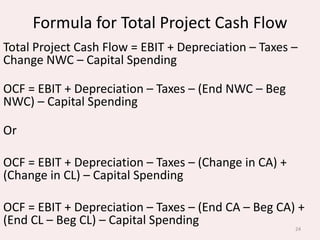

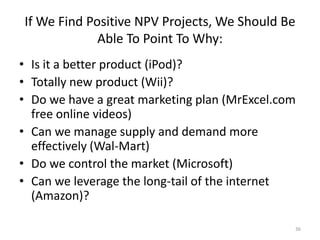

This document discusses various topics related to making capital investment decisions, including relevant cash flows for projects, cash flows from accounting numbers, MACRS tax depreciation rules, and sensitivity analysis. It provides examples of calculating net present value from pro forma financial statements and cash flows. It emphasizes that actual future cash flows are unknown and discusses using scenario and sensitivity analysis to account for forecasting risk when evaluating projects.