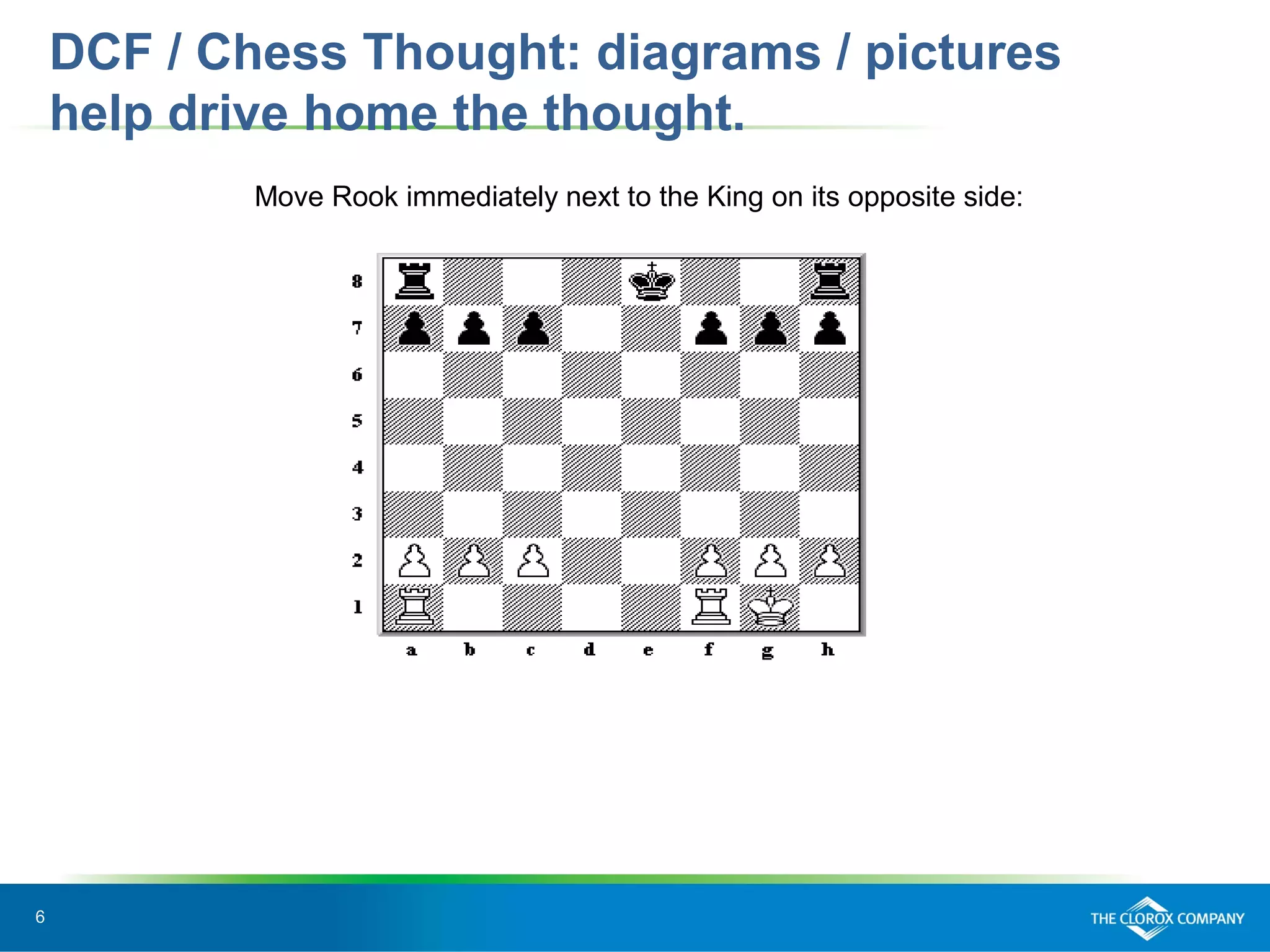

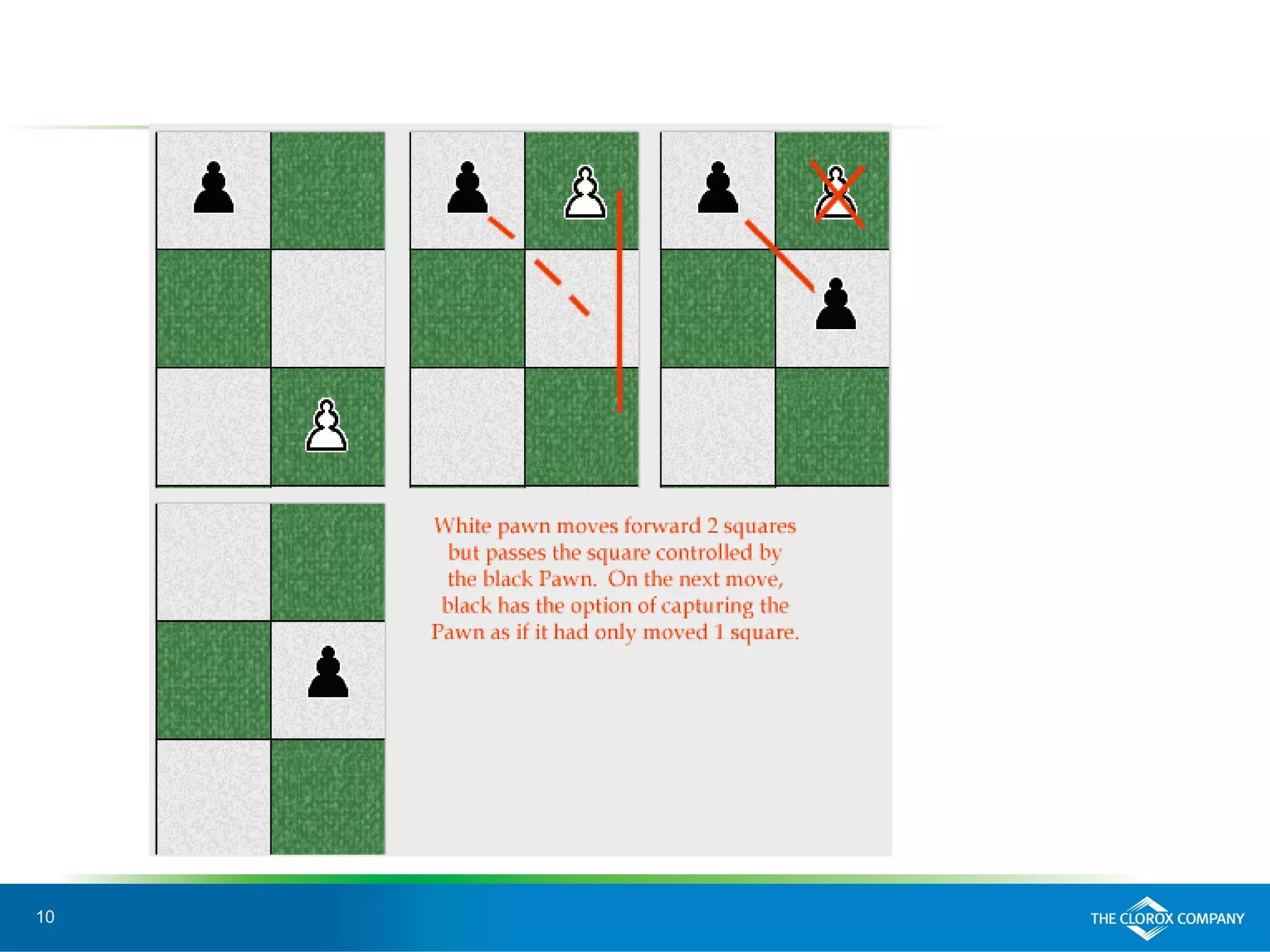

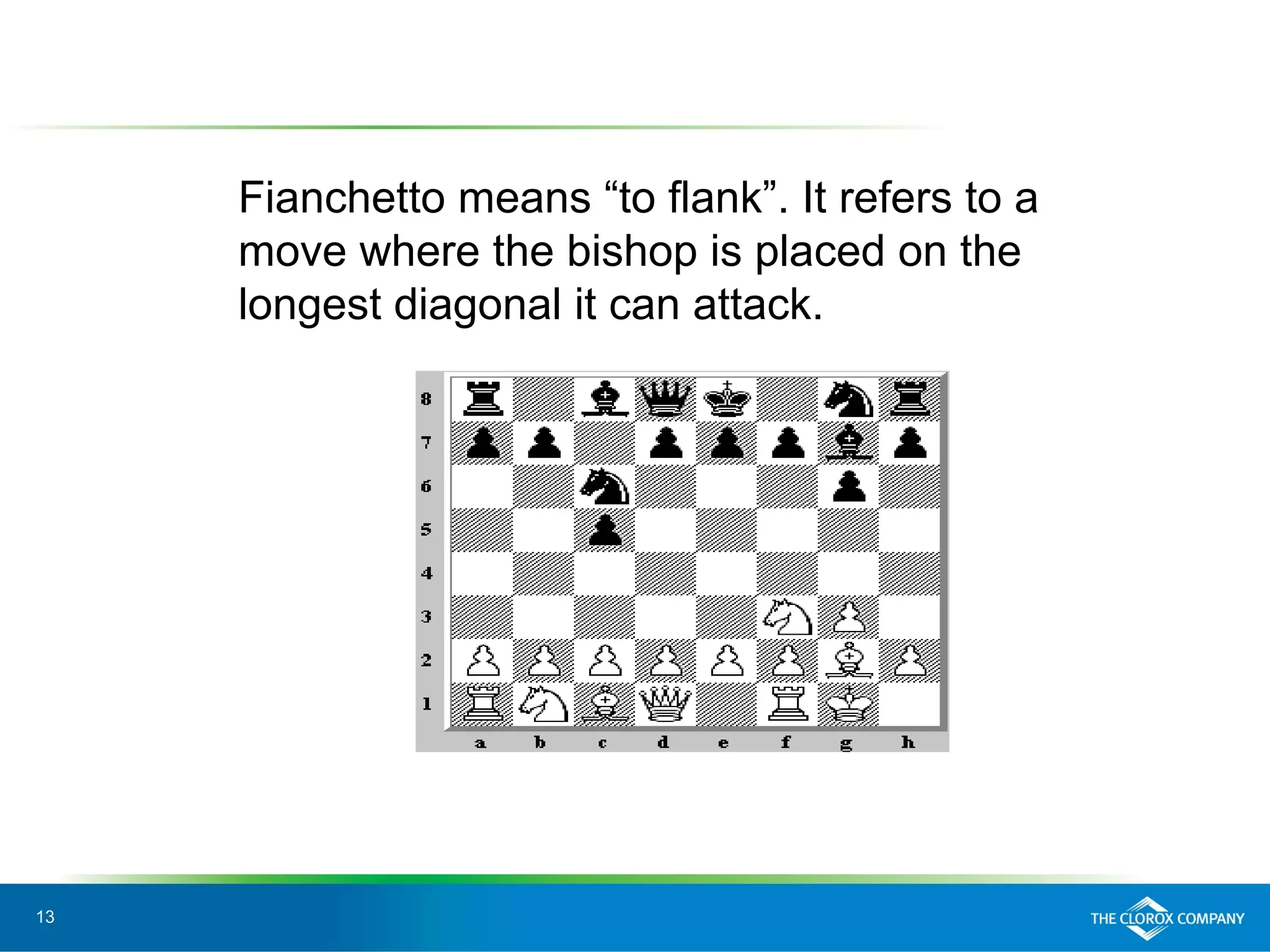

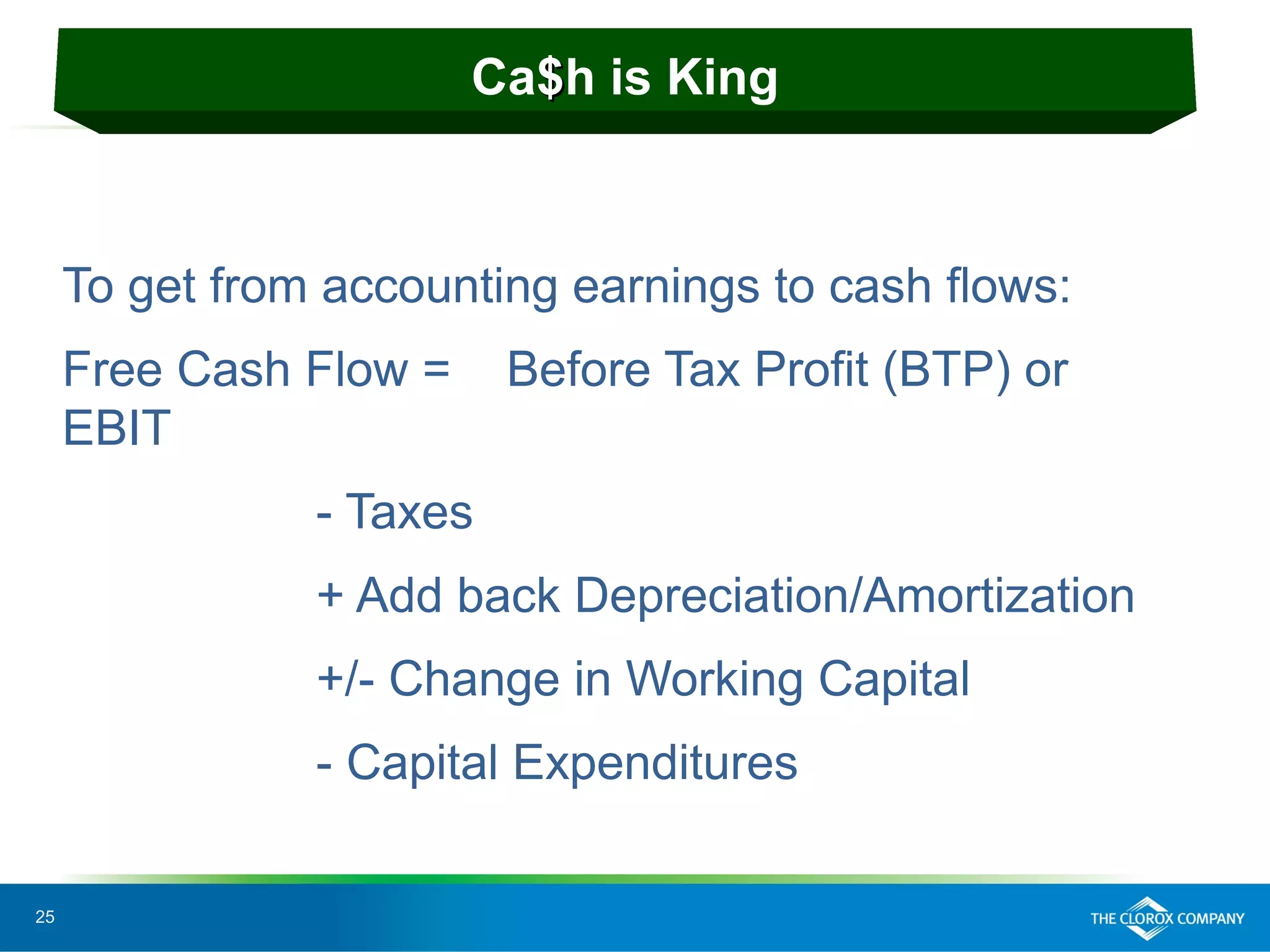

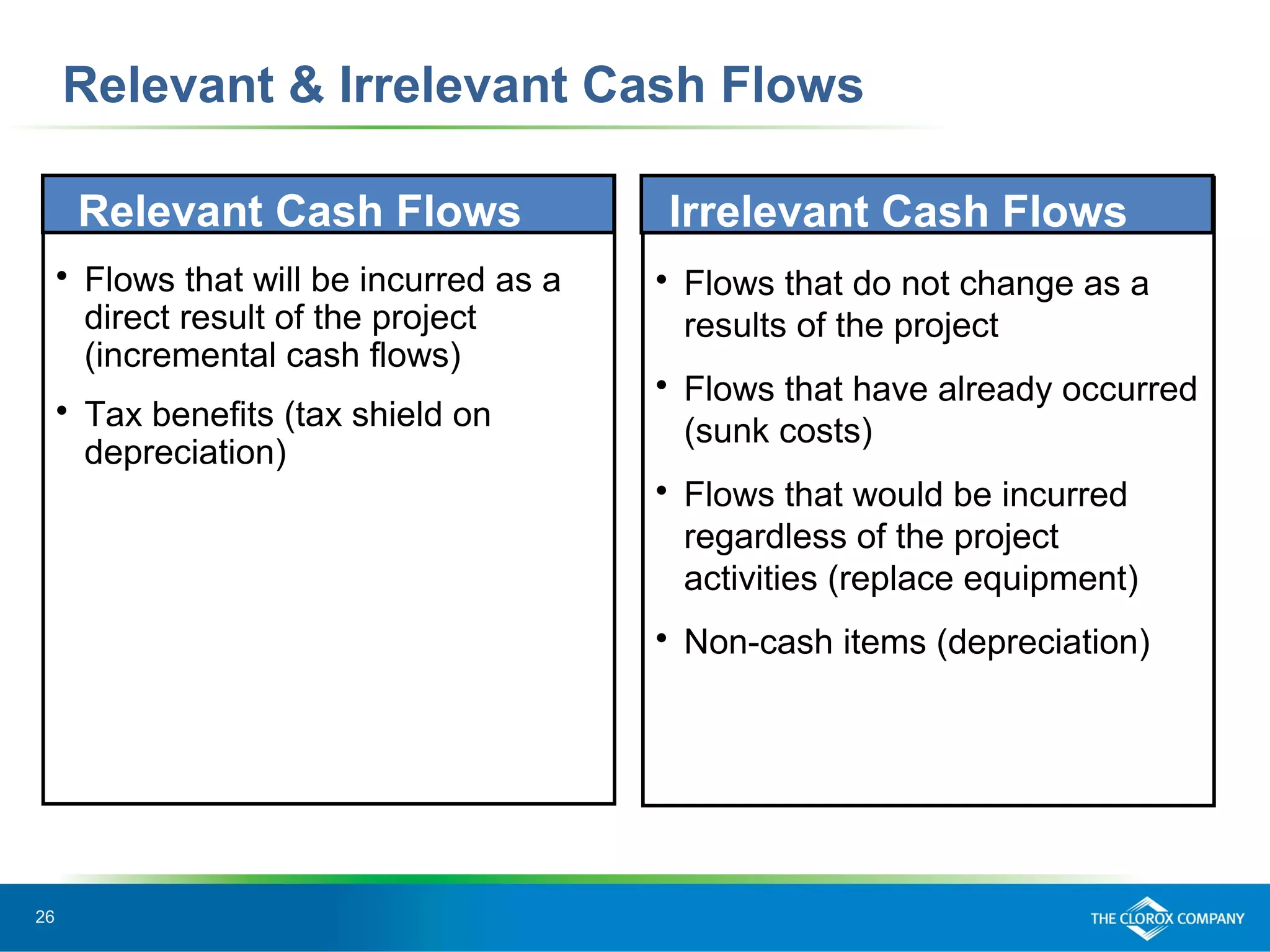

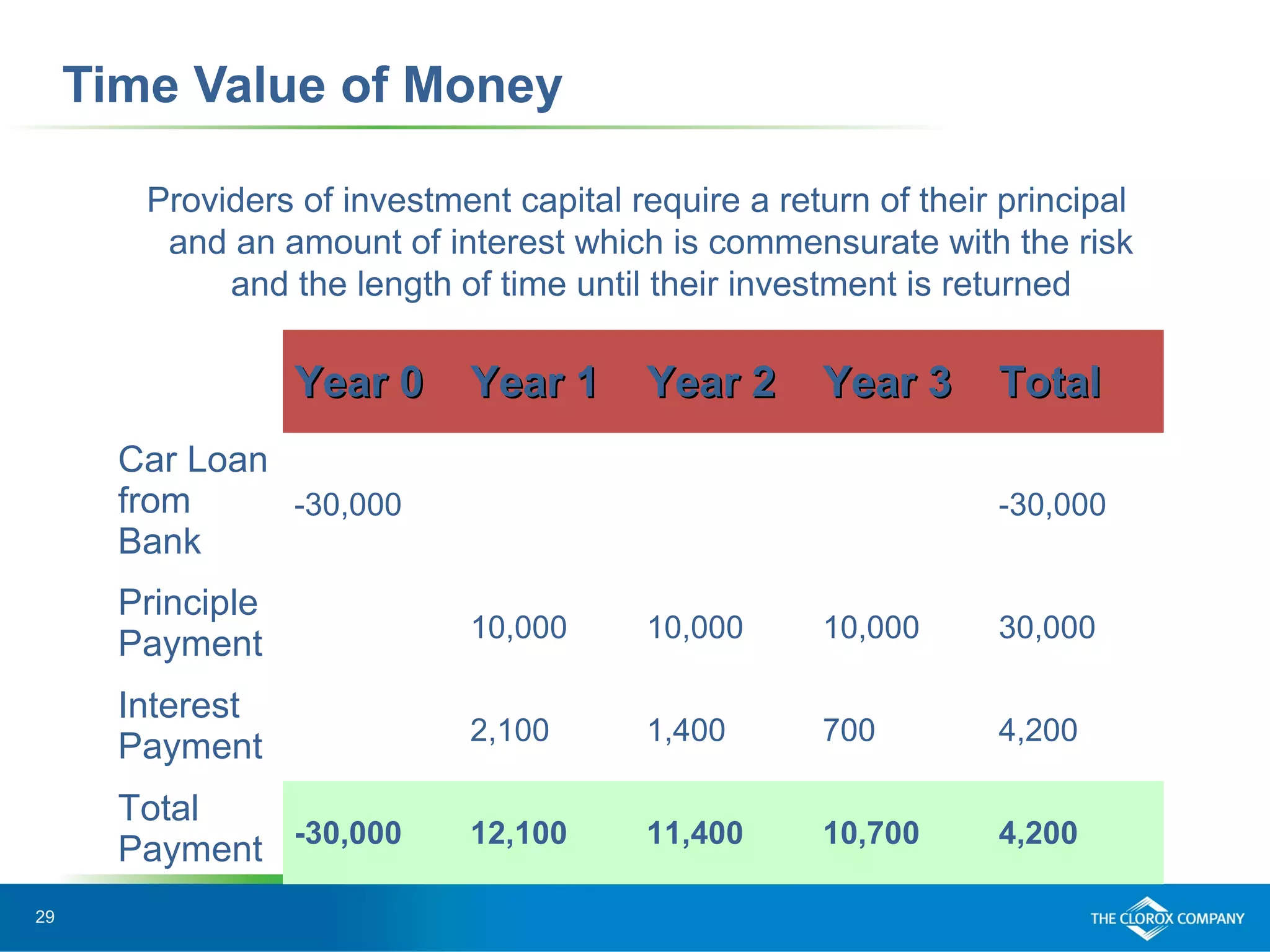

