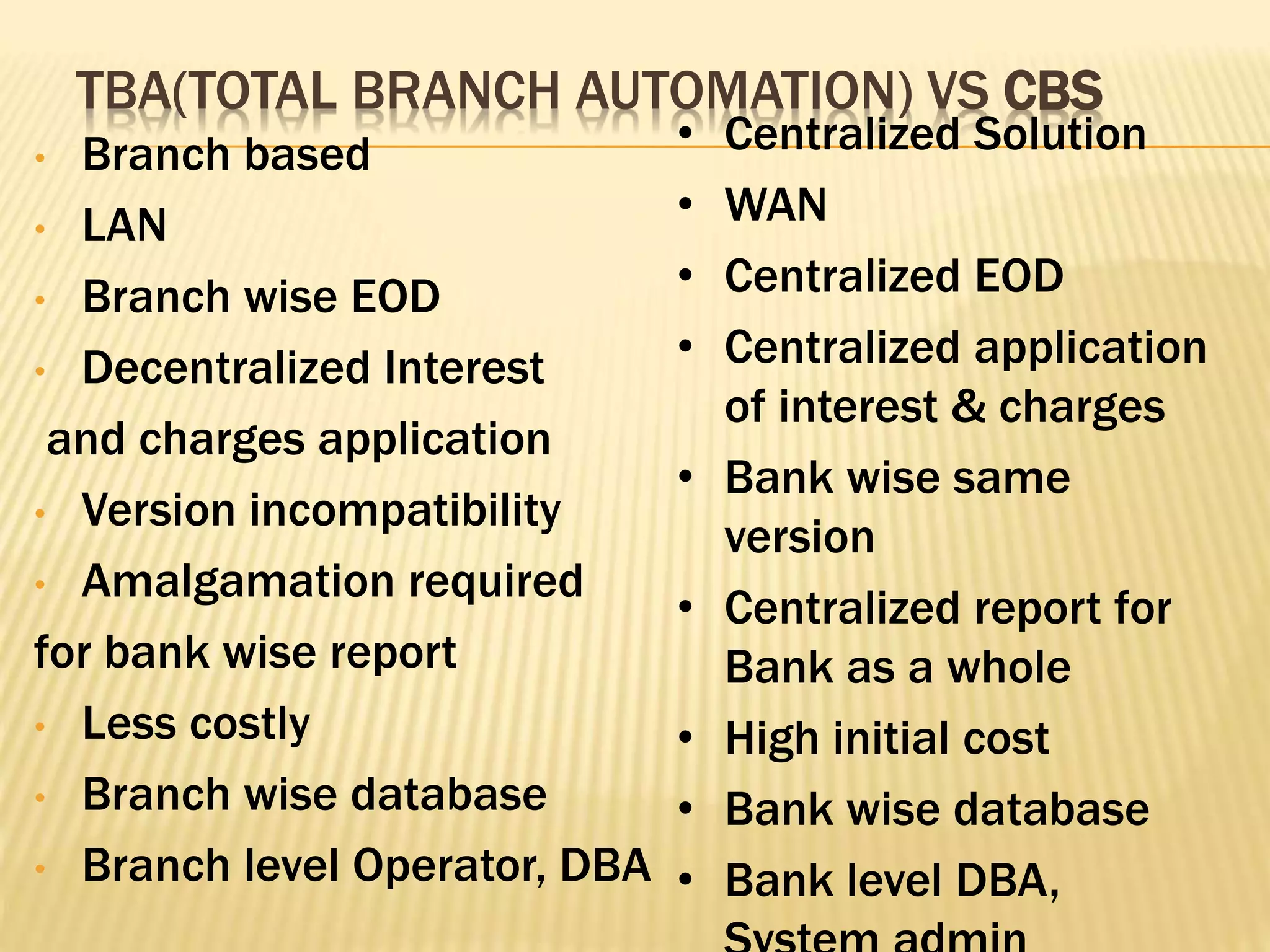

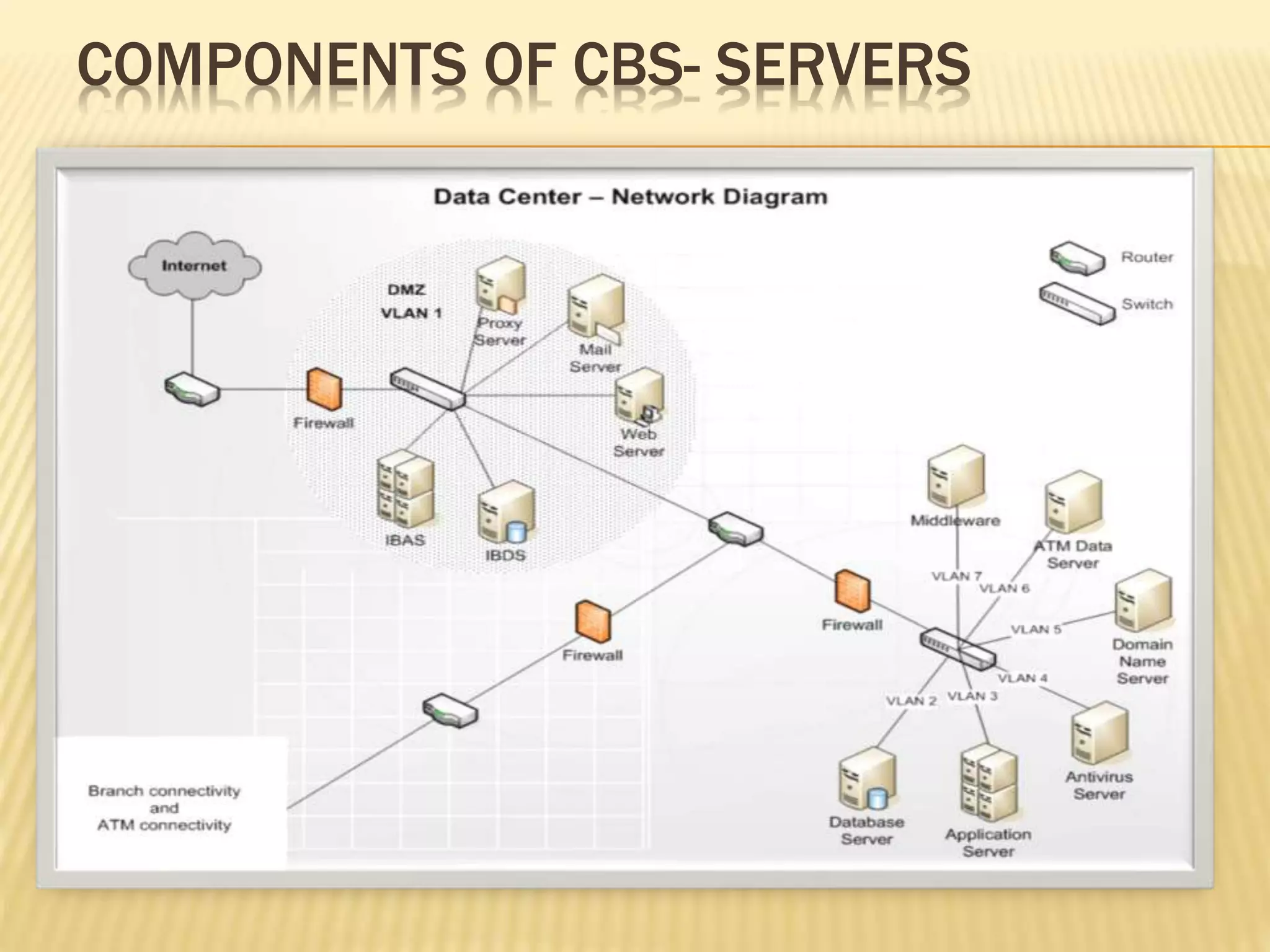

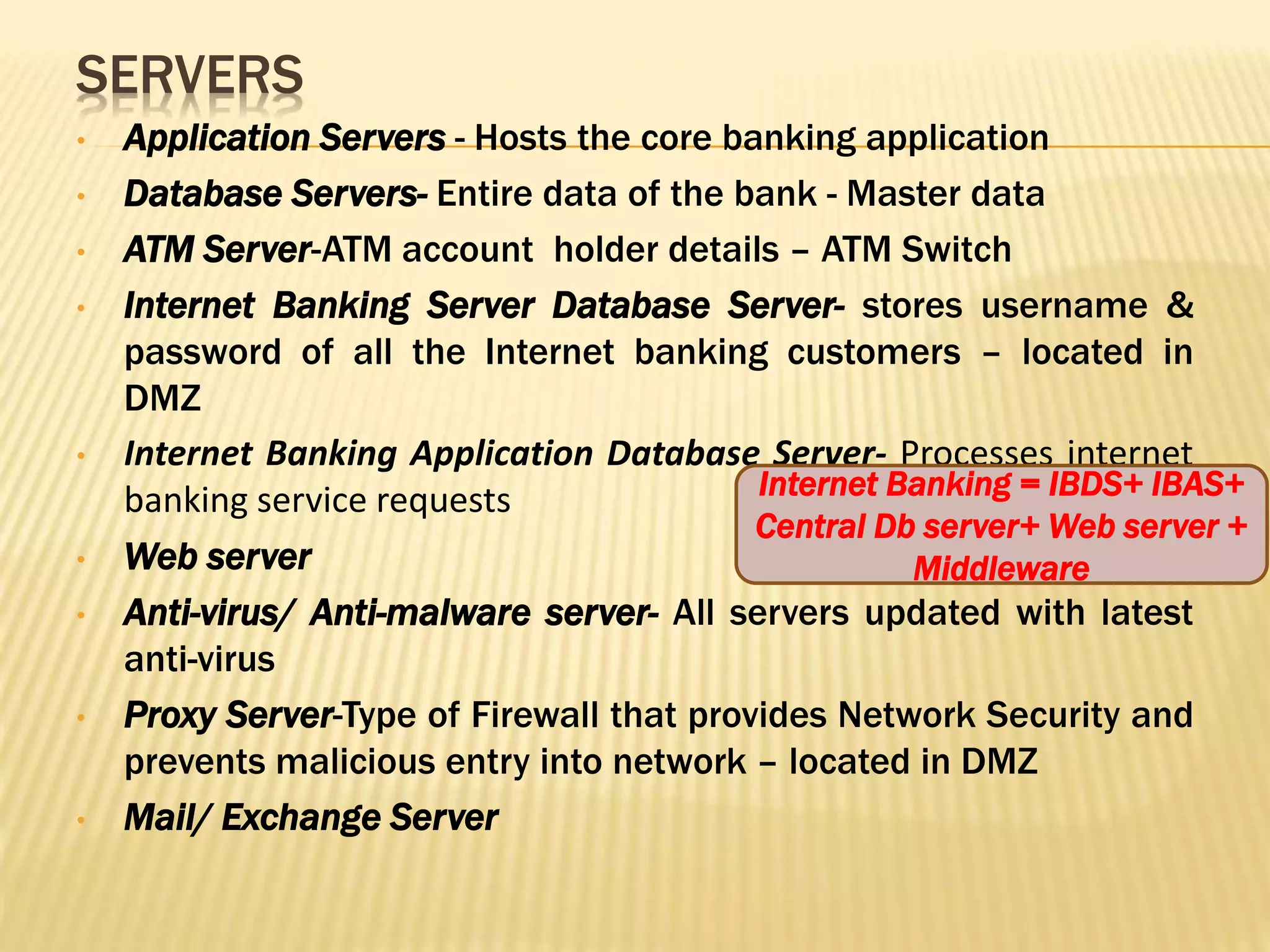

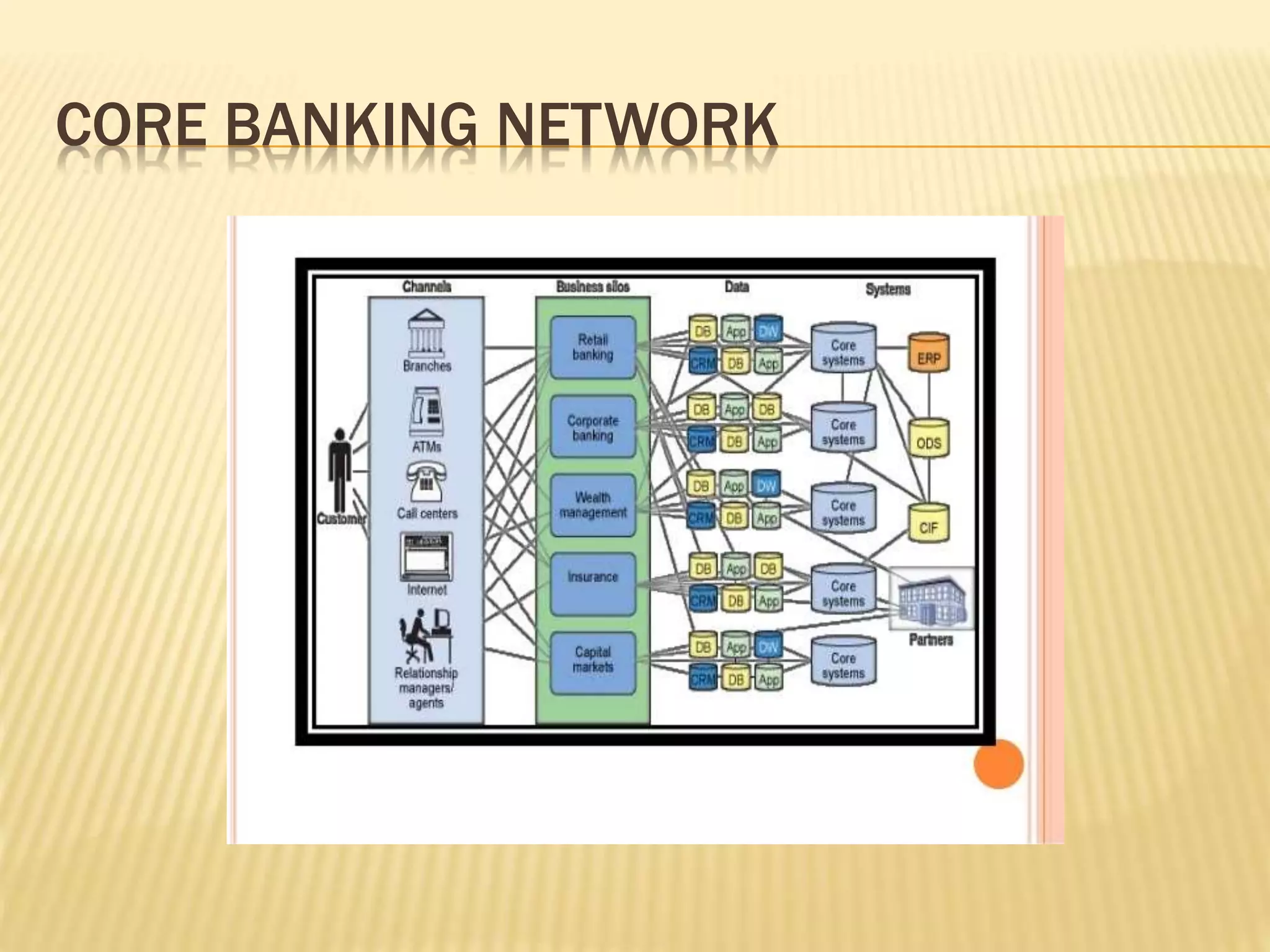

