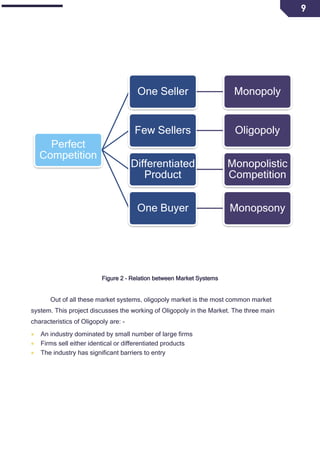

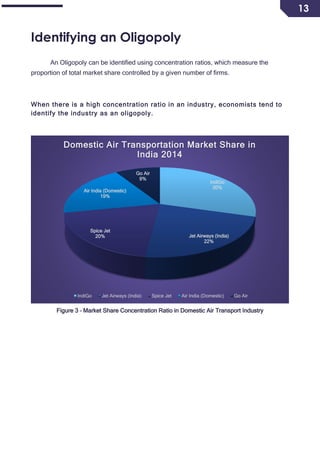

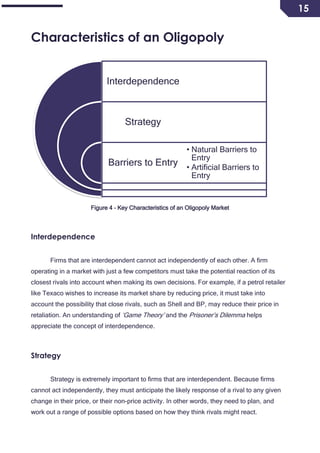

This document is a practical assignment focused on oligopoly markets, detailing characteristics, types, and identification methods of oligopolies, along with their implications in the economy. It discusses concepts like collusive behavior, barriers to entry, pricing strategies, and non-pricing competition. The document emphasizes the significance of oligopolies in terms of their market dominance and the potential drawbacks such as reduced consumer choice and inefficiencies.