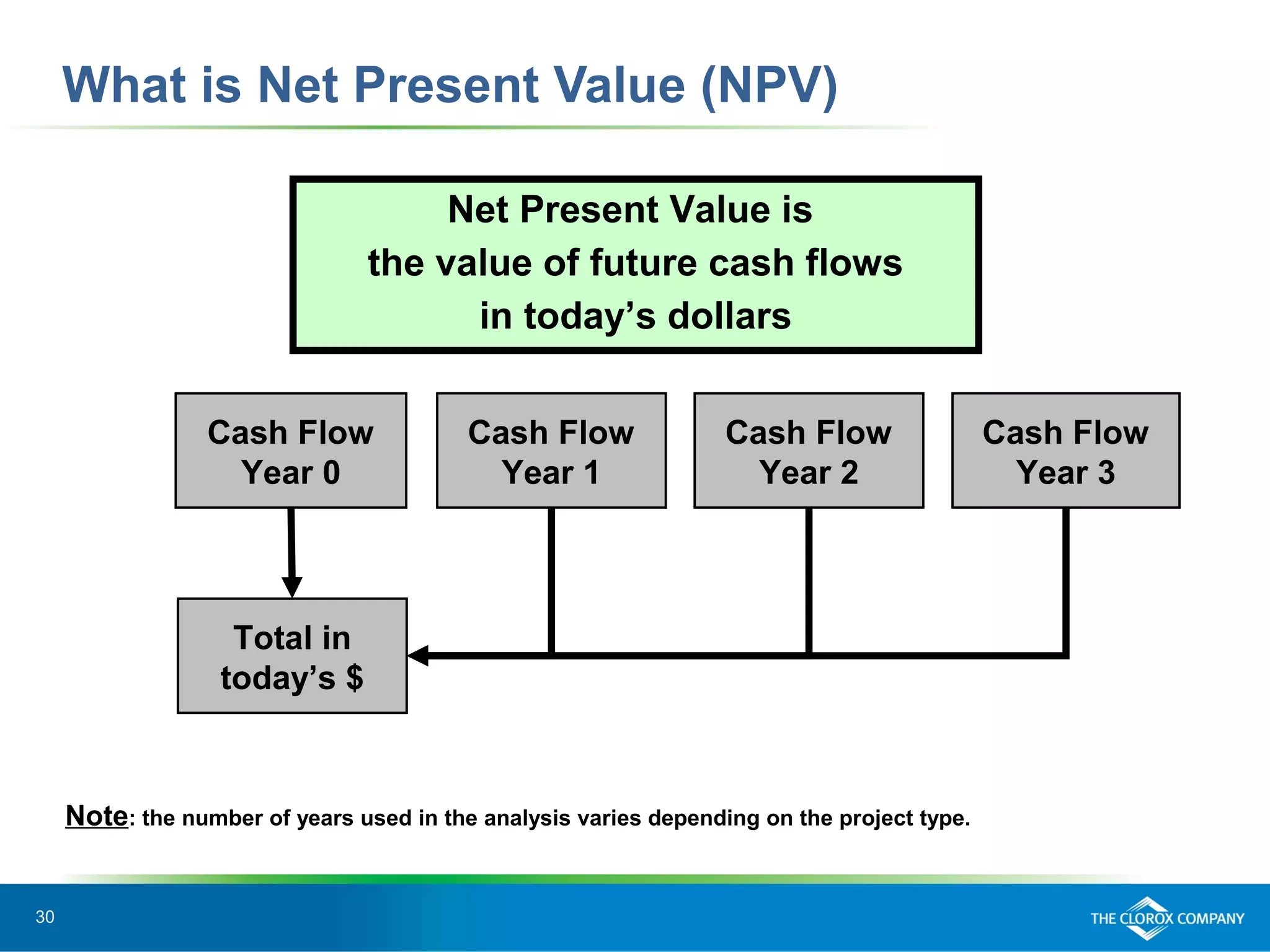

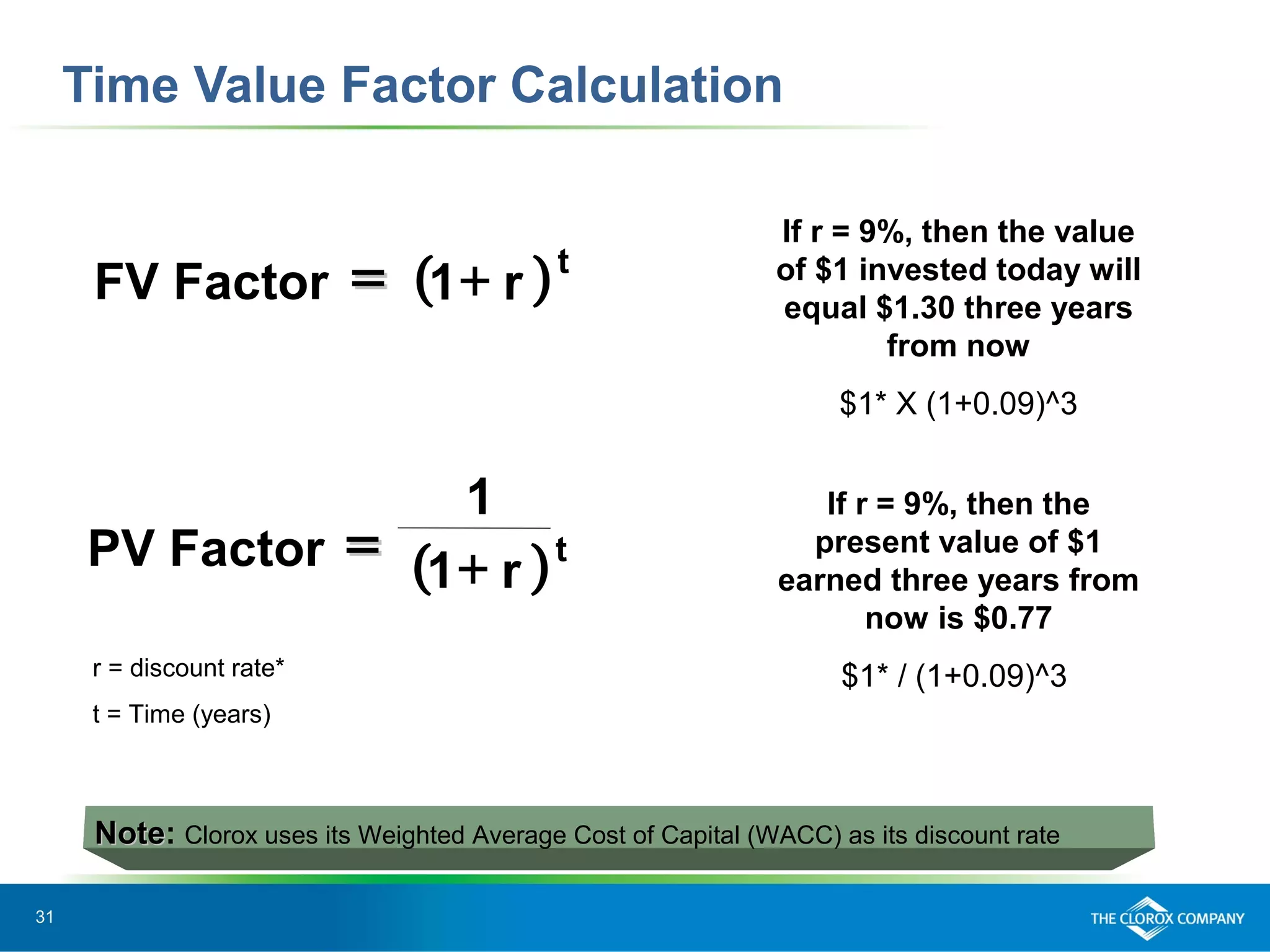

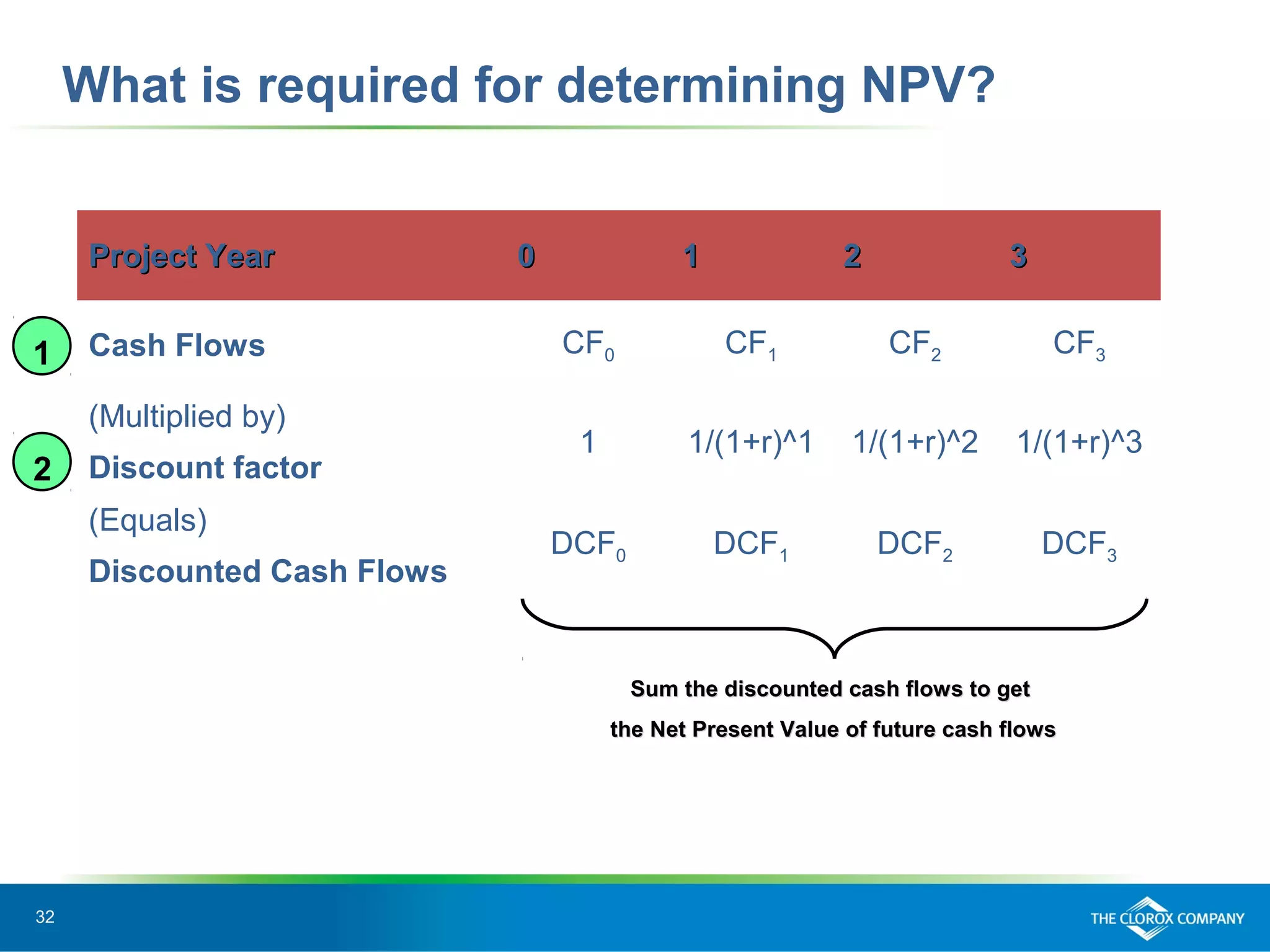

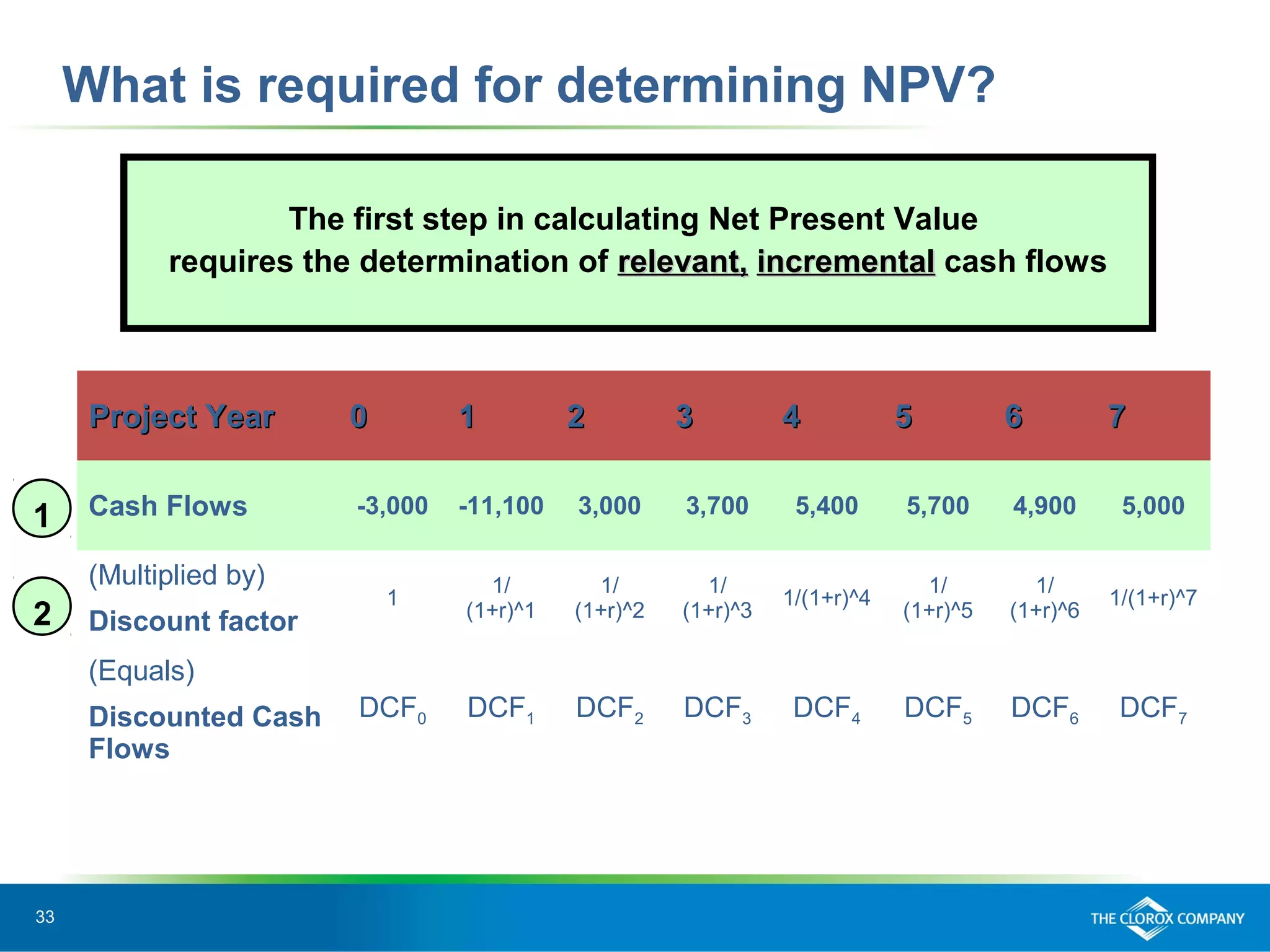

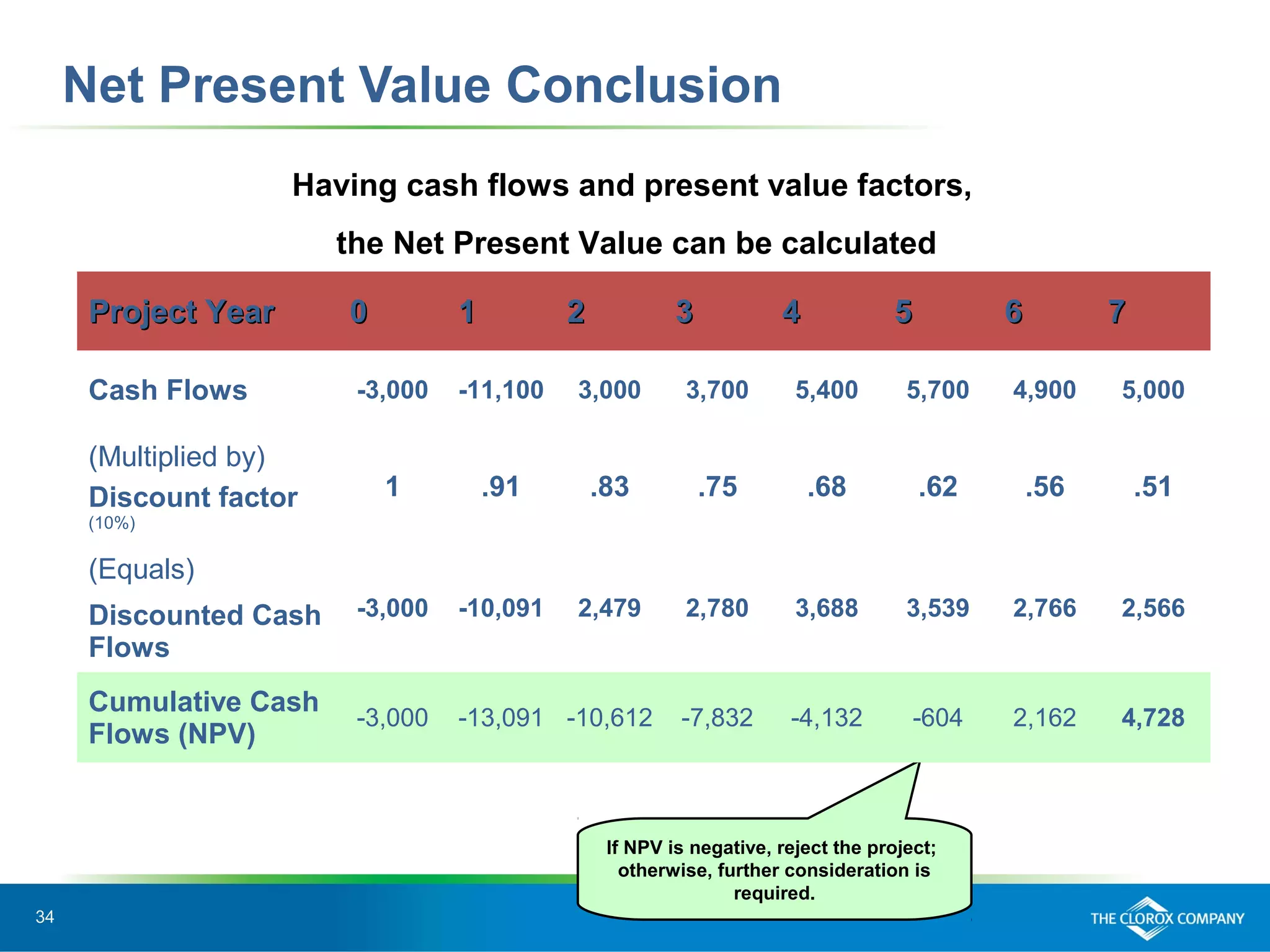

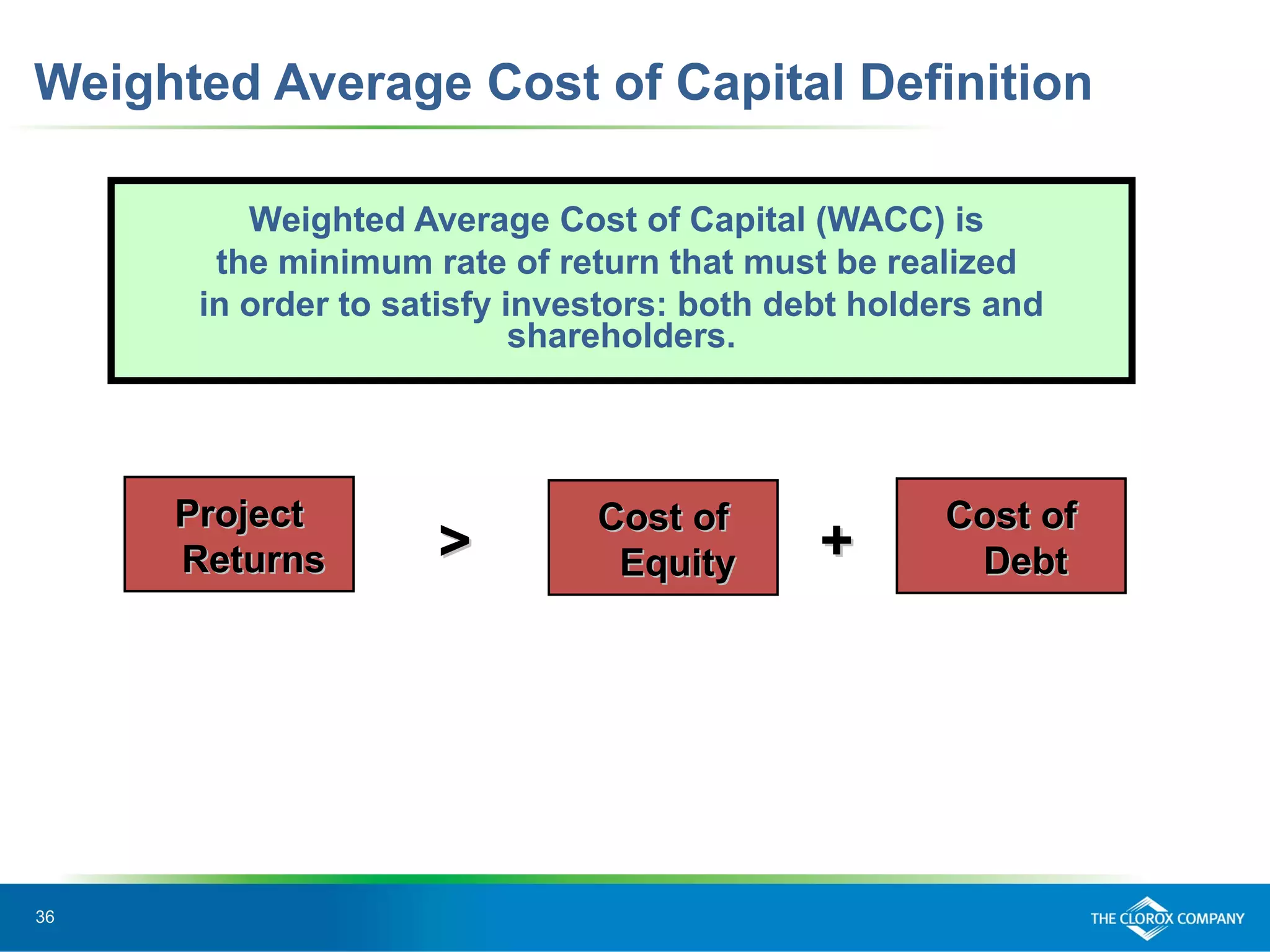

