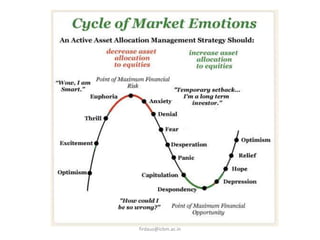

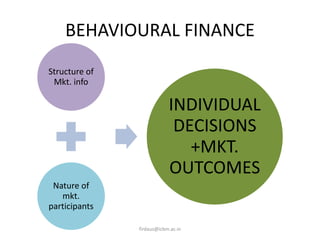

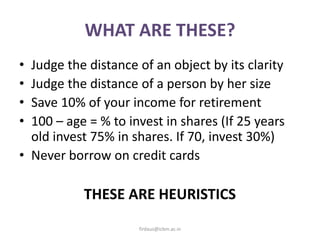

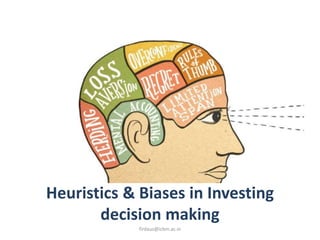

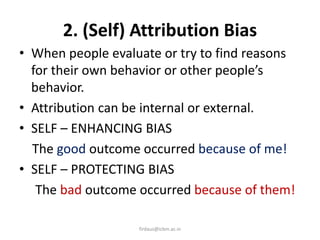

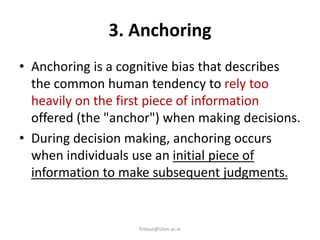

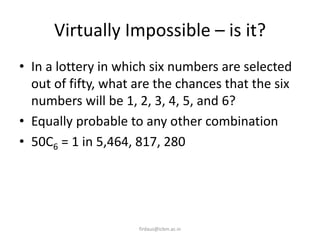

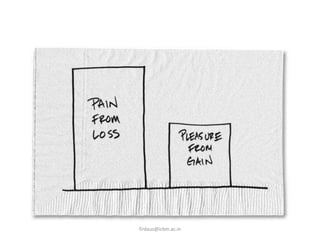

Behavioral finance is a sub-field of behavioral economics that examines how psychological factors influence financial decision-making and market anomalies. It highlights the role of heuristics and biases, such as representativeness bias and confirmation bias, that can lead to systematic errors in judgment and investment decisions. The document also discusses various cognitive biases, like loss aversion and herd behavior, that affect individual and group behavior in financial contexts.