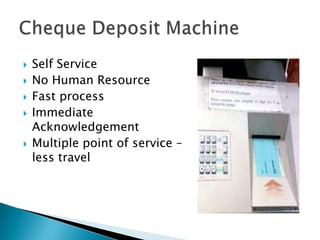

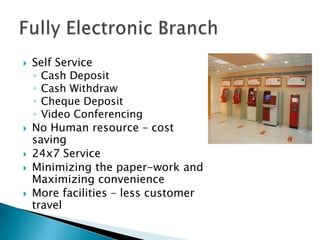

The banking operations in India are determined at three levels - the Reserve Bank of India, individual banks, and bank branches. The RBI establishes broad guidelines for operations and customer services, which banks must follow. Banks then develop their own detailed operational plans based on RBI guidelines and their own service needs. Bank branches implement the operations according to their bank's plans and local requirements. The document then discusses some specific operations of bank branches, including cash handling, managing customer demand, and processes for cash deposits and cheque deposits. It notes challenges with current processes and proposes automated self-service options to make transactions like deposits faster and more convenient.