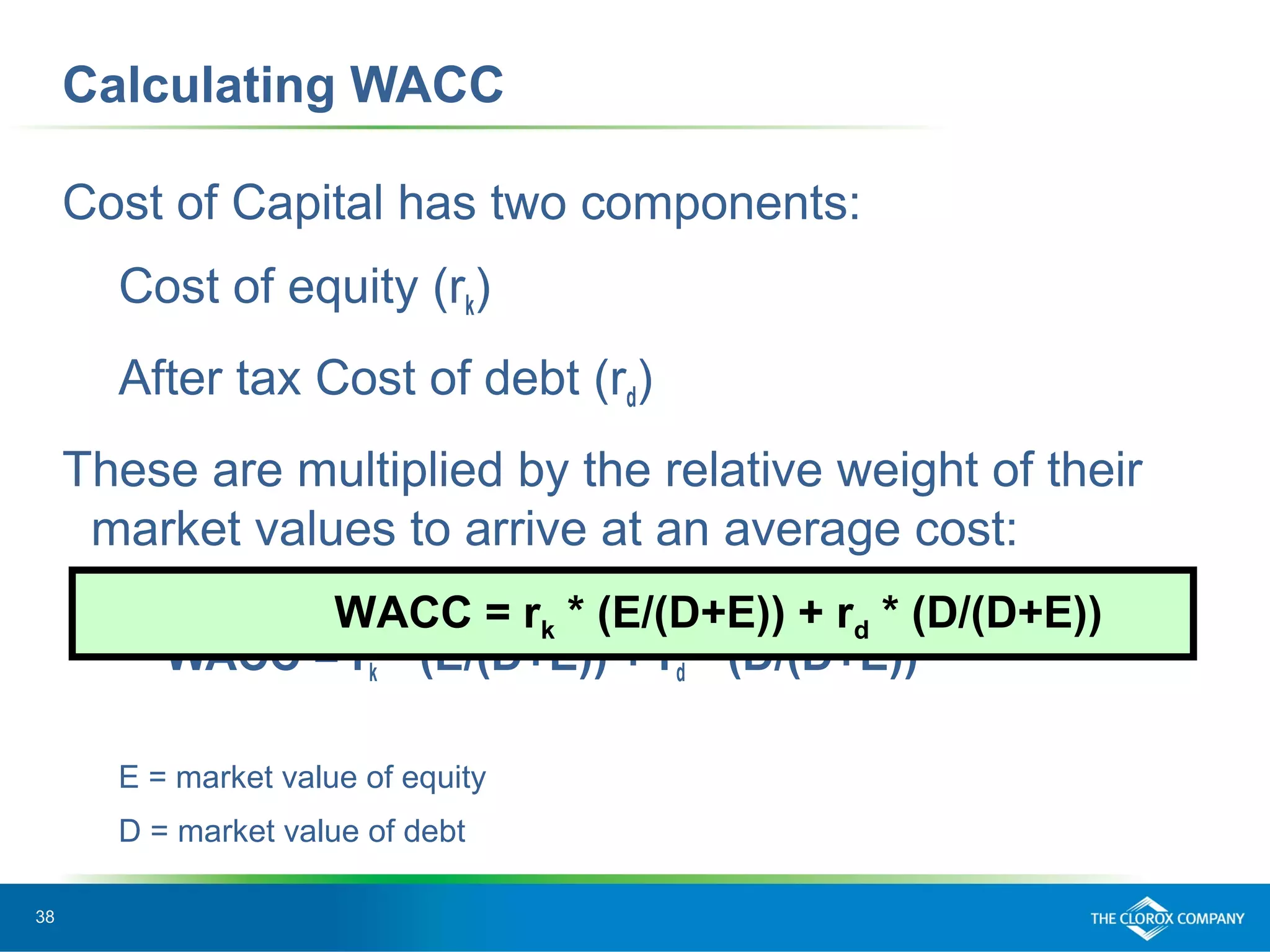

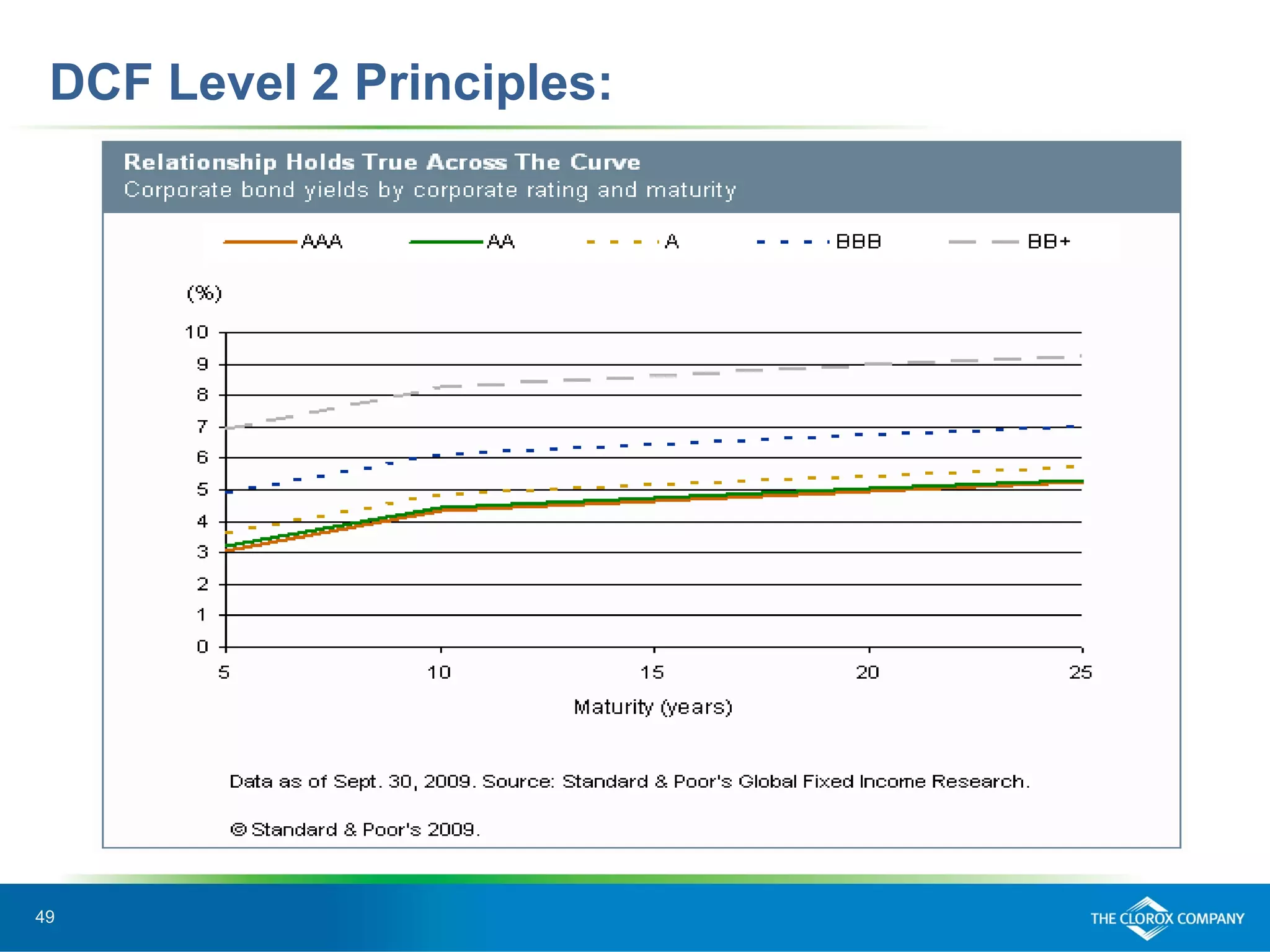

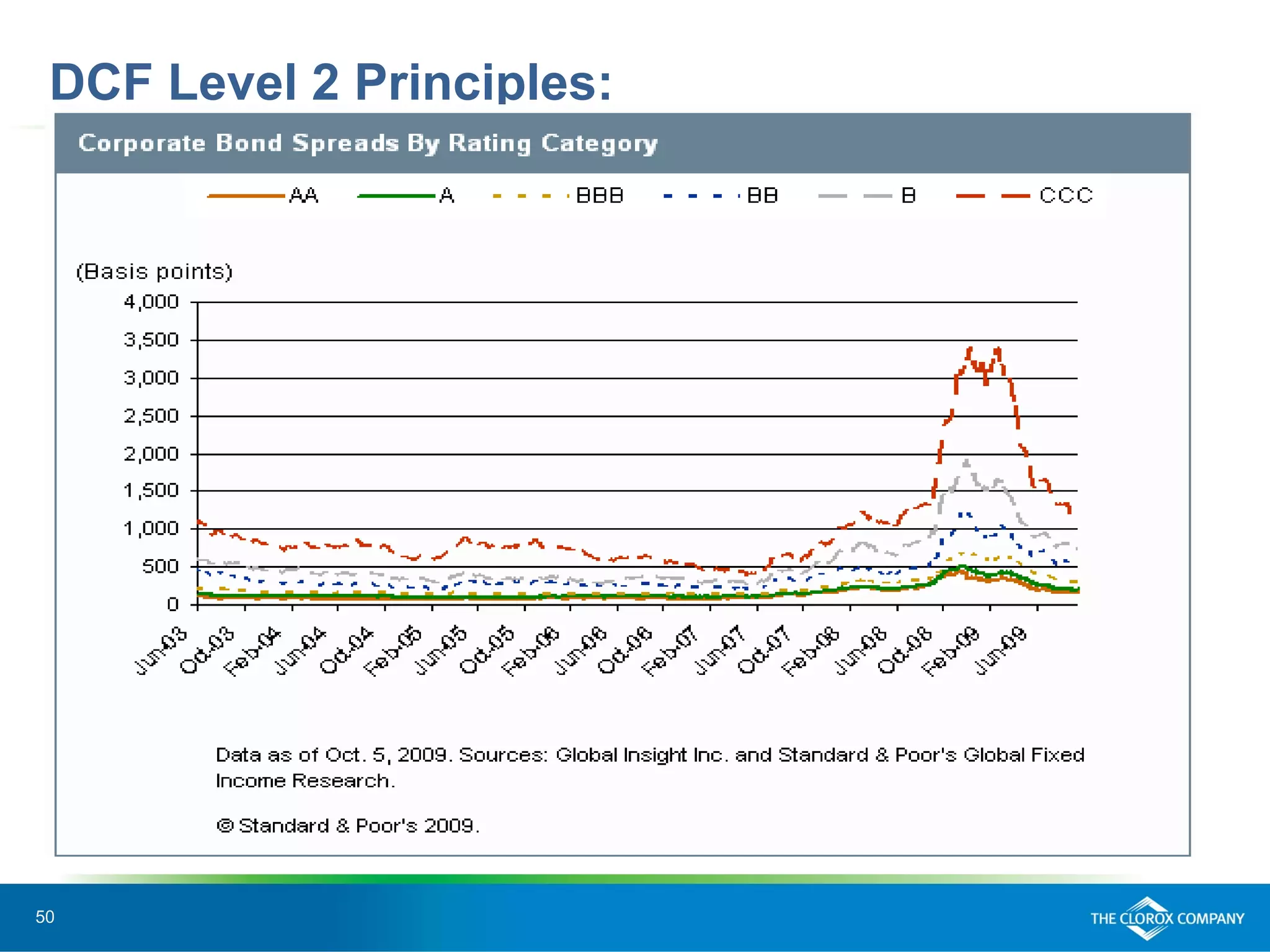

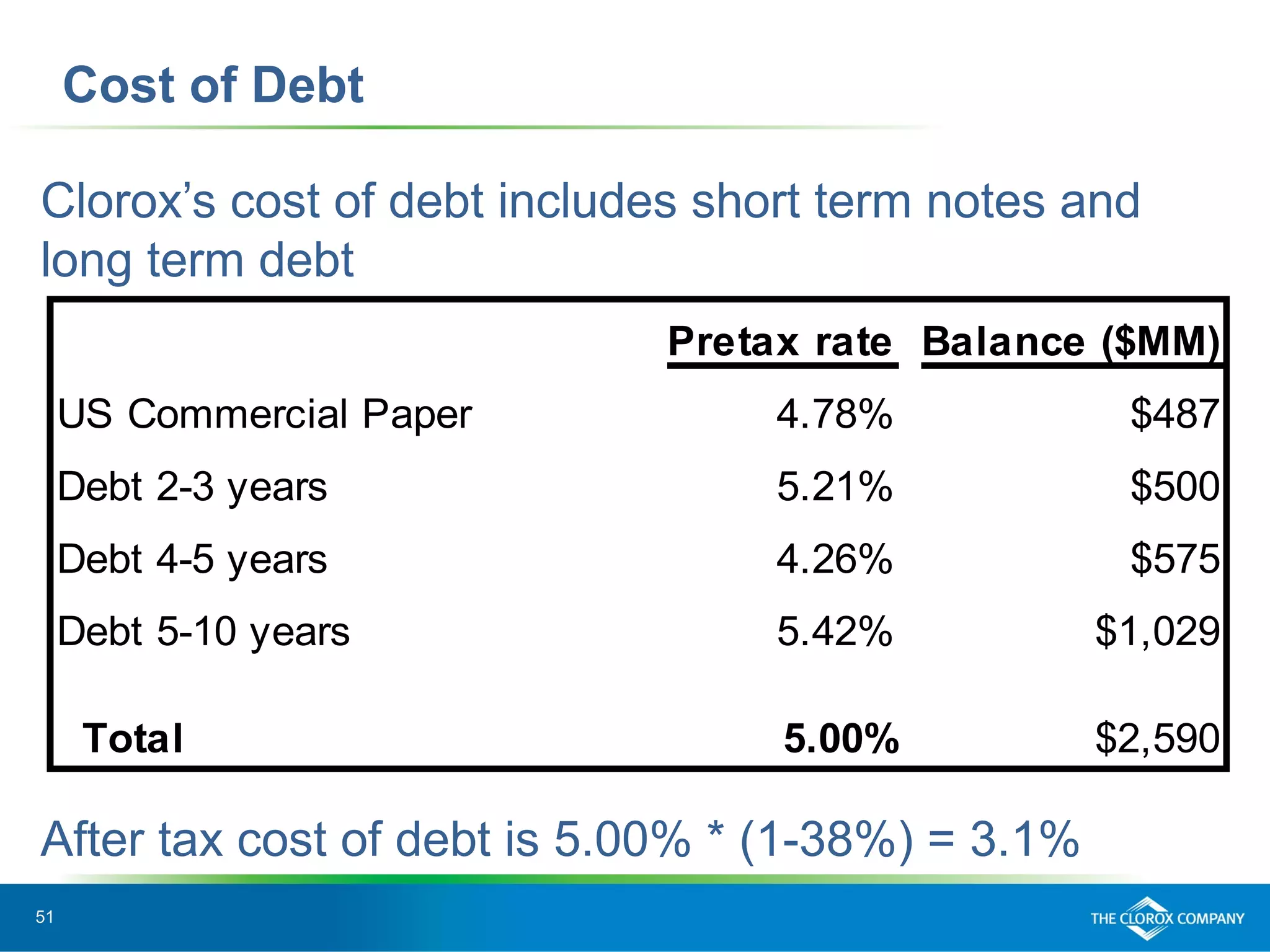

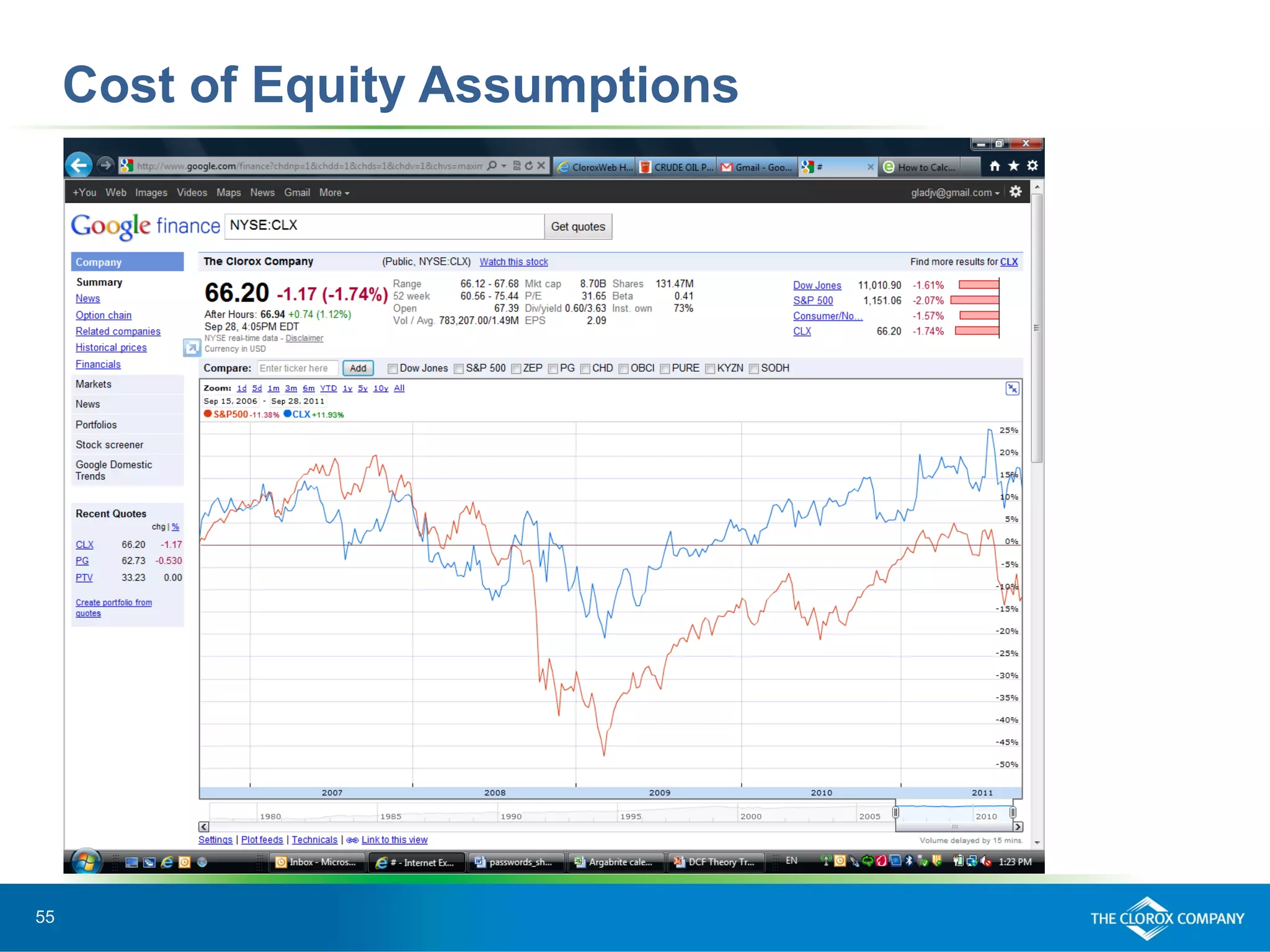

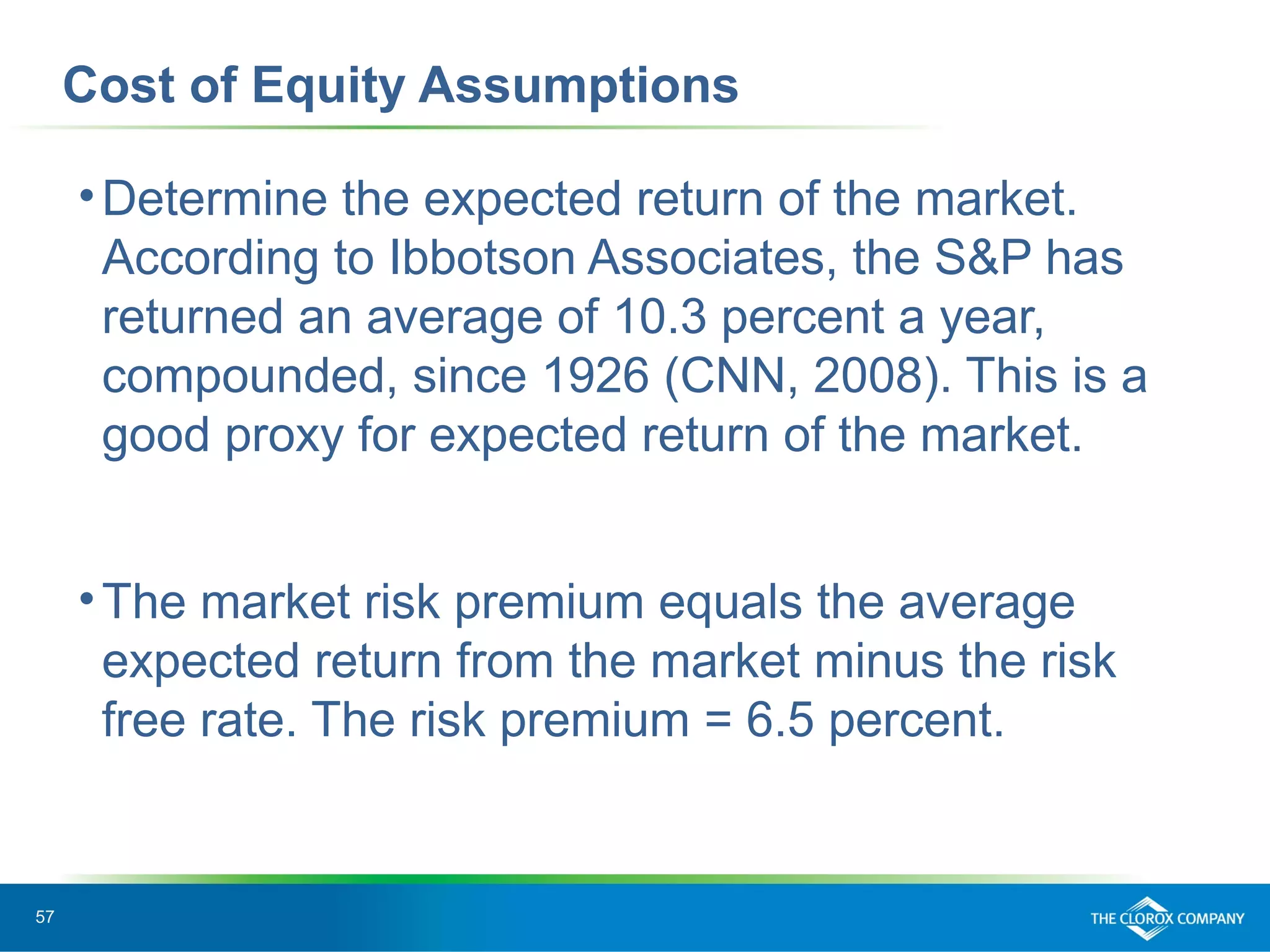

