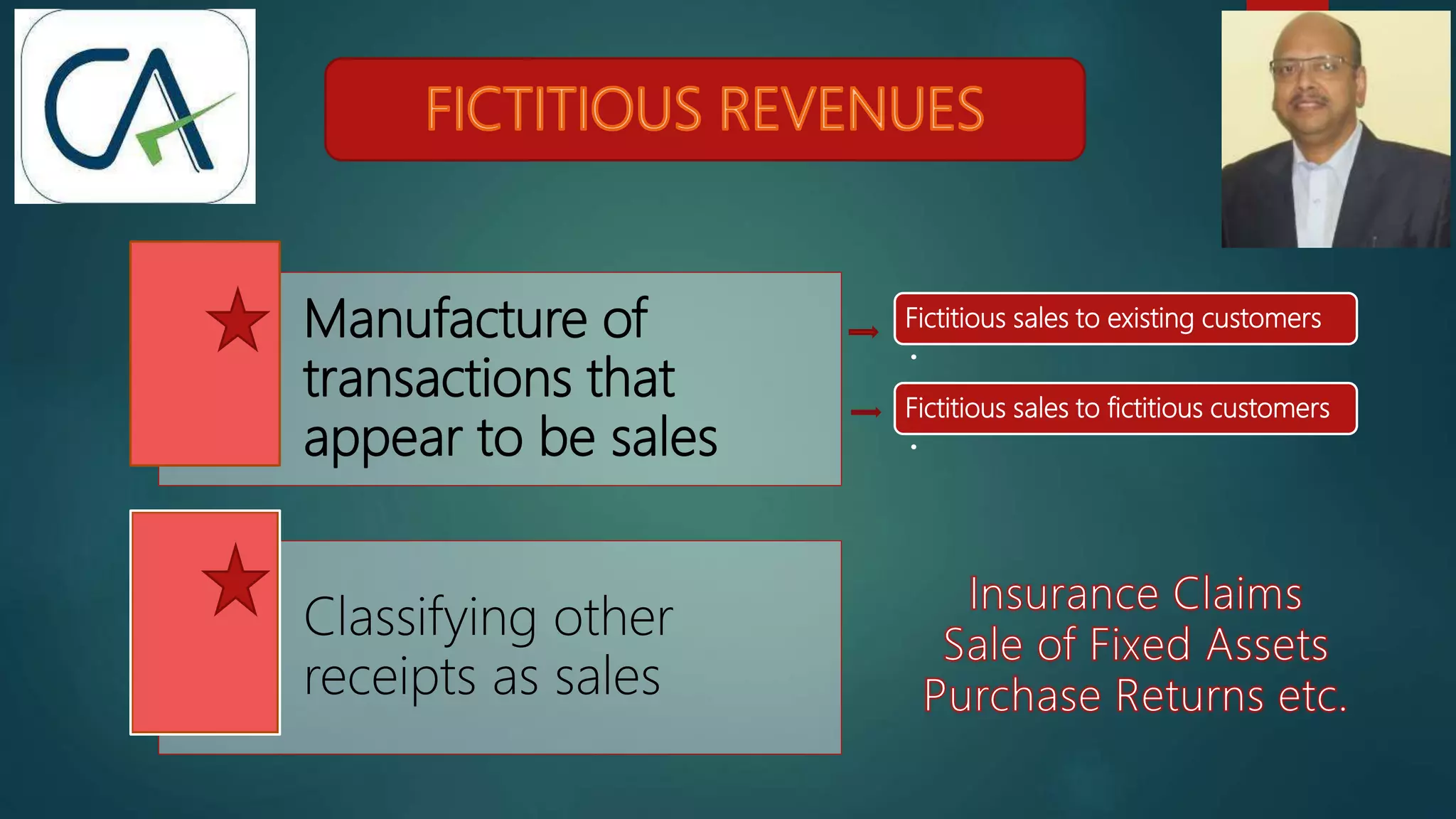

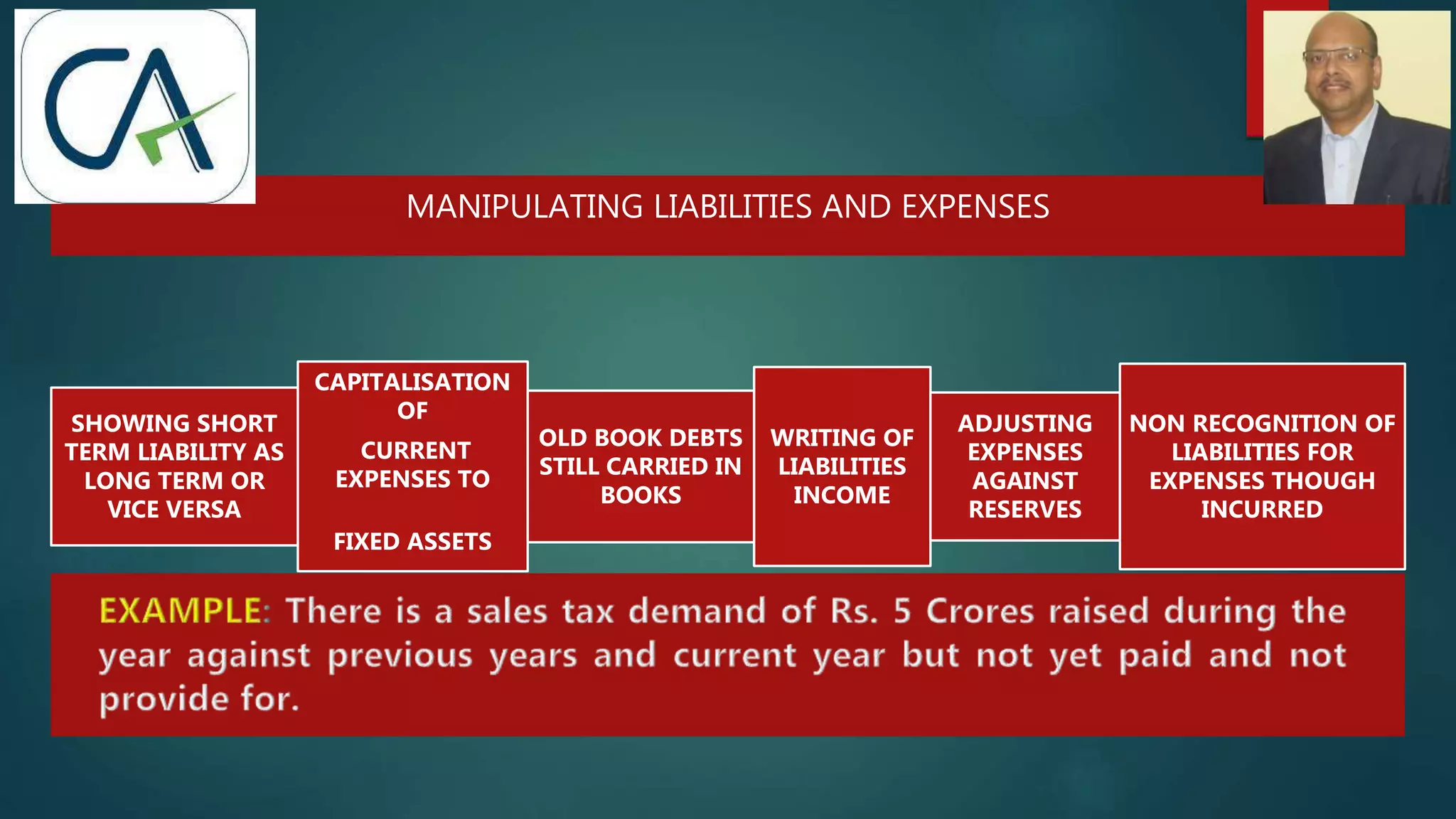

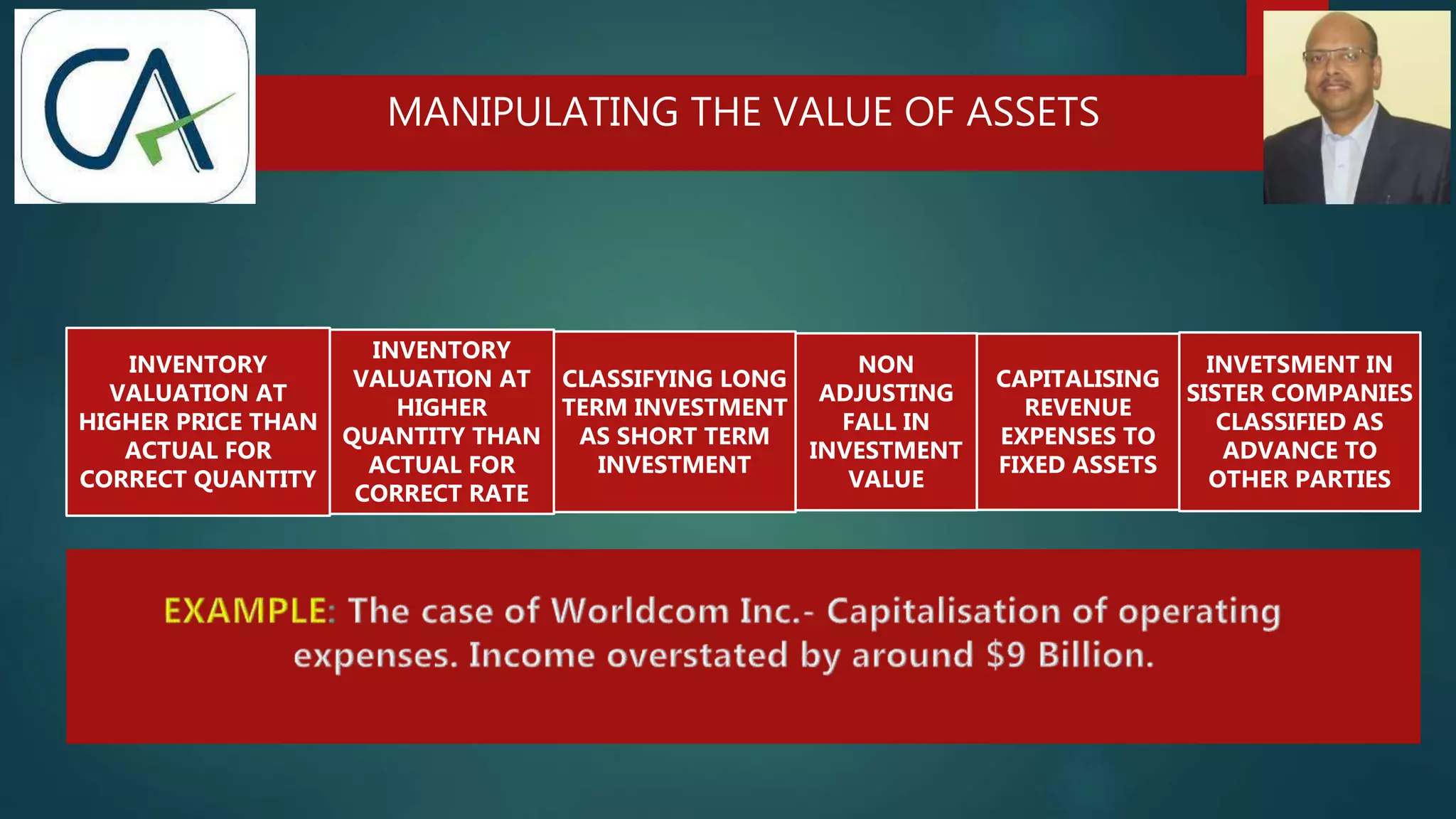

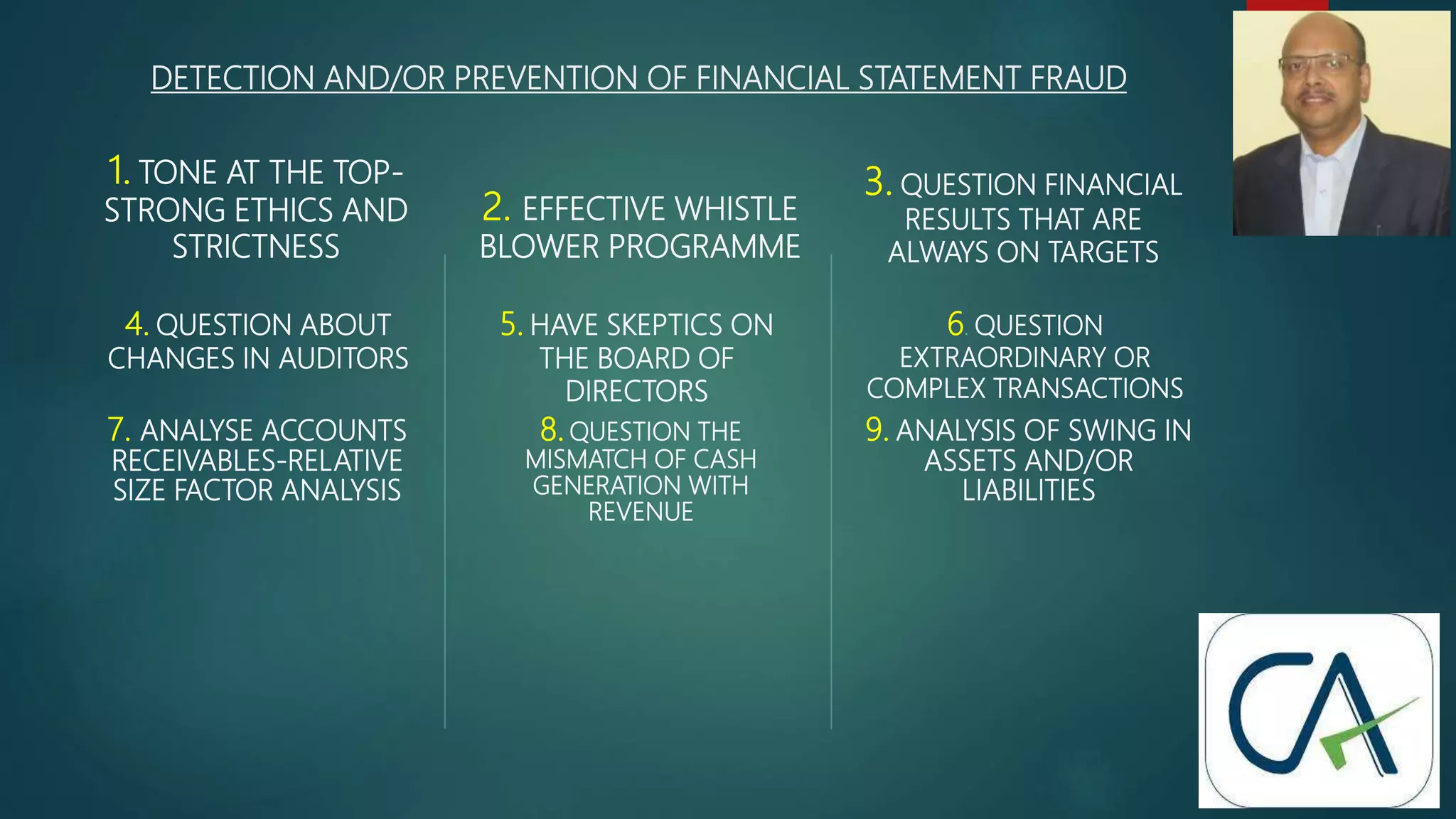

