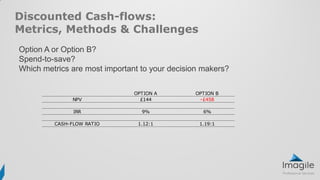

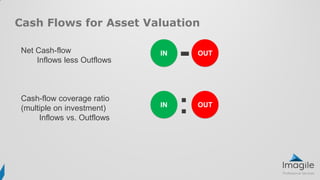

This document discusses the importance of financial modeling and lifecycle planning for asset management decision making. It emphasizes talking to senior management about value in terms of outcomes rather than specific assets or initiatives. The document outlines how to understand and express value, asset valuation using cash flows, financial modeling, lifecycle costing, and discounted cash flow analysis. It provides an example comparing two options using metrics like net present value, internal rate of return, and cash flow ratio to determine which option provides the best value.

![“The word value… has two different meanings, [it] sometimes

expresses the utility of [something], and sometimes [the purchasing

power of it]. The one may be called "value in use;" the other, "value in

exchange." Adam Smith “Of the Origin and Use of Money”

We’re first going to need to understand what we mean by “Value”

“The regard that something is held to deserve, the importance, worth

or usefulness of something.” Oxford English Dictionary

“The total amount of money for which something can be exchanged in

a market” CIMA Dictionary of Finance and Accounting

Value](https://image.slidesharecdn.com/lukebody-170731141925/85/Stream-C_Luke-Body-5-320.jpg)

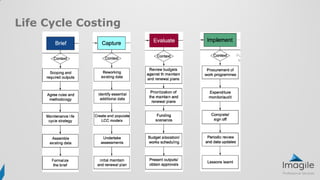

![Life Cycle Costing is “[the] methodology for the systematic economic

evaluation of life cycle costs over a period of analysis, as defined in the

agreed scope. Life Cycle Costing can address a period of analysis that

covers the entire life cycle or (a) selected stage(s) or periods of interest

thereof.”

ISO 15686-5:2008, 3.1.8

Life Cycle Costing](https://image.slidesharecdn.com/lukebody-170731141925/85/Stream-C_Luke-Body-15-320.jpg)

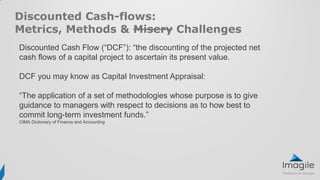

![Discounted Cash-flows:

Metrics, Methods & Challenges

TIME VALUE OF MONEY

“Measurement of the difference between future monies and the present

day value of monies [reflecting uncertainty]” BS 8544-2013

DISCOUNT RATES

Inflation

Weighted Average Cost of Capital

Expected / target returns (IRR*)

Risk appetite / premium](https://image.slidesharecdn.com/lukebody-170731141925/85/Stream-C_Luke-Body-20-320.jpg)