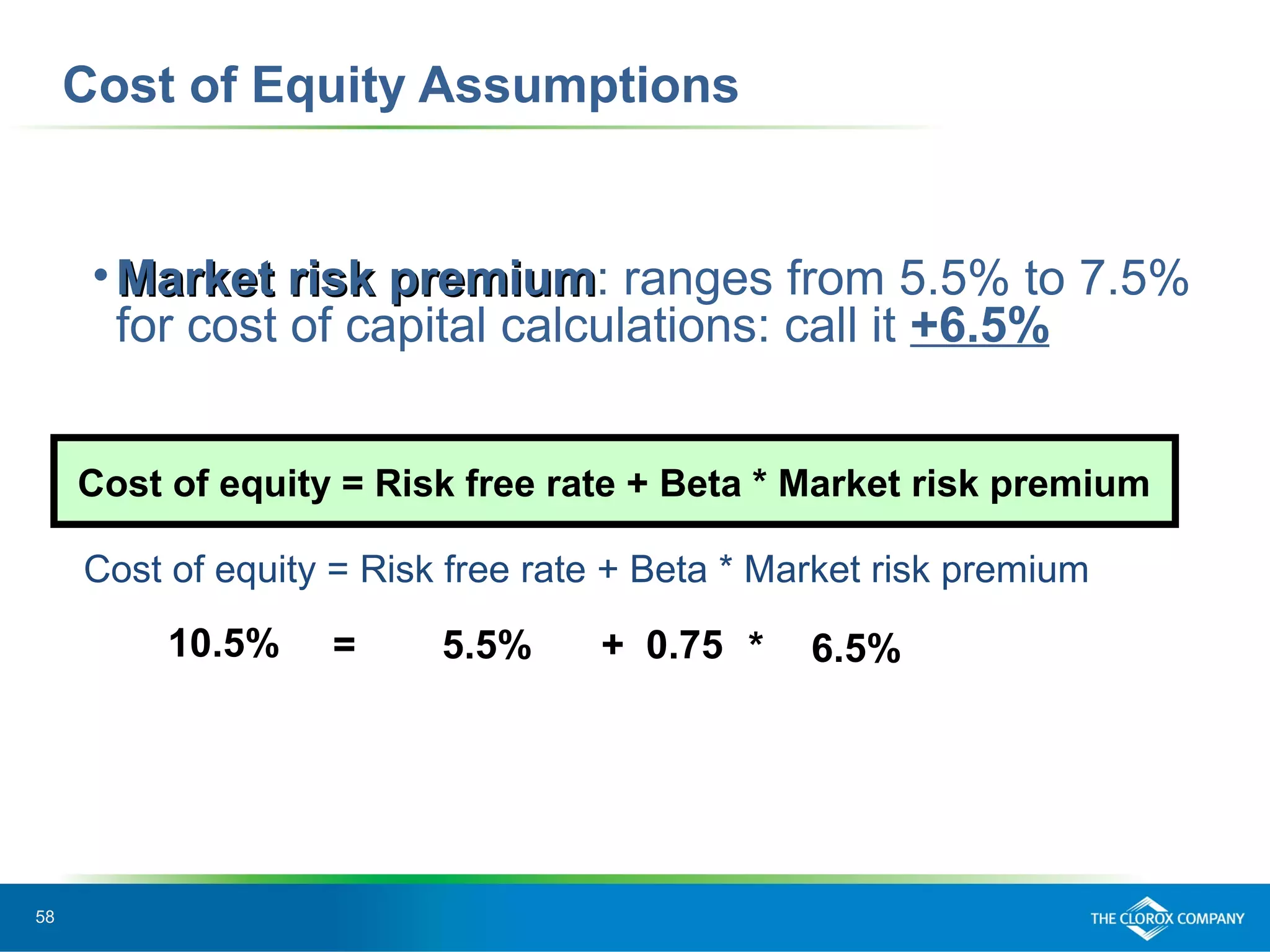

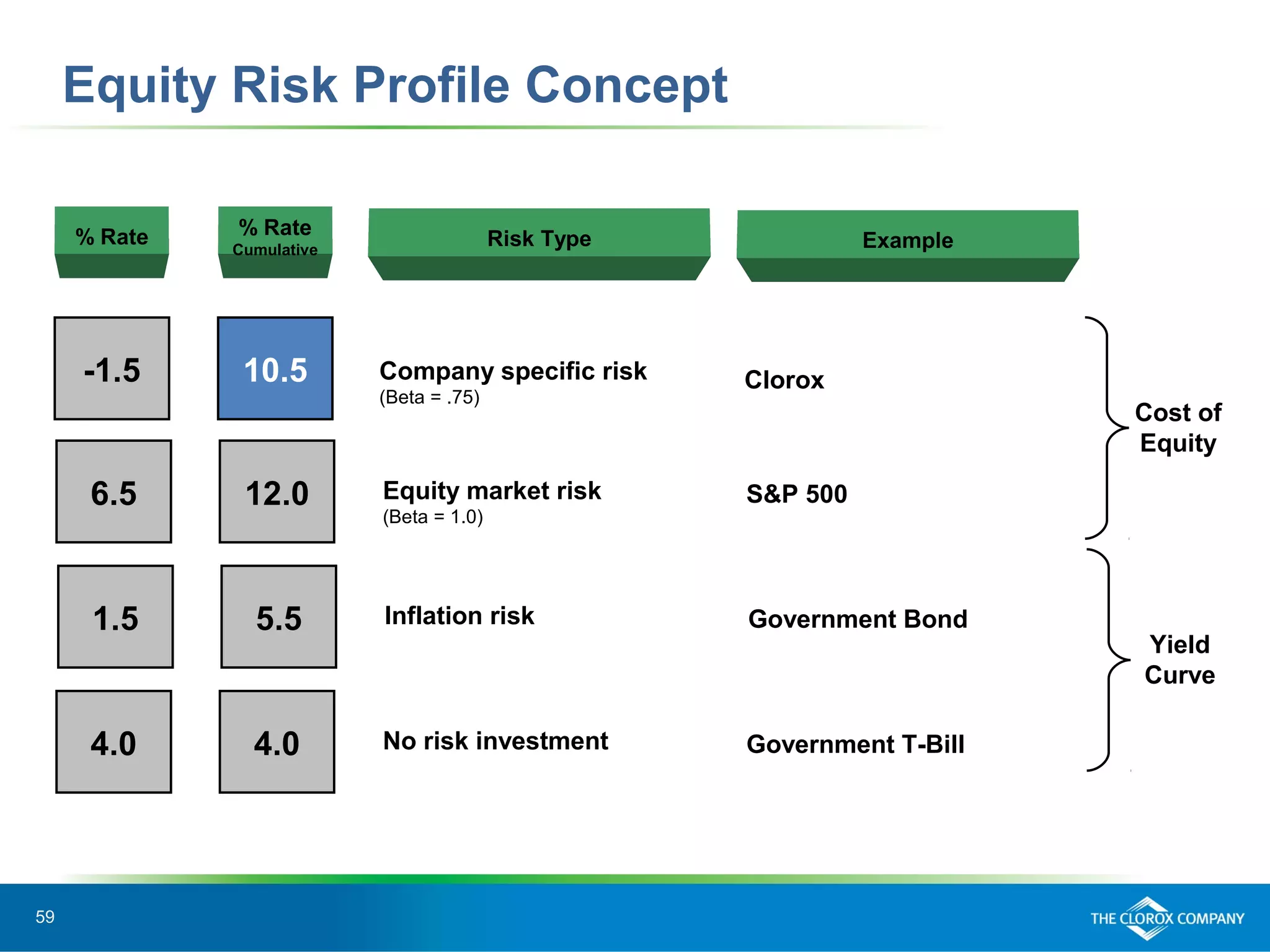

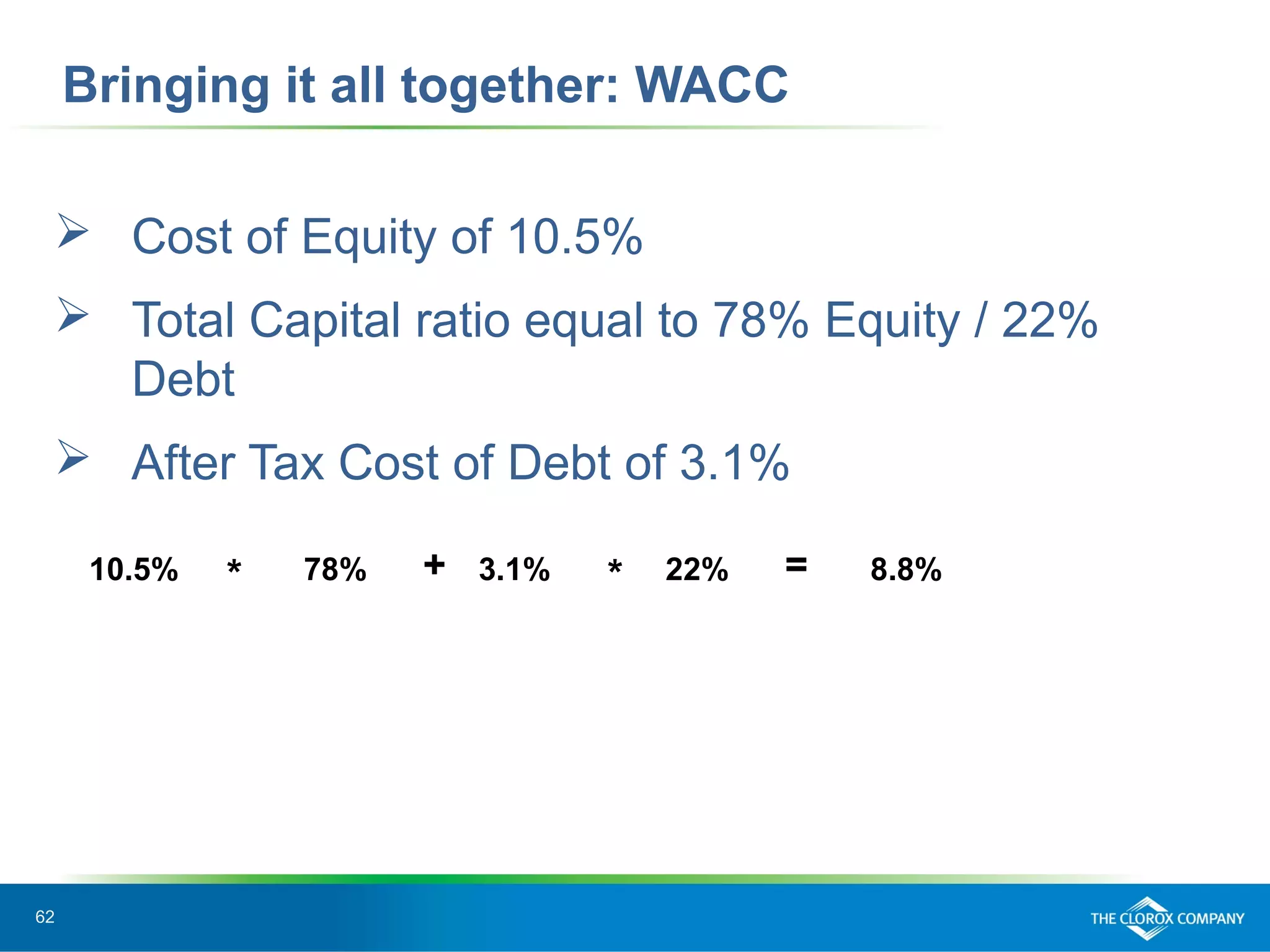

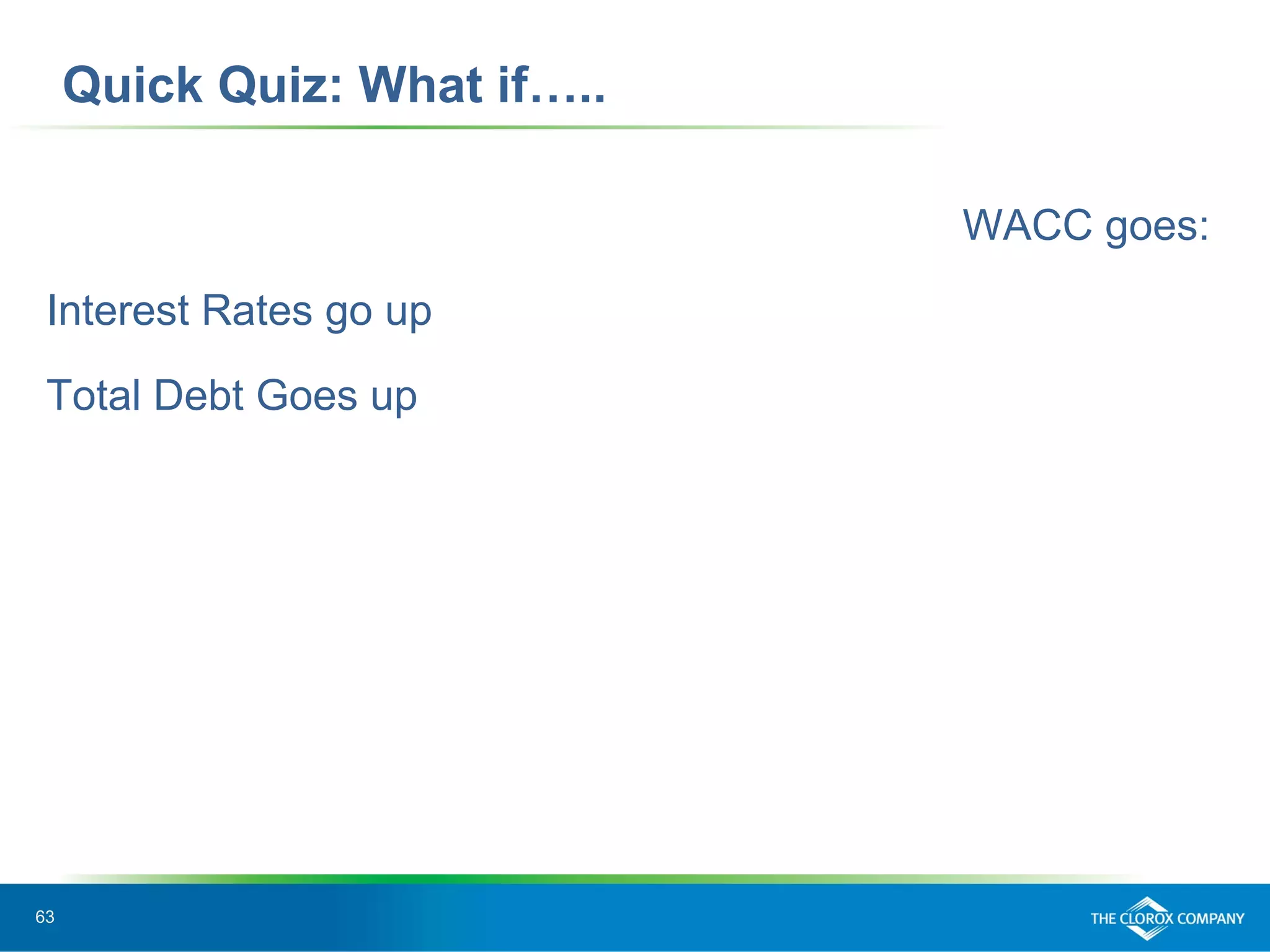

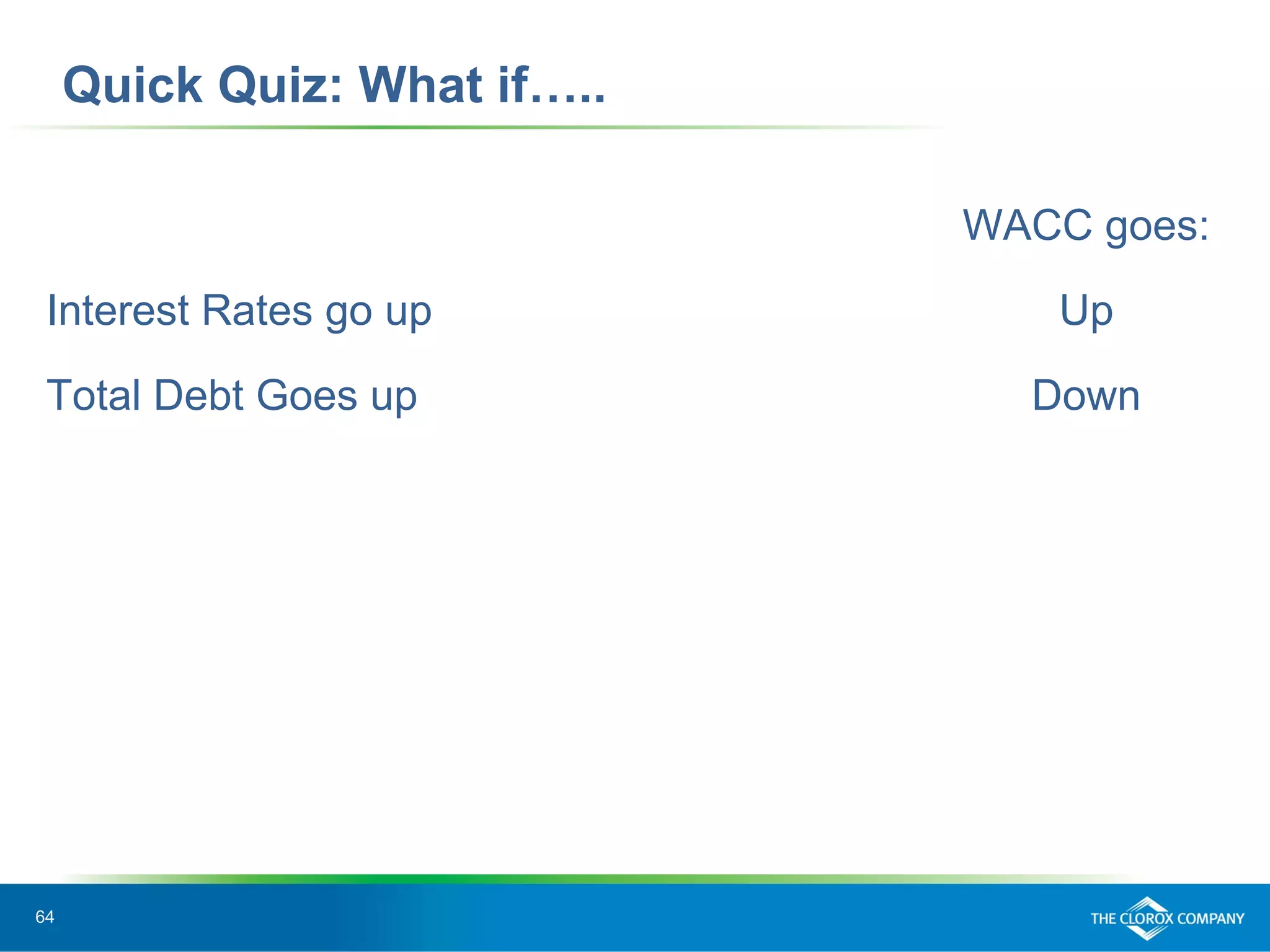

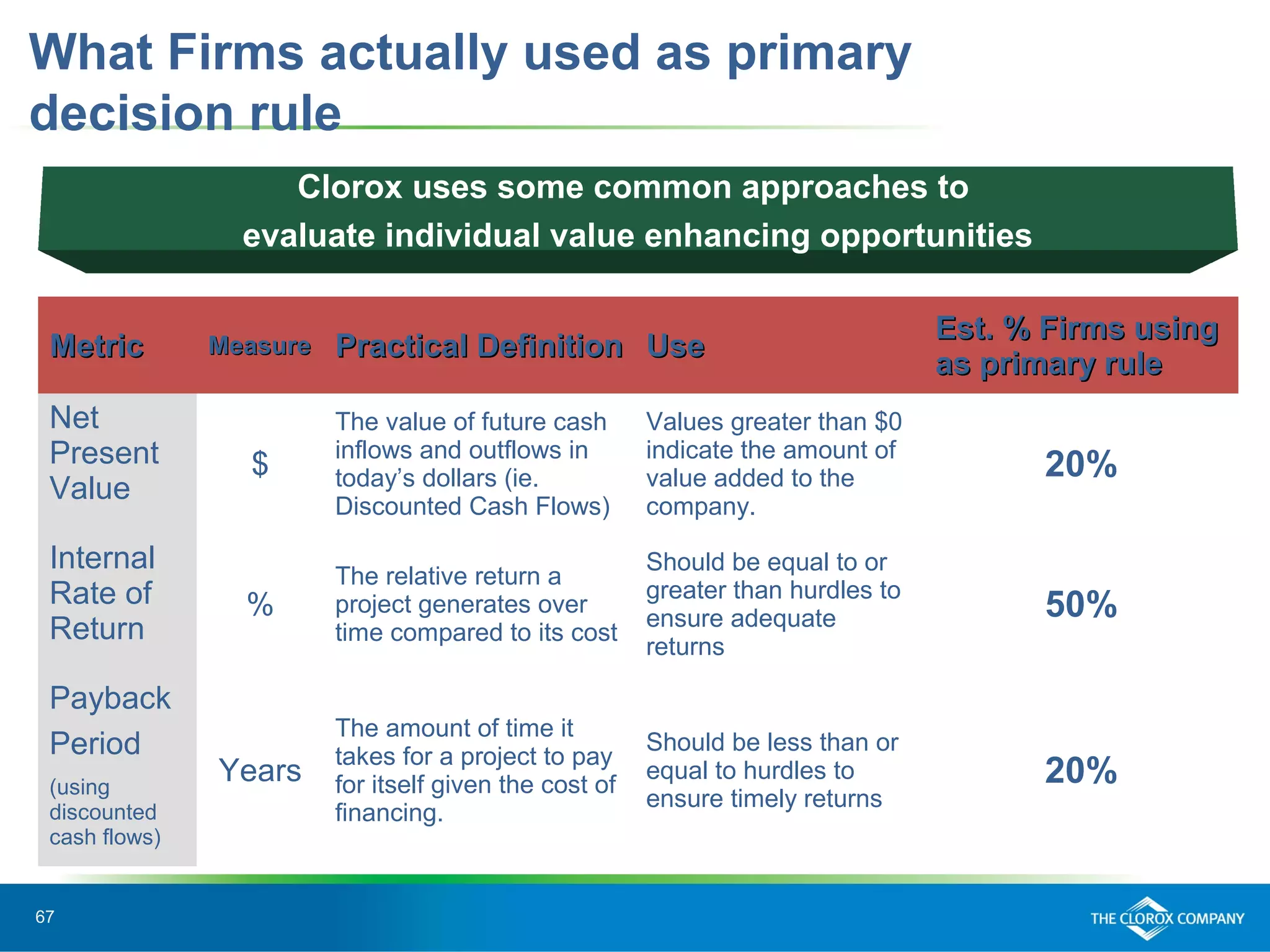

