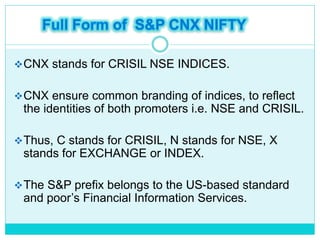

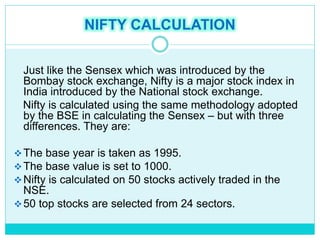

The National Stock Exchange of India (NSE) is located in Mumbai and was founded in 1992. It is regulated by the Securities and Exchange Board of India and trades in various markets including equities, derivatives, debt, and commodities. The NSE calculates several indices to track the performance of its markets, with the S&P CNX Nifty being its main index consisting of the 50 largest stocks by market capitalization. The NSE aims to provide a fair, transparent and efficient marketplace for investors through electronic trading systems.