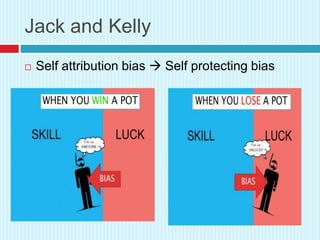

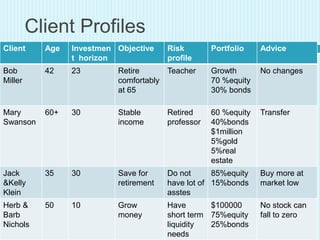

The document discusses behavioral finance, which examines how psychological factors influence investors' decisions and market outcomes. It outlines various cognitive biases such as ambiguity aversion, mental accounting, framing, and herd behavior that can impact investment behavior. Additionally, it provides detailed client profiles with specific investment strategies tailored to their age, objectives, and risk profiles.