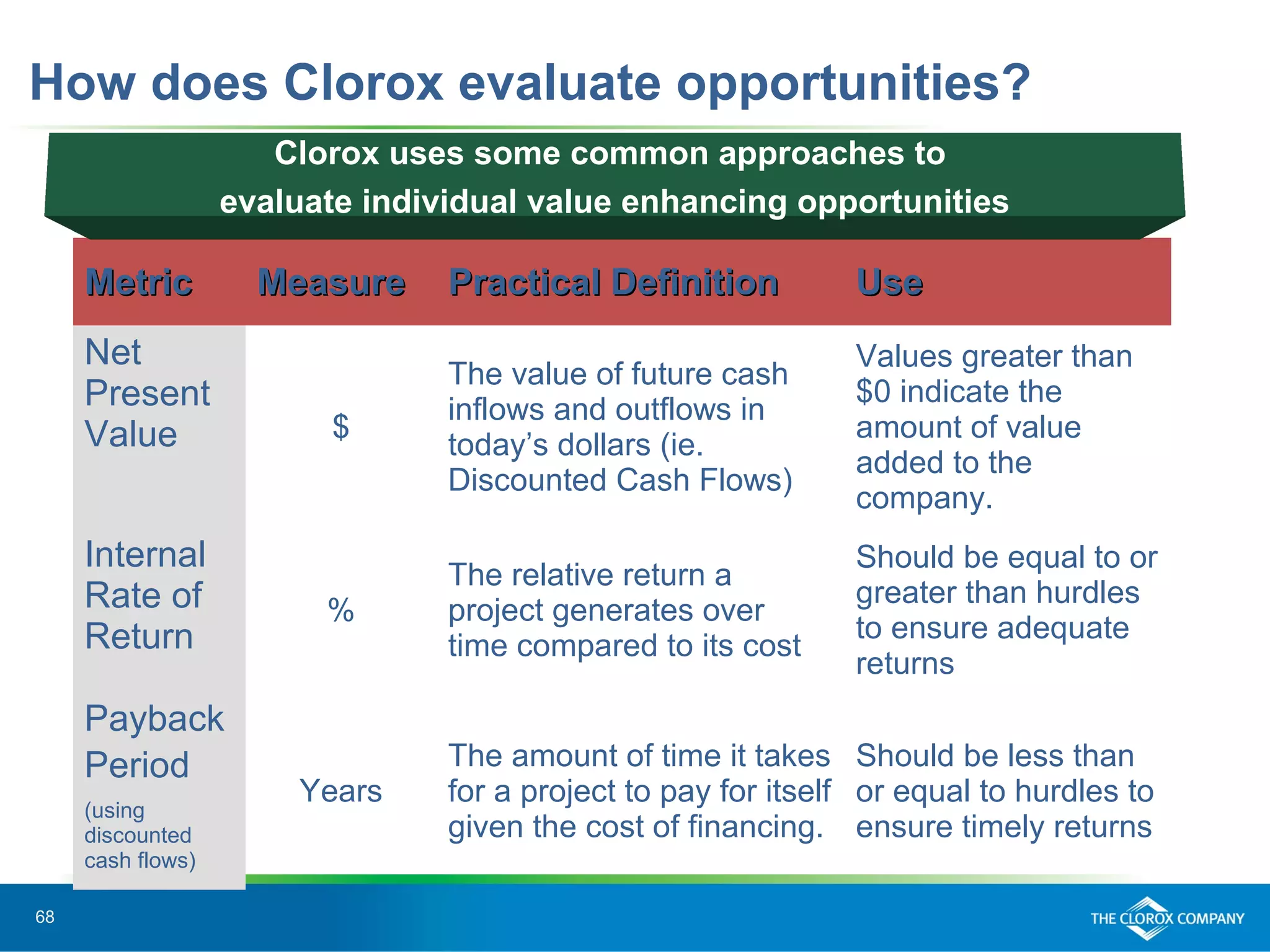

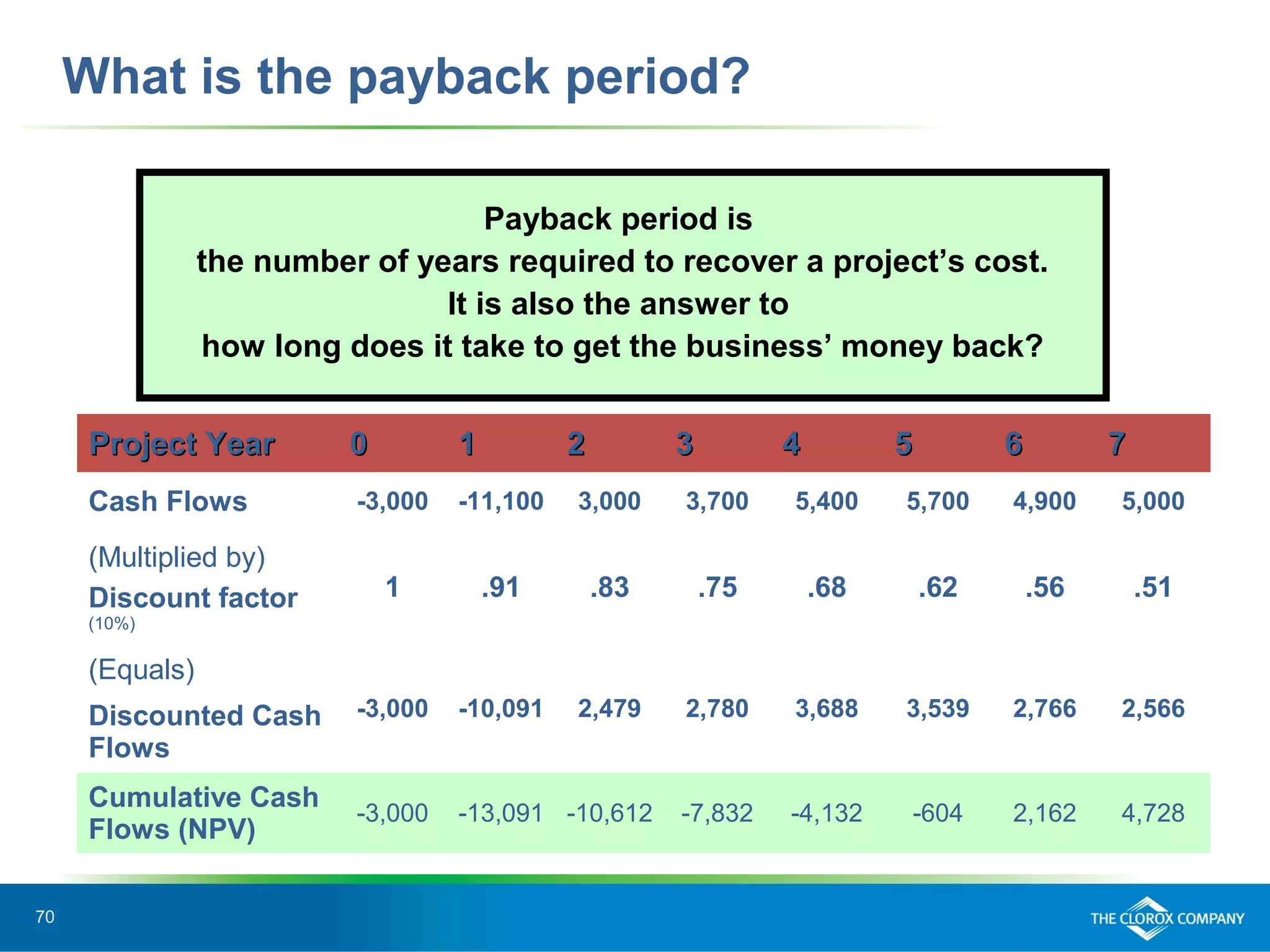

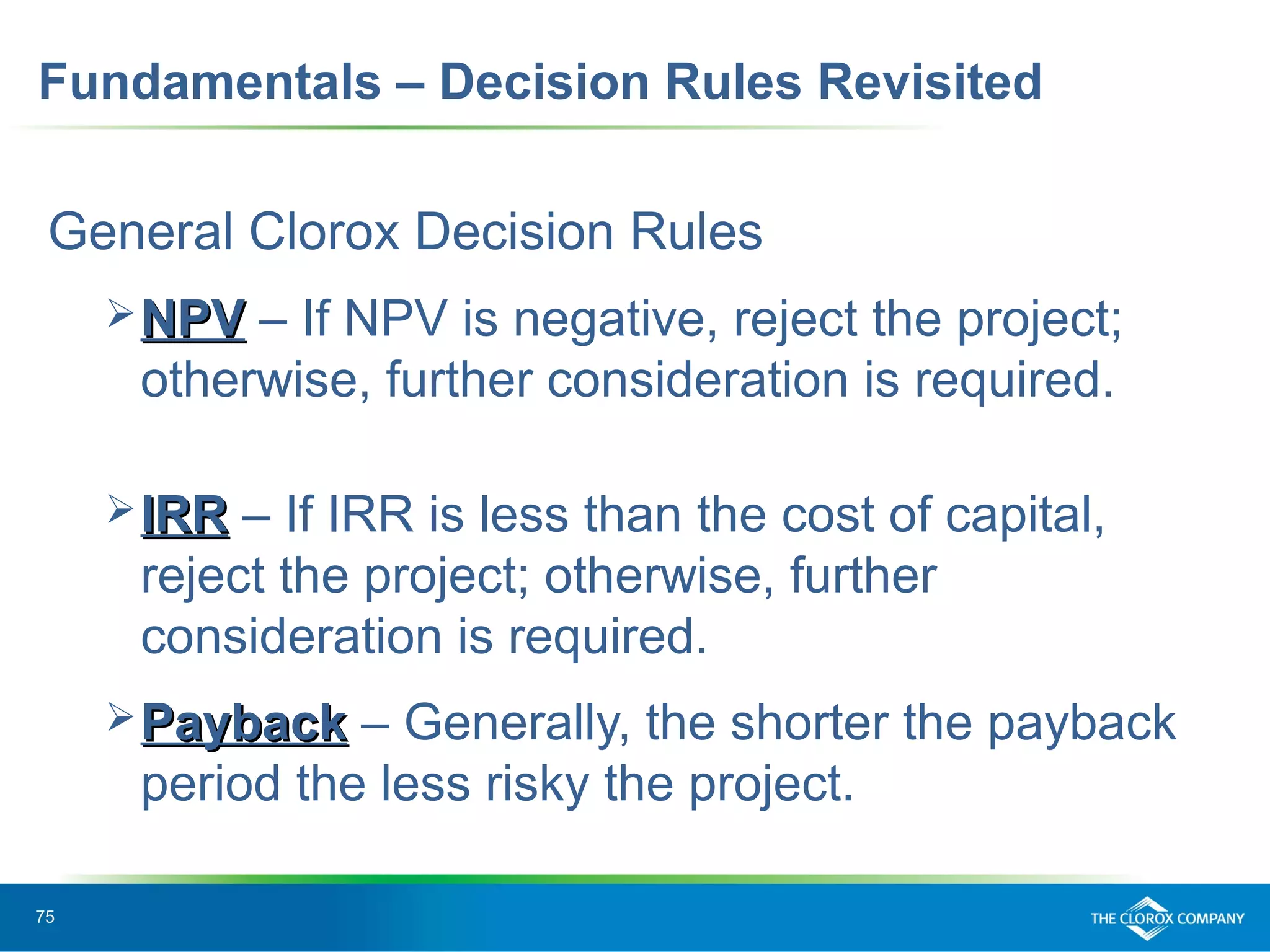

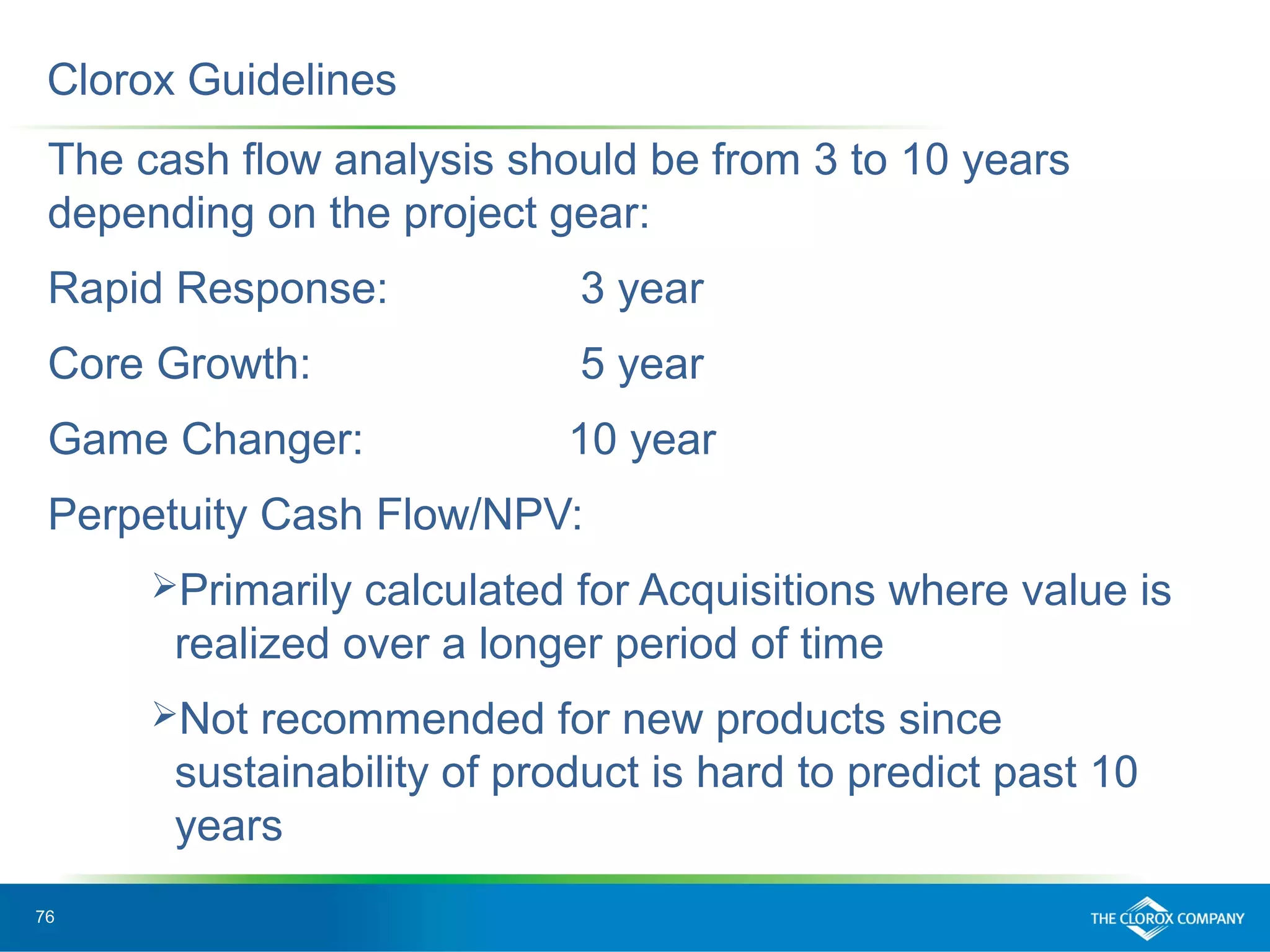

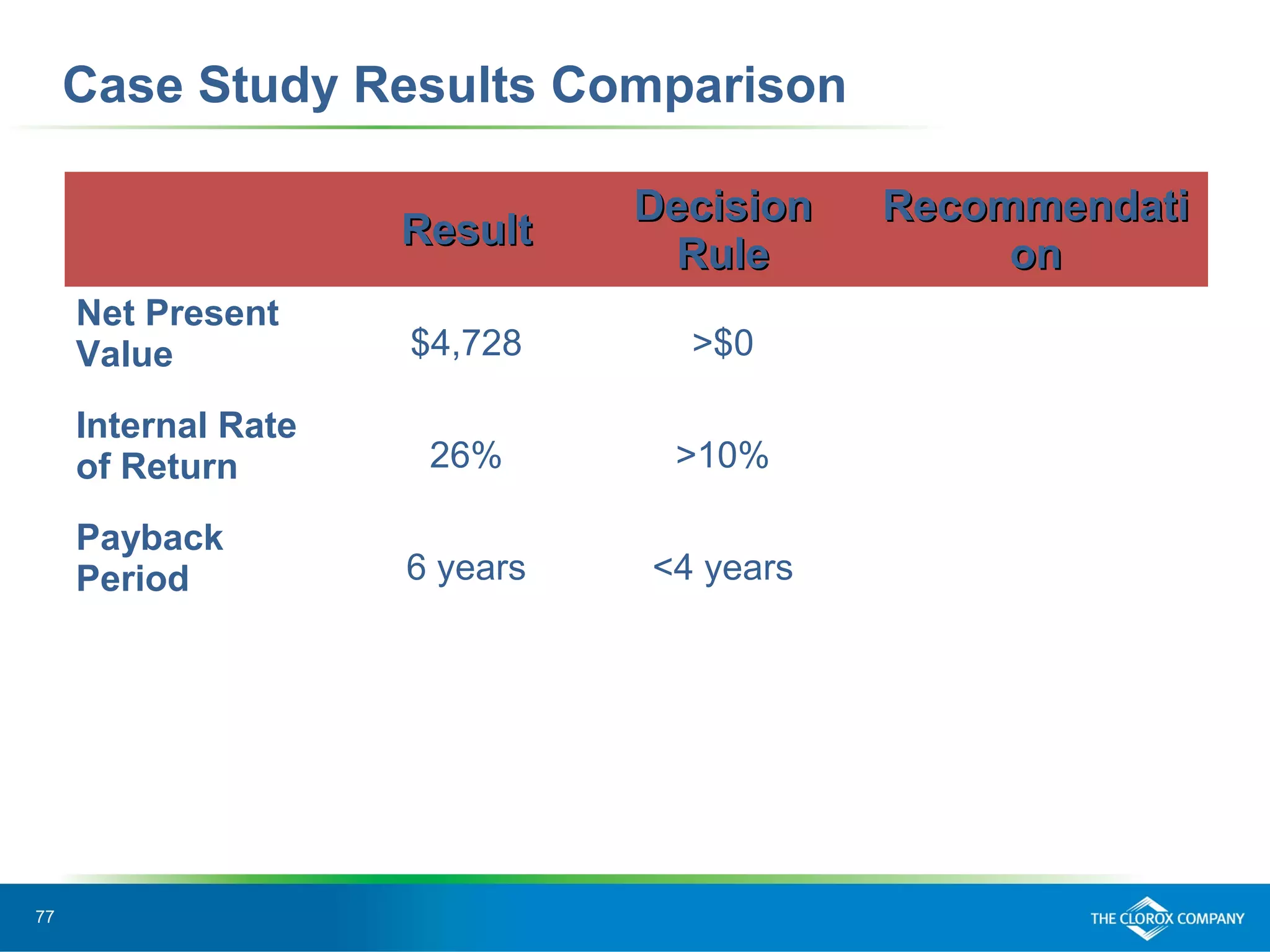

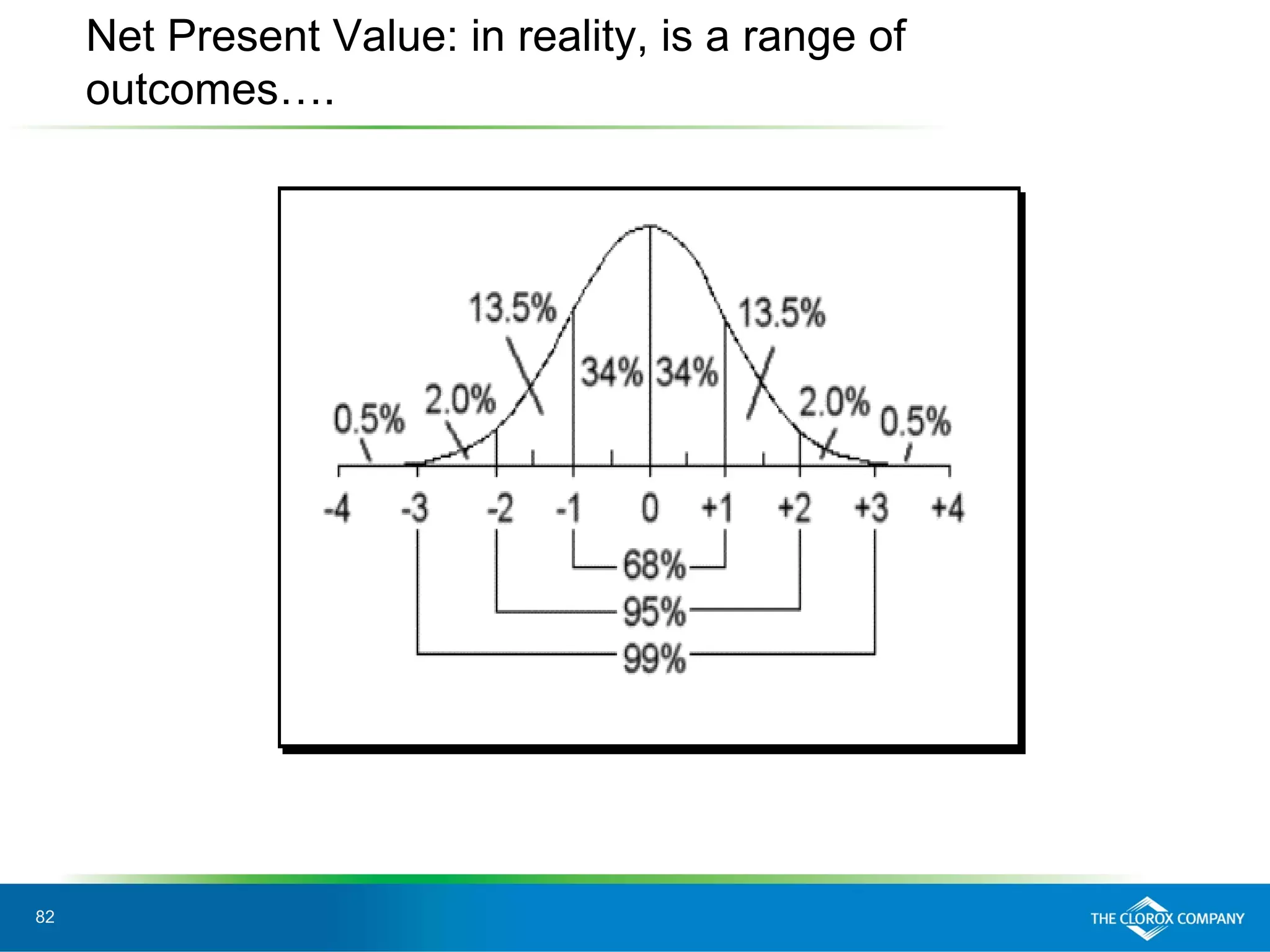

