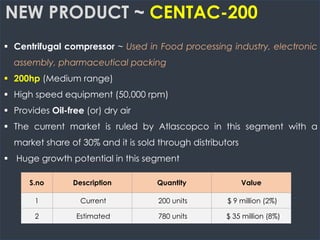

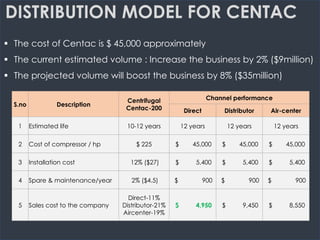

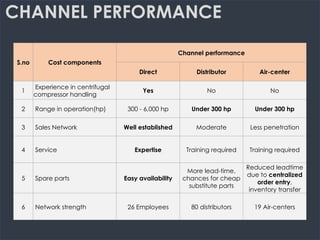

Ingersoll Rand manufactures stationary air compressors ranging from 3/4 to 6,000 hp. They use four distribution channels: direct sales force, independent distributors, IR distributors (Air-centers), and manufacturer's representatives. IR is introducing a new centrifugal compressor, the Centac-200, in the medium 200hp range. This market is currently dominated by Atlas Copco, which uses distributors. Three options for distributing the Centac-200 were considered: direct sales force, individual distributors, or Air-centers. Air-centers were concluded to be the best option as they are specialists who can focus on the niche oil-free compressor market and provide expert service, unlike individual distributors. This