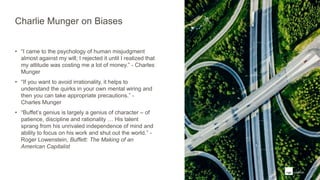

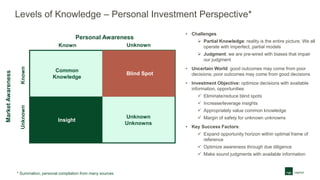

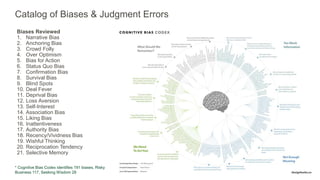

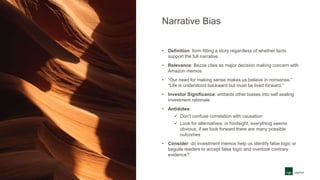

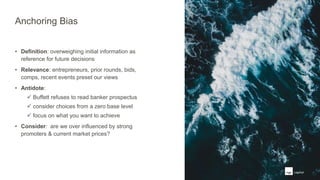

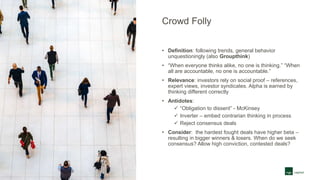

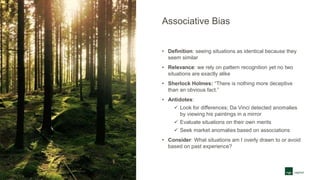

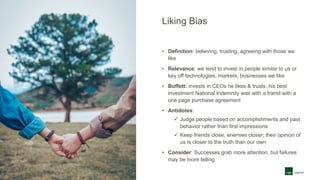

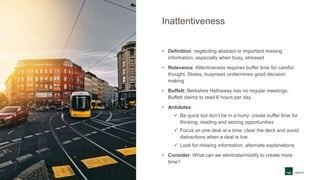

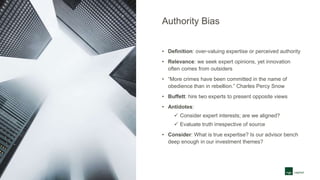

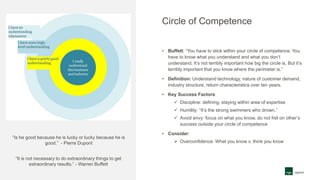

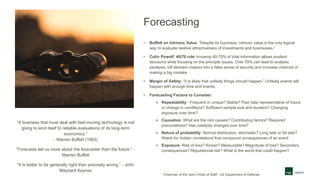

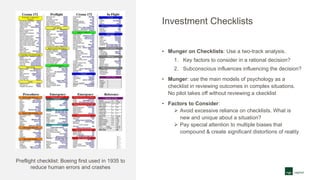

The document reviews key insights from Peter Bevelin's 'Seeking Wisdom: From Darwin to Munger,' focusing on the significance of understanding cognitive biases and judgment errors in decision-making. It emphasizes principles from notable figures like Charlie Munger and Warren Buffett, detailing various biases such as confirmation bias, narrative bias, and loss aversion that can affect investment choices. The text also outlines strategies to mitigate these biases and enhance decision-making processes, advocating for increased awareness and humility in investment practices.