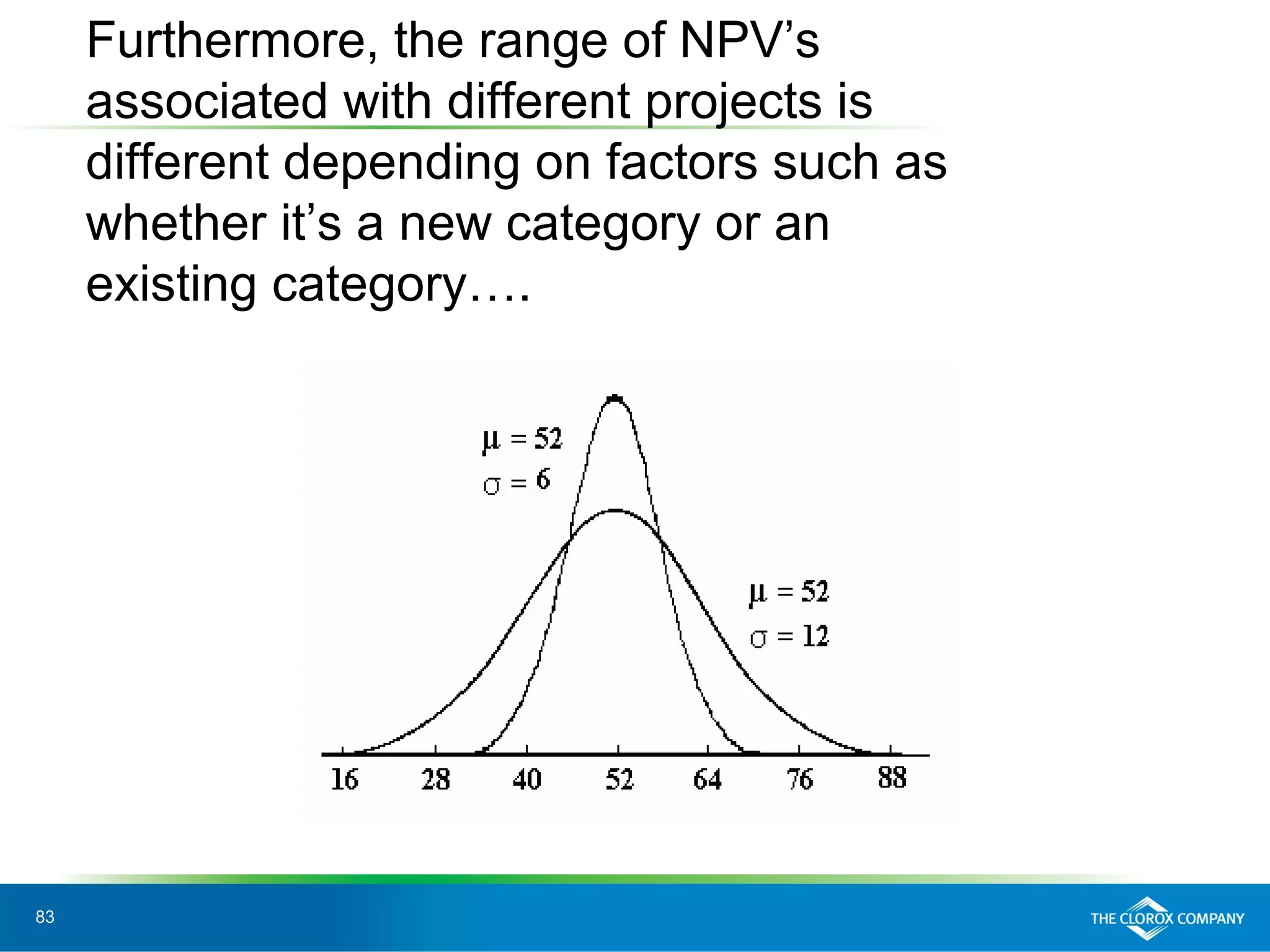

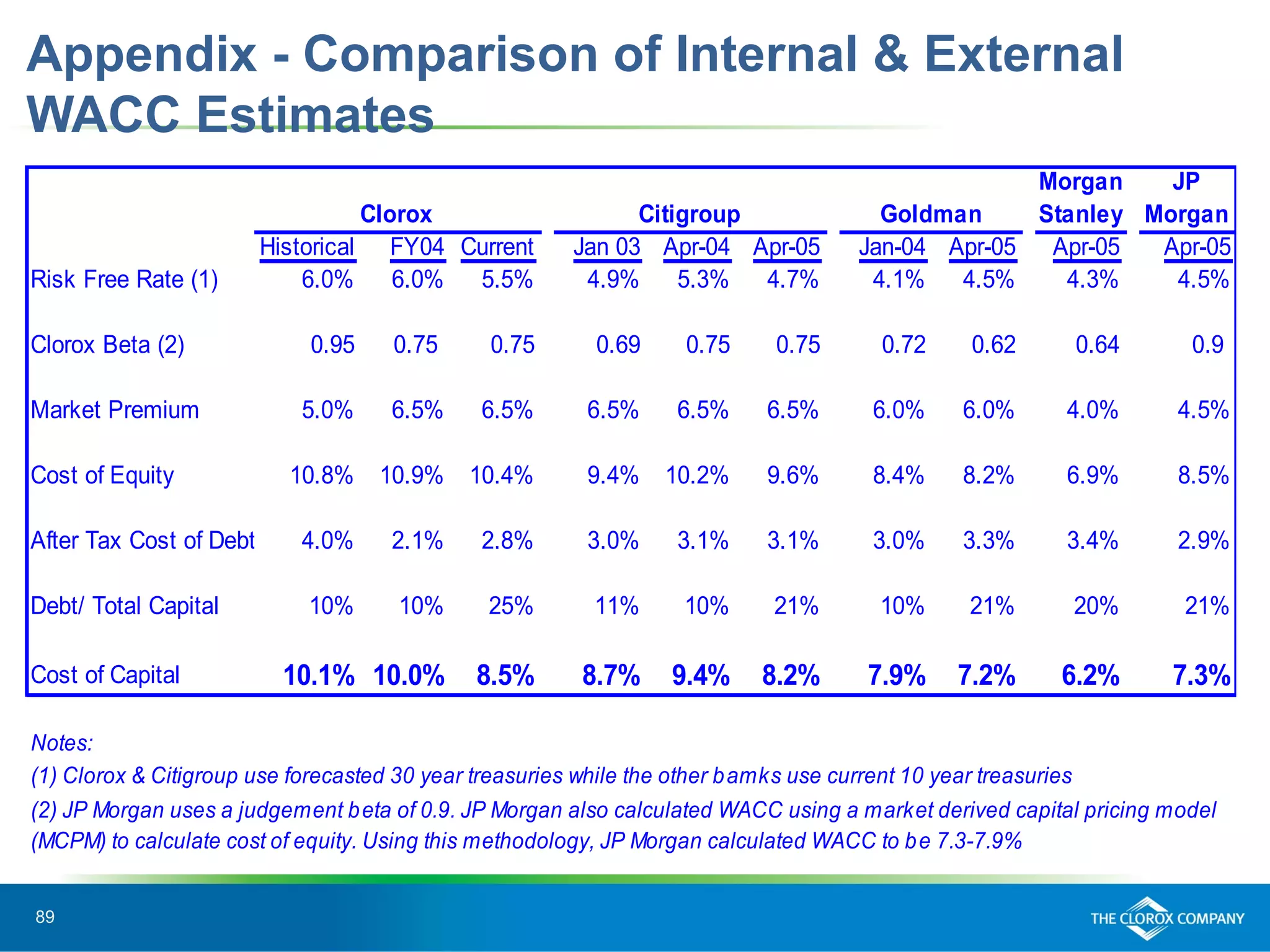

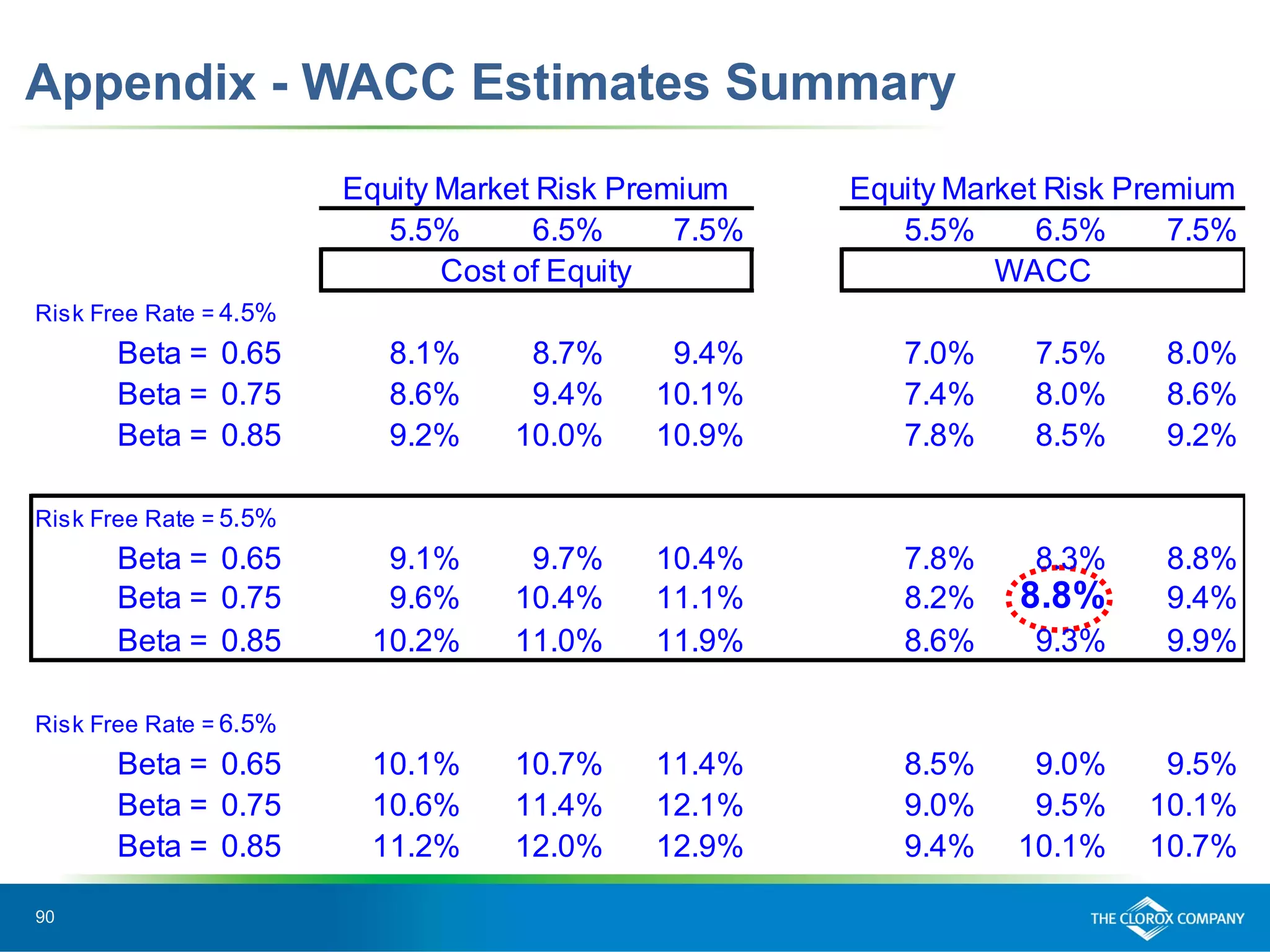

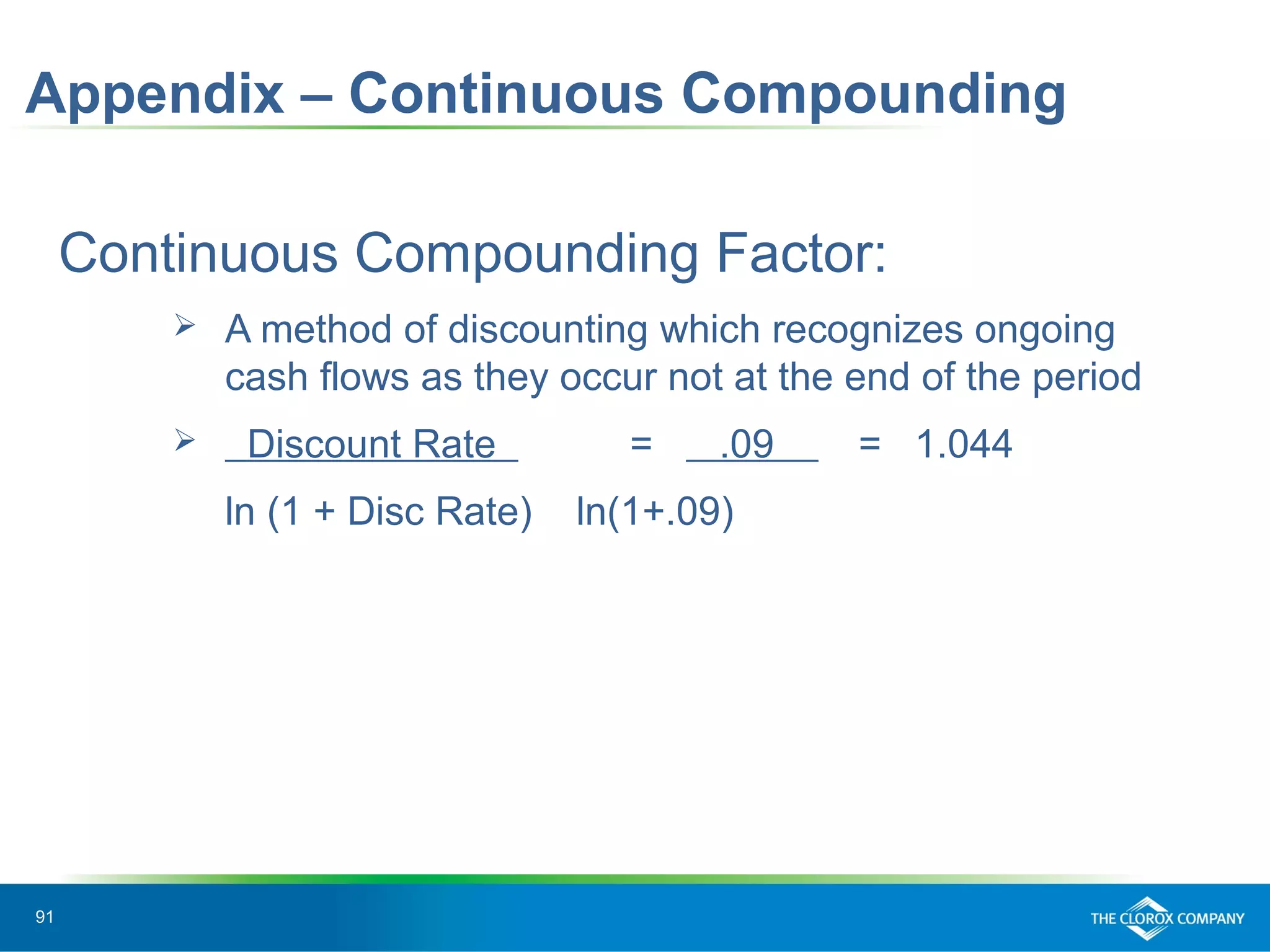

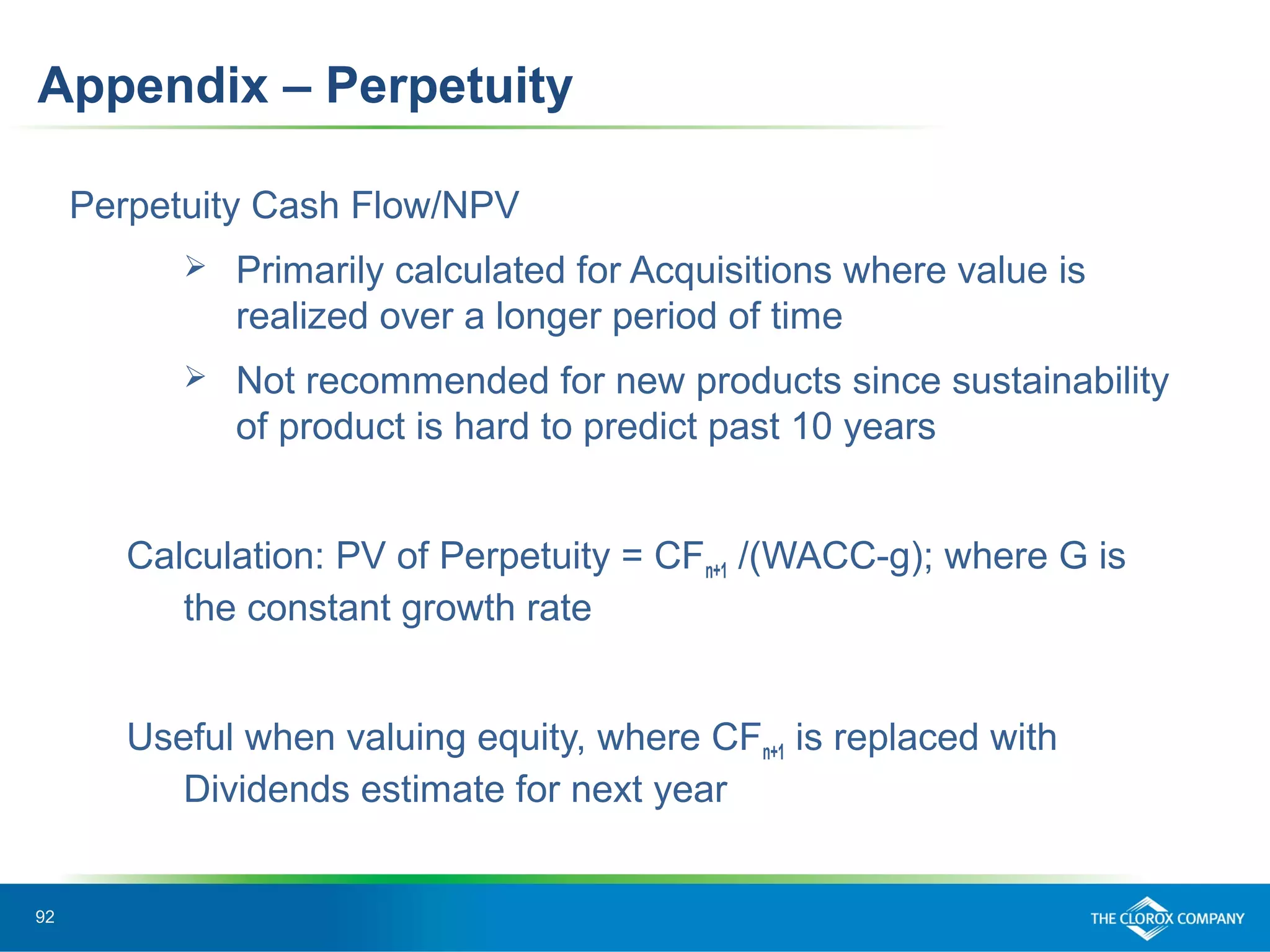

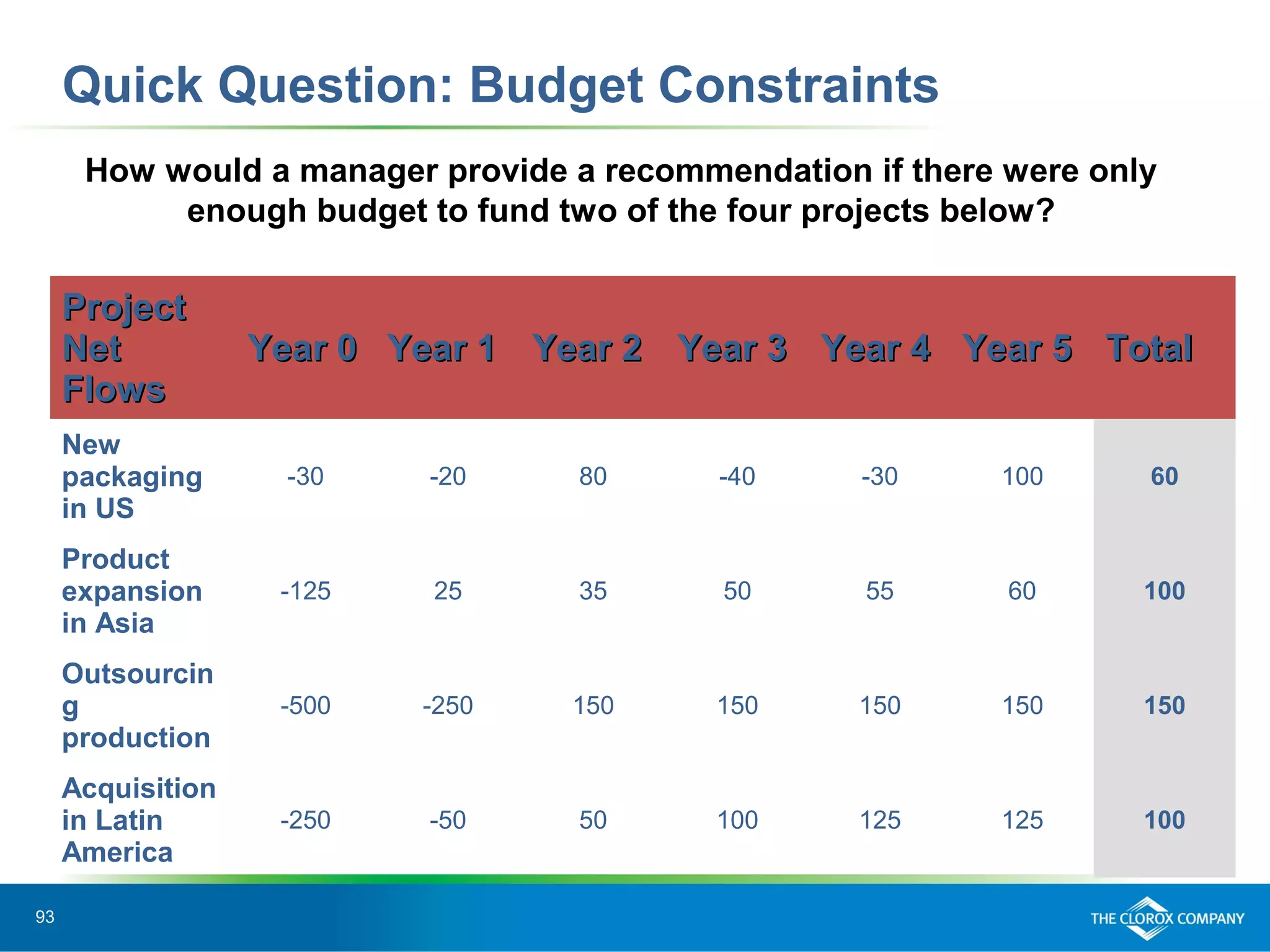

The document provides an overview of discounted cash flow (DCF) analysis and net present value (NPV) calculations. It begins with introductions to basic DCF principles and levels from 1 to 3, similar to levels in chess. It discusses key concepts like time value of money, relevant versus irrelevant cash flows, and how to calculate weighted average cost of capital (WACC) and NPV. The document aims to provide both fundamentals and more advanced strategies for analyzing investments using DCF.