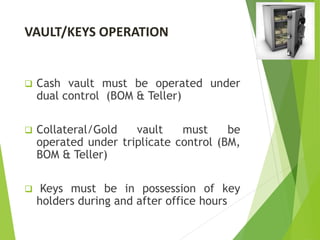

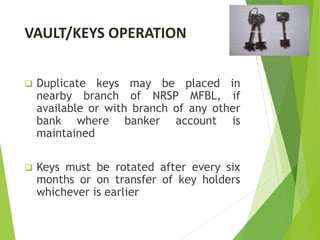

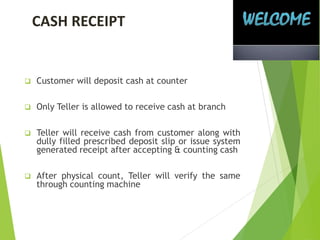

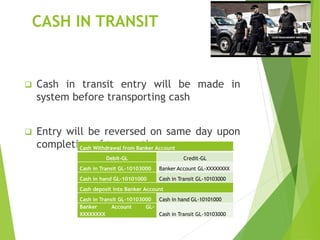

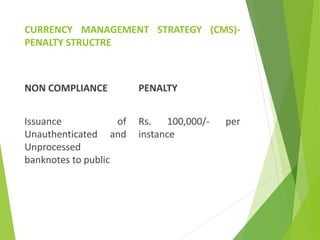

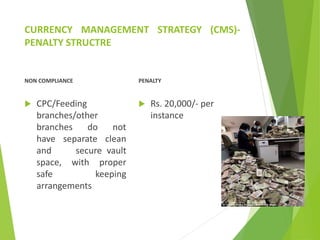

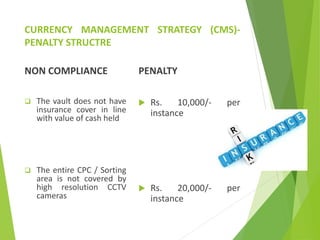

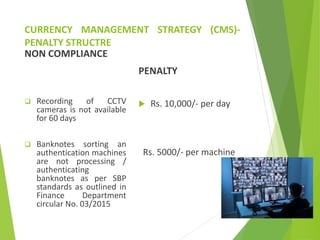

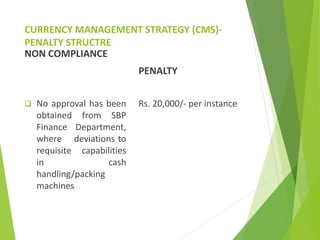

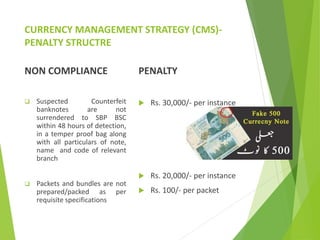

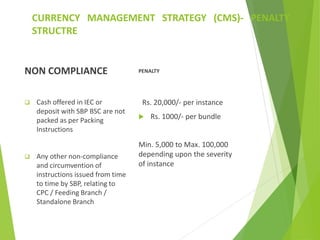

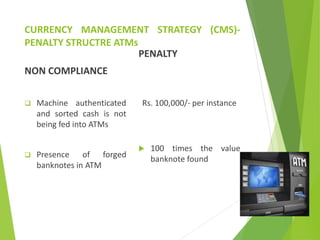

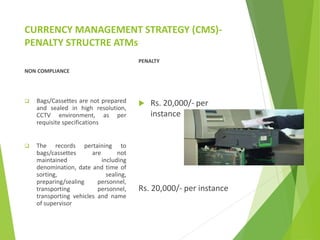

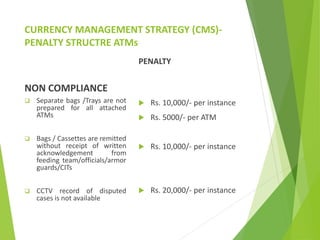

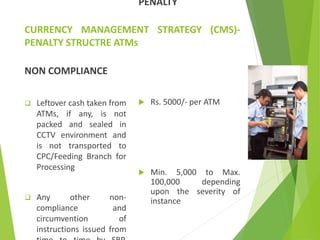

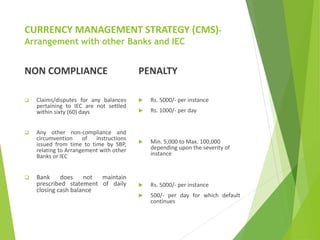

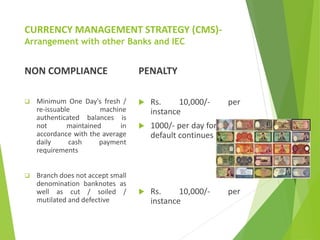

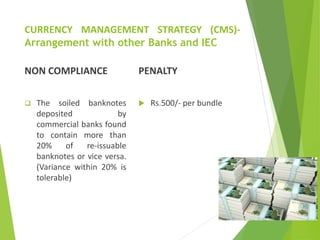

This document outlines the standard operating procedures for cash operations at a bank branch. It discusses topics such as vault operations, cash receipt and payment, utility bill collection, cash in transit, clean note policy, and currency management strategy. The key responsibilities for cash handling are described, including dual controls, documentation, sorting, and compliance with central bank policies.