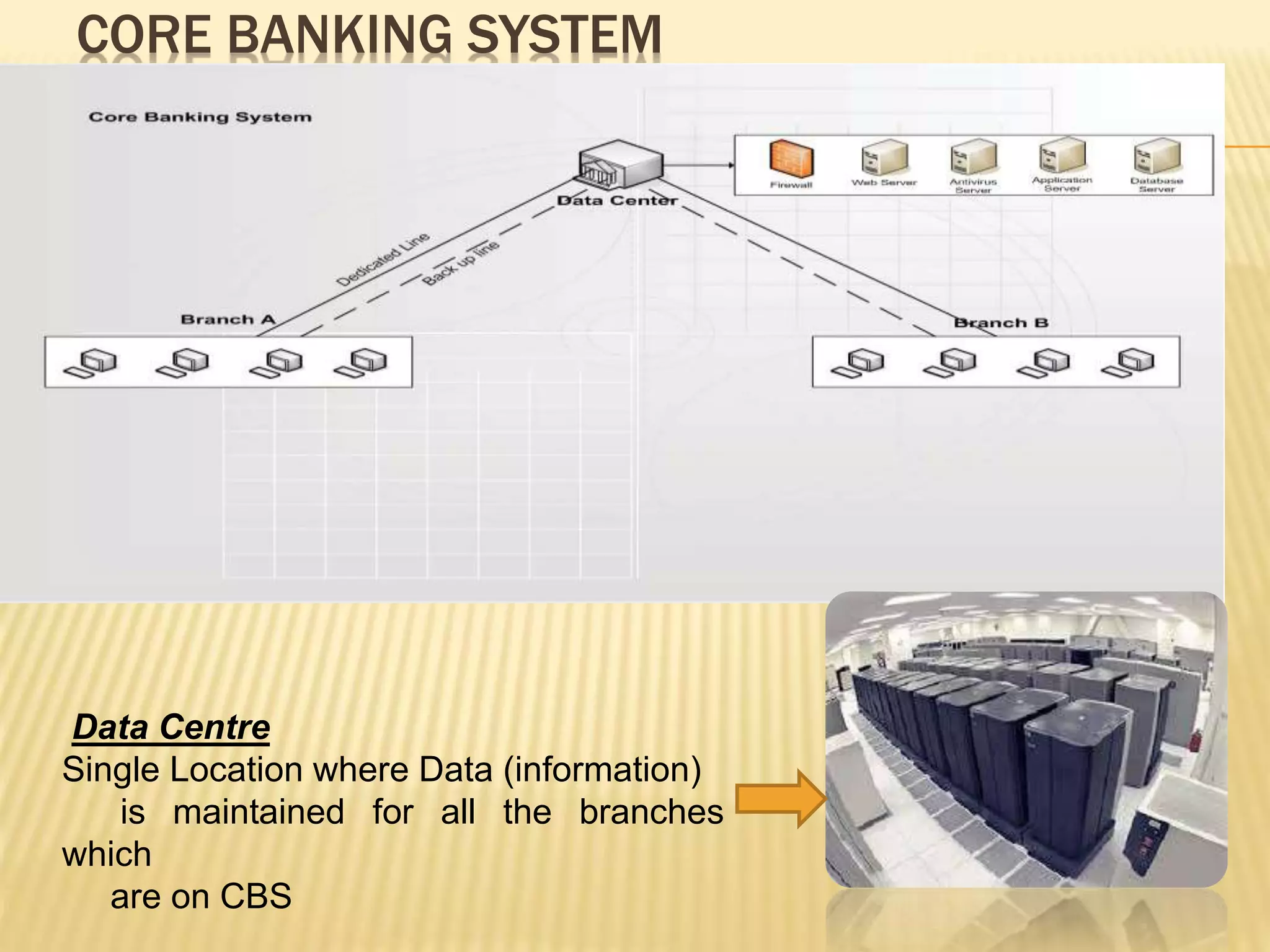

Core banking solution (CBS) is a centralized banking system that allows integrated access to account information and facilitates fund transfer between branches. It consists of application servers, database servers, ATM servers, internet banking servers, and other components connected over a secure network. CBS provides advantages like centralized operations, improved services, and security, but also risks from technology failures or data breaches. It marks a shift from branch-based banking to banks serving customers as a unified whole.