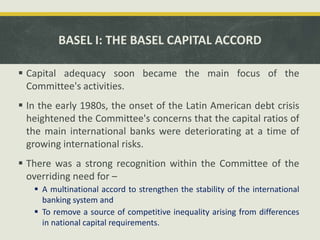

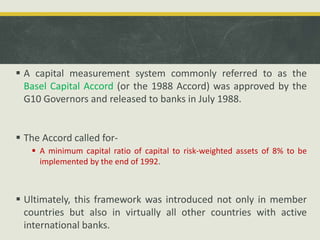

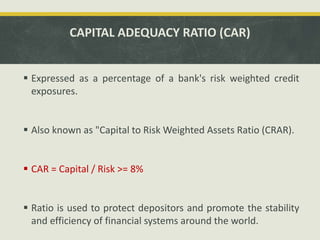

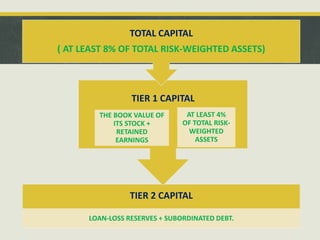

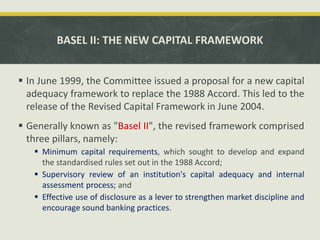

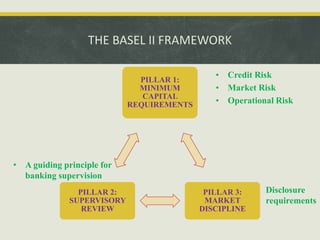

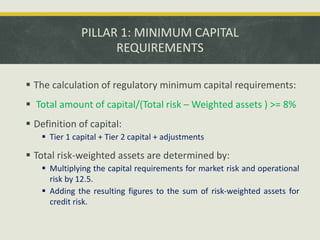

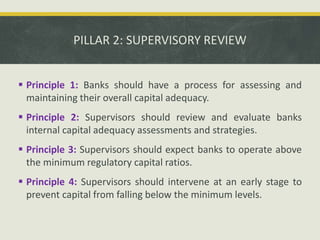

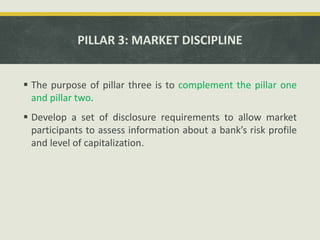

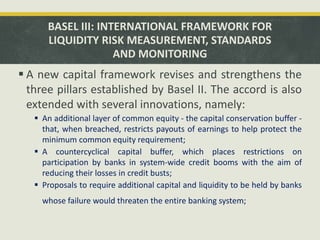

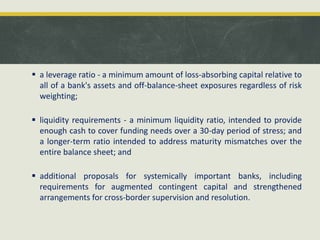

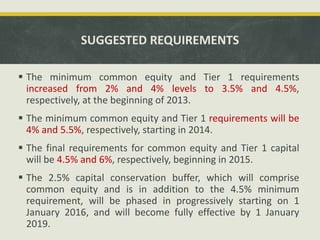

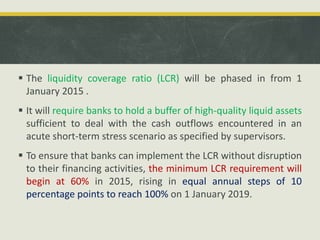

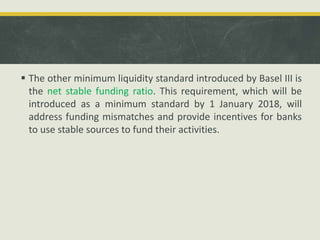

The document summarizes the history and development of the Basel Committee on Banking Supervision and the Basel Accords. It discusses how the Basel Committee was formed in 1974 in response to banking crises. It then describes the three Basel Accords - Basel I established minimum capital requirements in 1988, Basel II introduced additional risk-based requirements in 2004, and Basel III strengthened capital and liquidity standards following the 2008 financial crisis. The document provides details on the pillars and key provisions of each accord.