1) Time value of money is an important concept in capital budgeting where the value of cash flows depends on when they occur due to interest rates.

2) To calculate the net present value (NPV) of a project, one discounts each cash inflow to its present value using the appropriate discount factor and sums these values, then subtracts the present value of cash outflows.

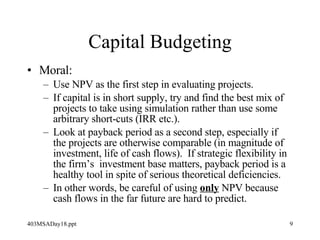

3) NPV is the preferred method for evaluating projects as it considers the timing of all cash flows, but payback period can also be considered to account for uncertainty in long-term cash flows.