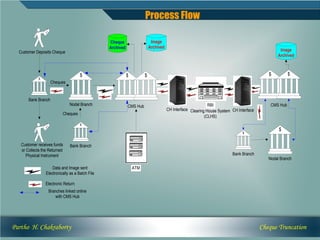

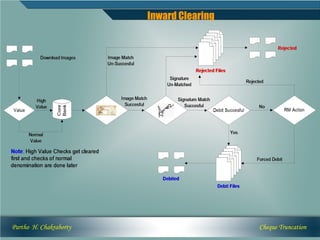

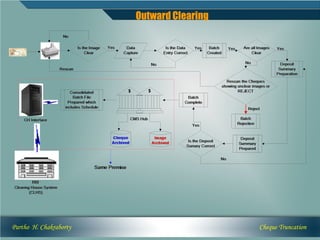

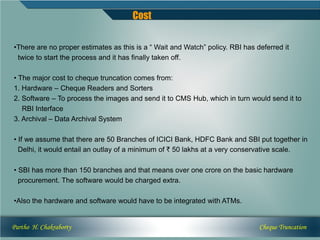

Cheque truncation is a system of cheque clearing and settlement between banks based on electronic cheque images instead of physical cheques. It allows for faster cheque processing and settlement. Under cheque truncation, when a cheque is deposited, the physical cheque is truncated and replaced with digital images. These images are sent electronically between banks to clear payment. This reduces clearing time from days to just one day and lowers processing costs for banks and customers. It enables innovative banking services and faster funds availability.