This document provides an overview of monopolistic competition and oligopoly market structures. It discusses key characteristics of each including:

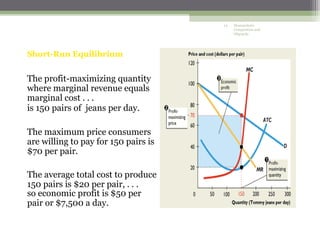

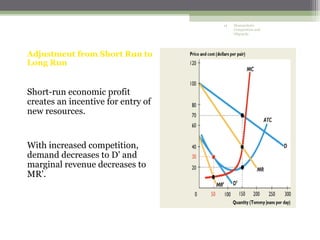

1) Monopolistic competition is characterized by many small sellers, differentiated products, and easy entry and exit. Firms compete through non-price factors like advertising and product quality.

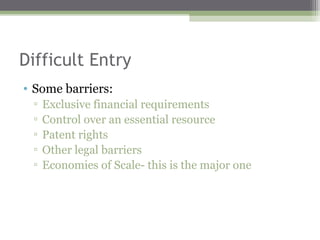

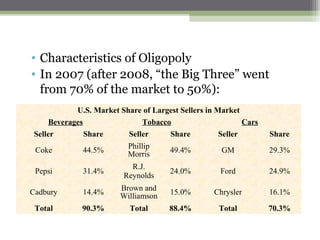

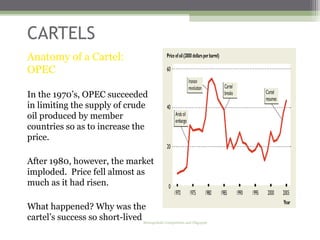

2) Oligopoly is dominated by a few large firms producing either homogeneous or differentiated products. Entry is difficult due to barriers like economies of scale. Firms must consider competitors' potential reactions in their pricing decisions.

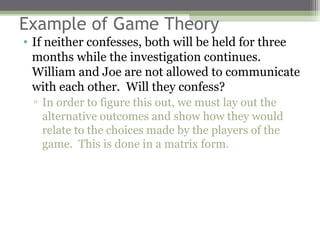

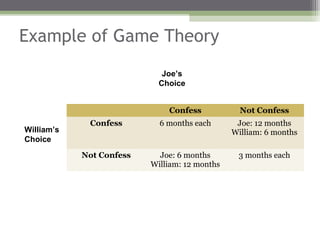

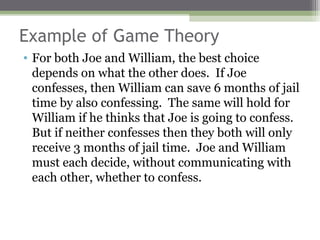

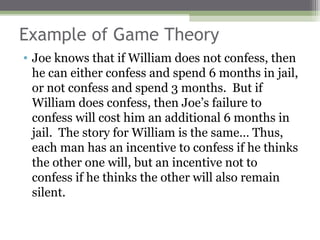

3) Game theory, such as the prisoner's dilemma, can model strategic interactions between oligopolistic competitors who are mutually interdependent. Firms must choose strategies without communicating directly with rivals.