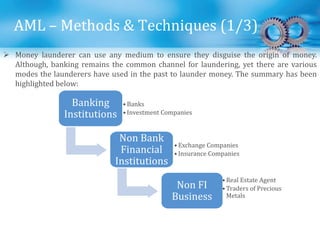

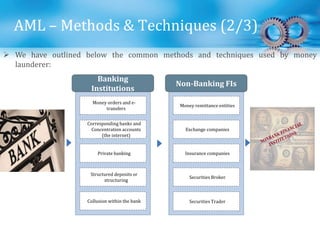

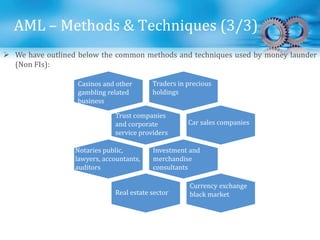

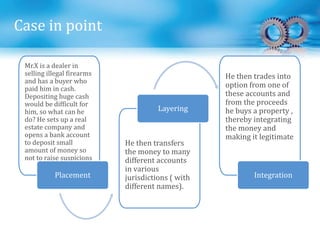

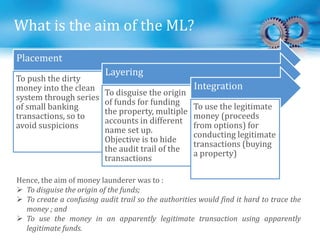

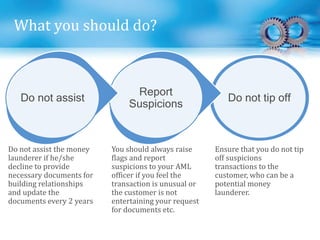

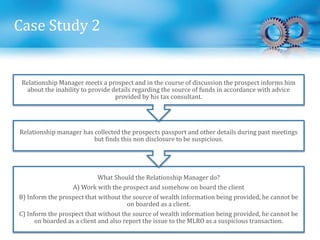

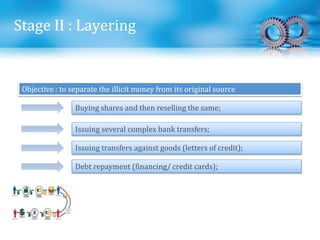

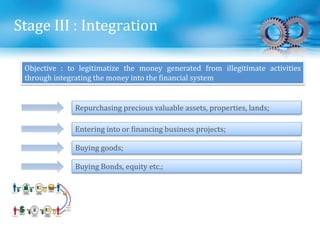

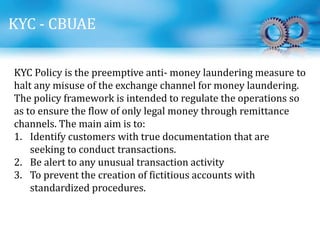

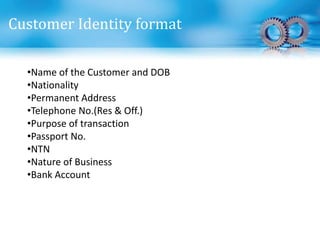

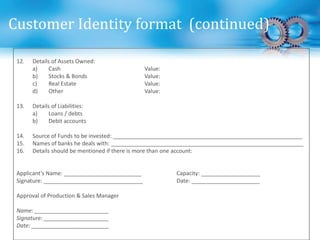

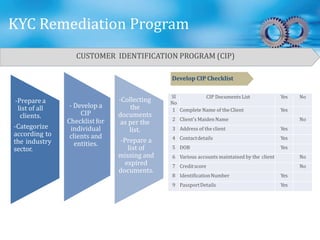

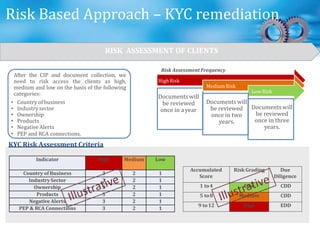

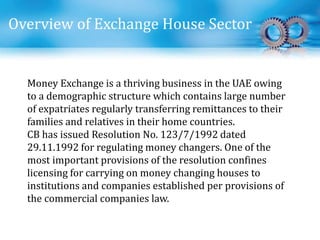

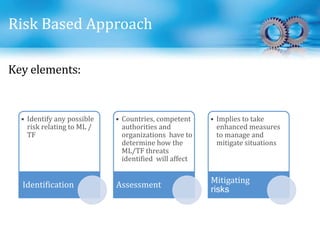

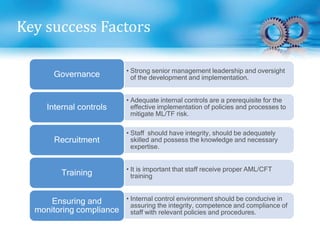

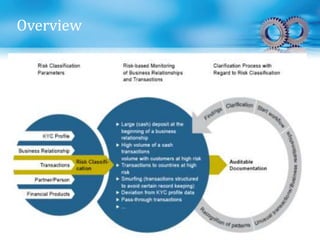

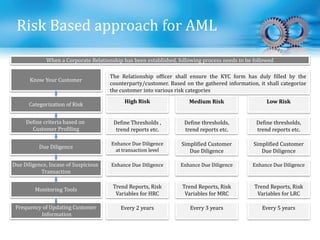

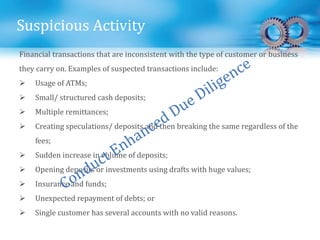

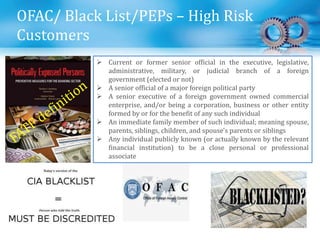

This document provides an overview of anti-money laundering (AML) practices. It discusses the stages of money laundering, including placement, layering, and integration. It covers key AML concepts like know-your-customer procedures, suspicious activity reporting, and the role of regulatory bodies like the Financial Action Task Force in establishing international AML standards. The document is intended to help participants understand AML definitions, pillars, risks, and compliance responsibilities.