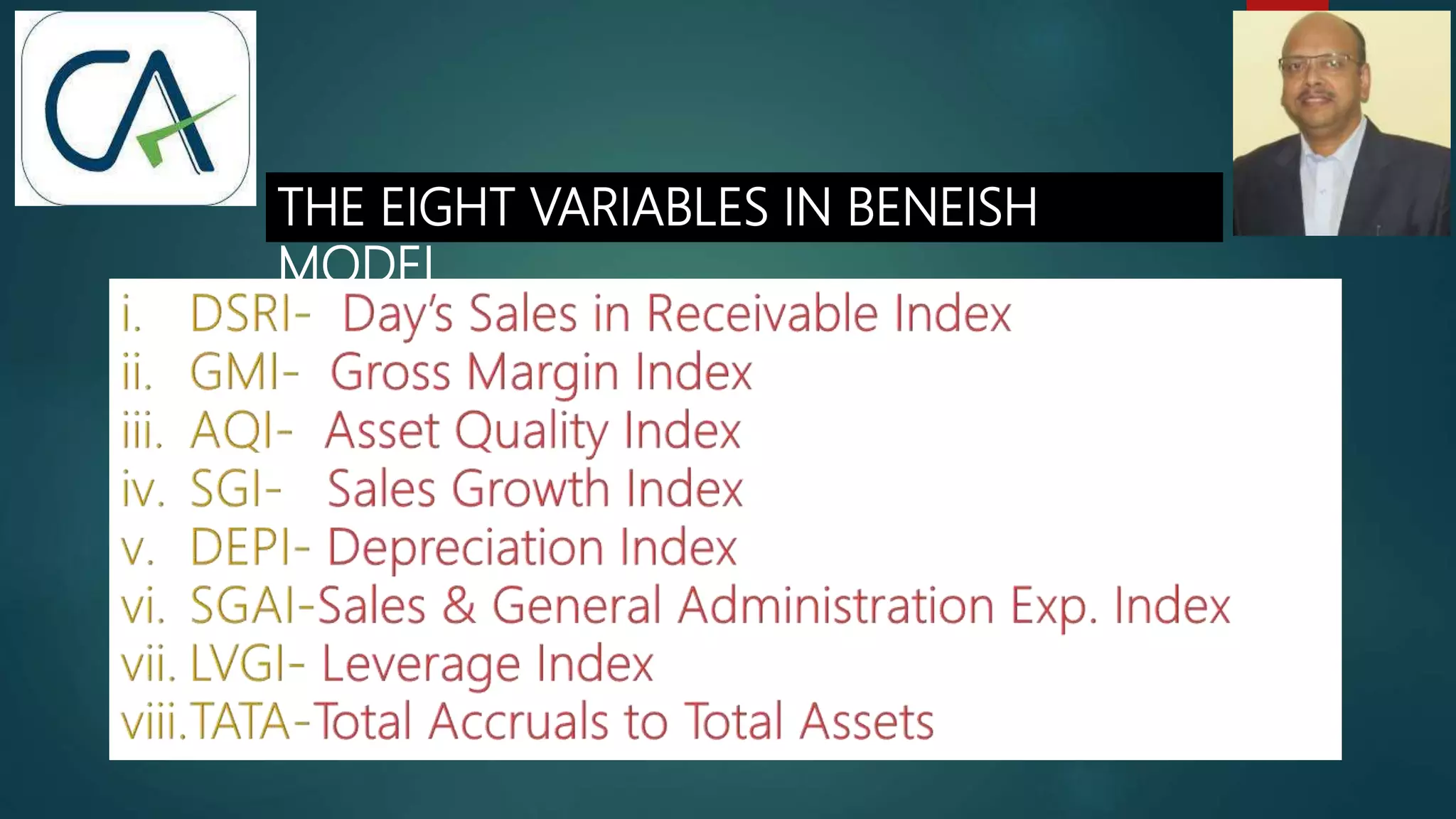

This document discusses financial statement fraud schemes. It defines financial statements and fraud, then outlines various schemes used to commit financial statement fraud such as time manipulations, early recognition of revenues, and postponing expenses. It also discusses perpetrators of fraud, reasons for fraud, and red flags that could indicate fraud. Methods for detecting and preventing financial statement fraud include analyzing unusual patterns in accounts receivables, cash flows, and asset/liability balances. The Beneish model is presented as a tool for detecting fraud using eight financial ratios.