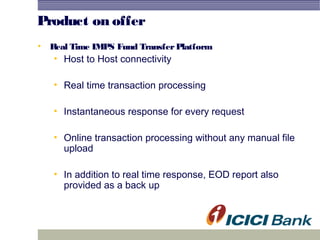

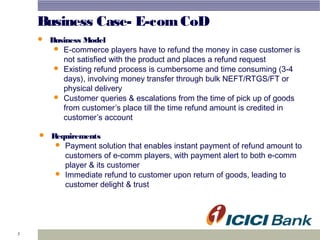

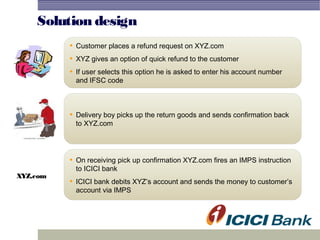

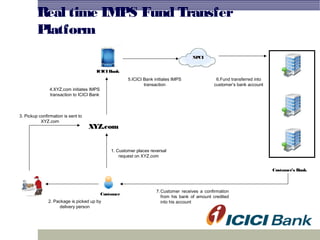

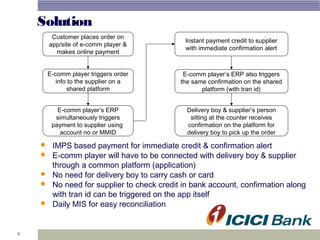

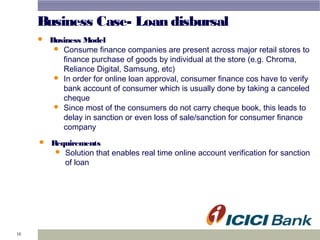

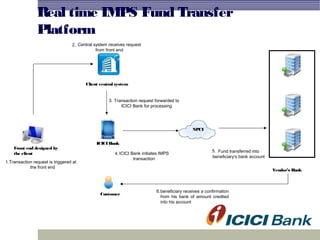

The document discusses ICICI Bank's IMPS (Immediate Payment Service) platform for real-time fund transfers. IMPS allows transactions 24/7/365 with SMS alerts to senders and receivers. ICICI Bank processes over 0.8 million IMPS transactions worth Rs. 6000 million per month, making it the largest processor in India. The document presents several business cases where IMPS can enable instant refunds for e-commerce returns, real-time supplier payments for hyperlocal deliveries, and online verification for loan disbursals.