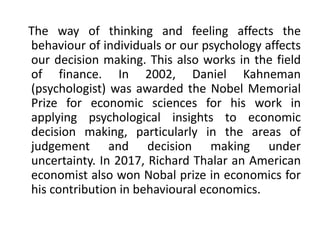

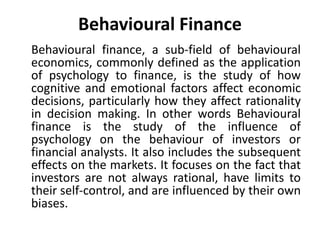

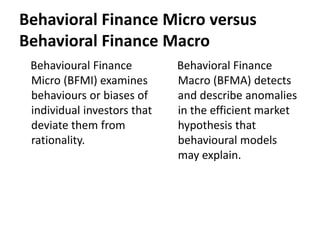

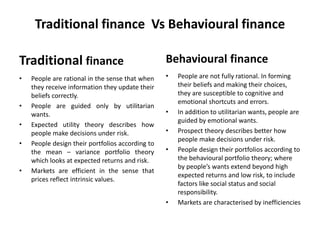

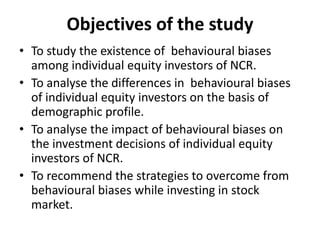

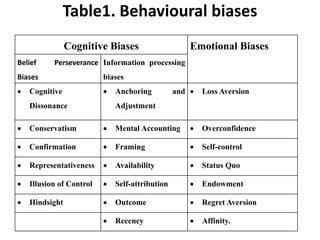

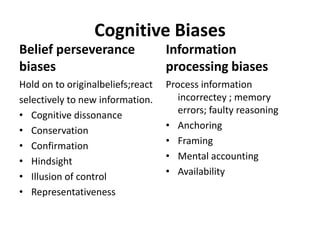

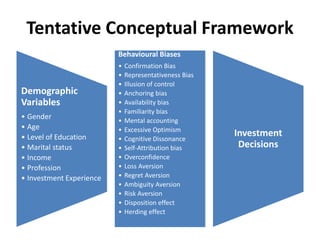

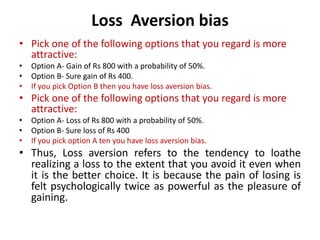

This document summarizes an annual seminar presentation given by Sushila, a doctoral research scholar. The presentation outlined her research on the impact of behavioural biases on individual equity investors in the National Capital Region of India. The presentation introduced behavioural finance concepts and highlighted key behavioral biases like anchoring bias, availability bias, and loss aversion. It described Sushila's literature review process, identification of 17 biases, and development of a conceptual model relating demographic factors and biases to investment decisions. The presentation concluded with details about Sushila's questionnaire to measure biases and a paper she published on applying behavioral finance to stock market investment decisions.