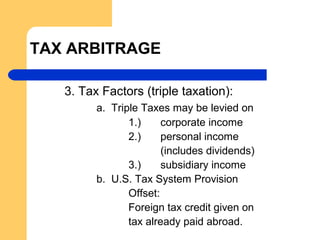

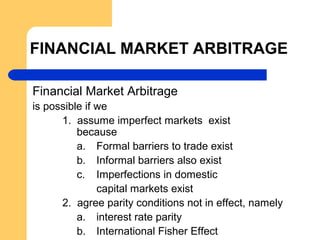

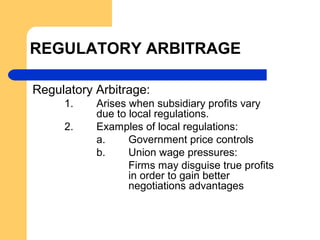

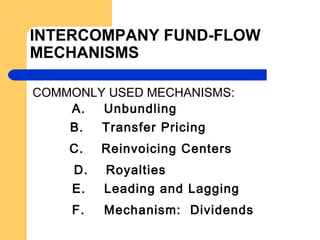

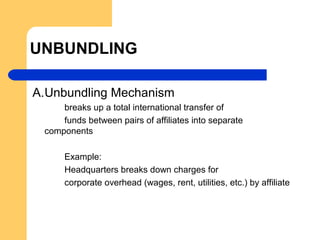

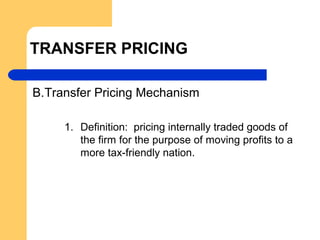

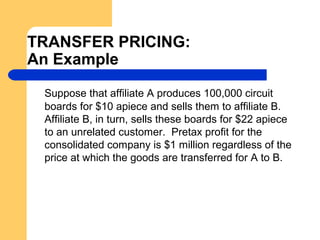

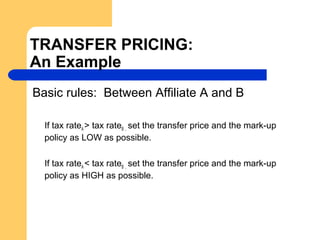

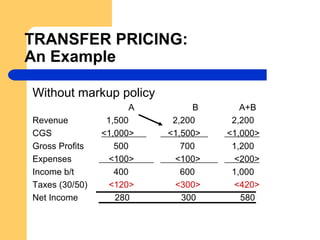

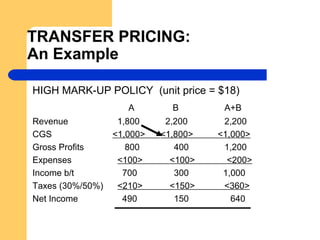

This document discusses various mechanisms used by multinational corporations to transfer funds between subsidiaries to reduce taxes and take advantage of regulatory differences. It describes mechanisms like transfer pricing, where internal prices are adjusted to shift profits between high and low tax jurisdictions. Reinvoicing centers, where a center in a low tax nation handles invoicing to gain currency and tax advantages, are also discussed. The document provides examples and details of these various intercompany fund transfer mechanisms used by multinational financial systems.