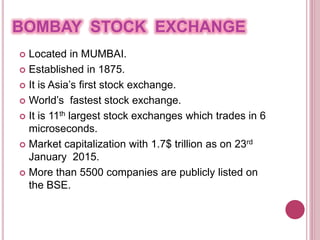

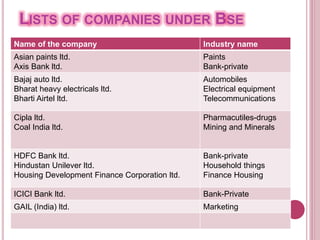

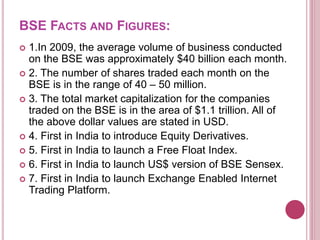

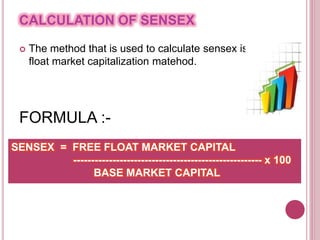

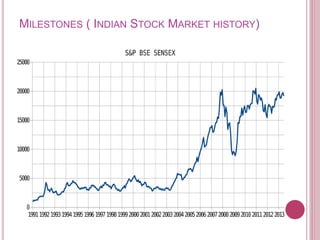

The document provides information about the Bombay Stock Exchange (BSE) in India. It discusses that the BSE is located in Mumbai and was established in 1875, making it Asia's first stock exchange. It also lists some key facts about the BSE, such as it being the 11th largest stock exchange globally and having over 5,500 publicly listed companies. The document then discusses the role of stock exchanges in India and provides an overview of the BSE's management, network, and objectives.