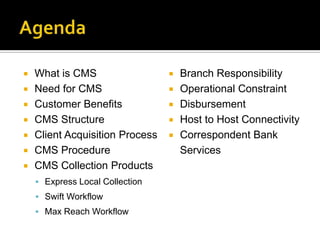

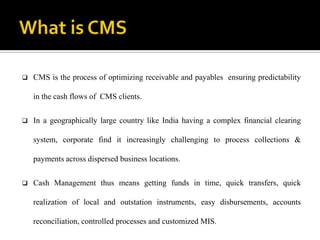

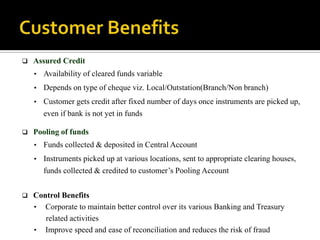

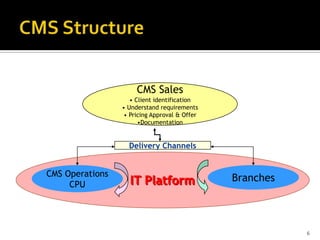

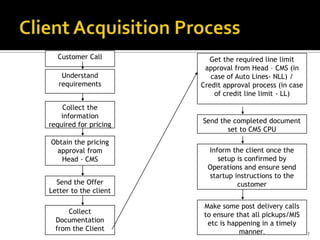

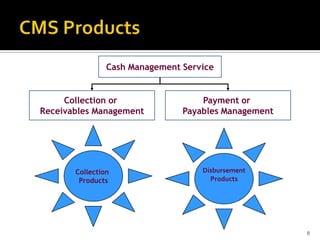

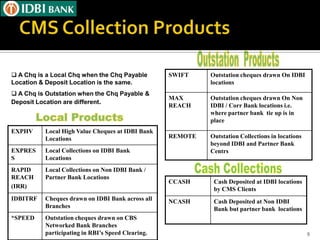

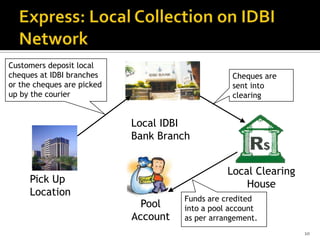

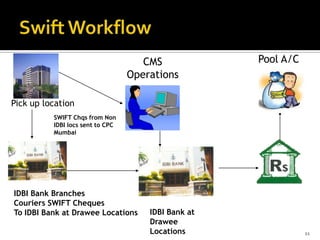

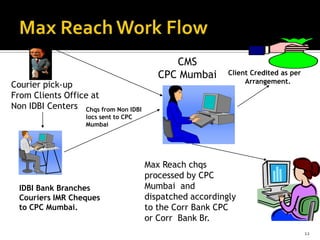

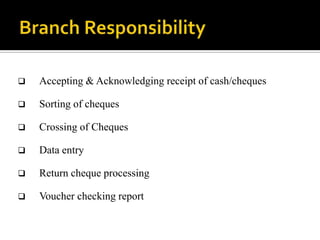

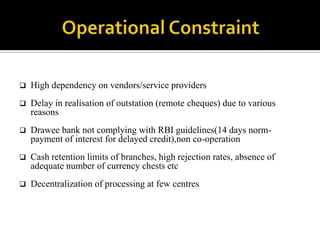

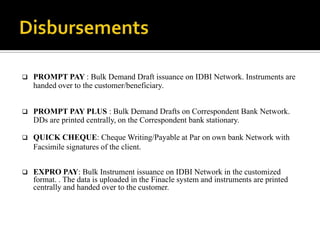

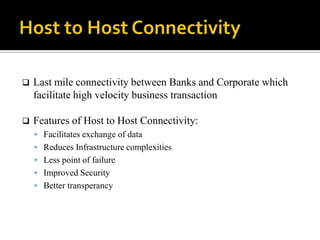

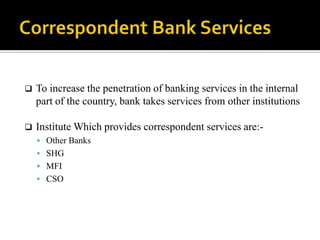

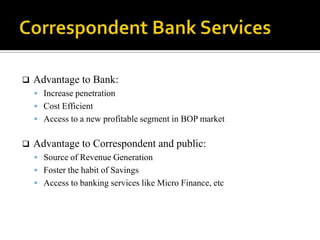

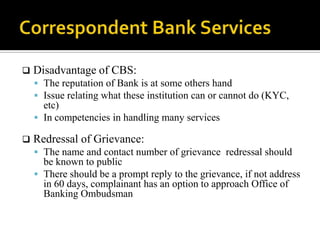

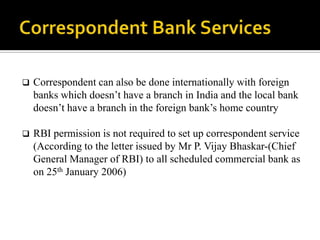

The document discusses cash management services (CMS) and related topics. It defines CMS and outlines its benefits for customers, including assured credit, pooling of funds, and control benefits. It describes the CMS structure and process, including client acquisition, collection and disbursement products, branch responsibilities, and operational constraints. Host to host connectivity, correspondent banking services, and related advantages and disadvantages are also summarized.