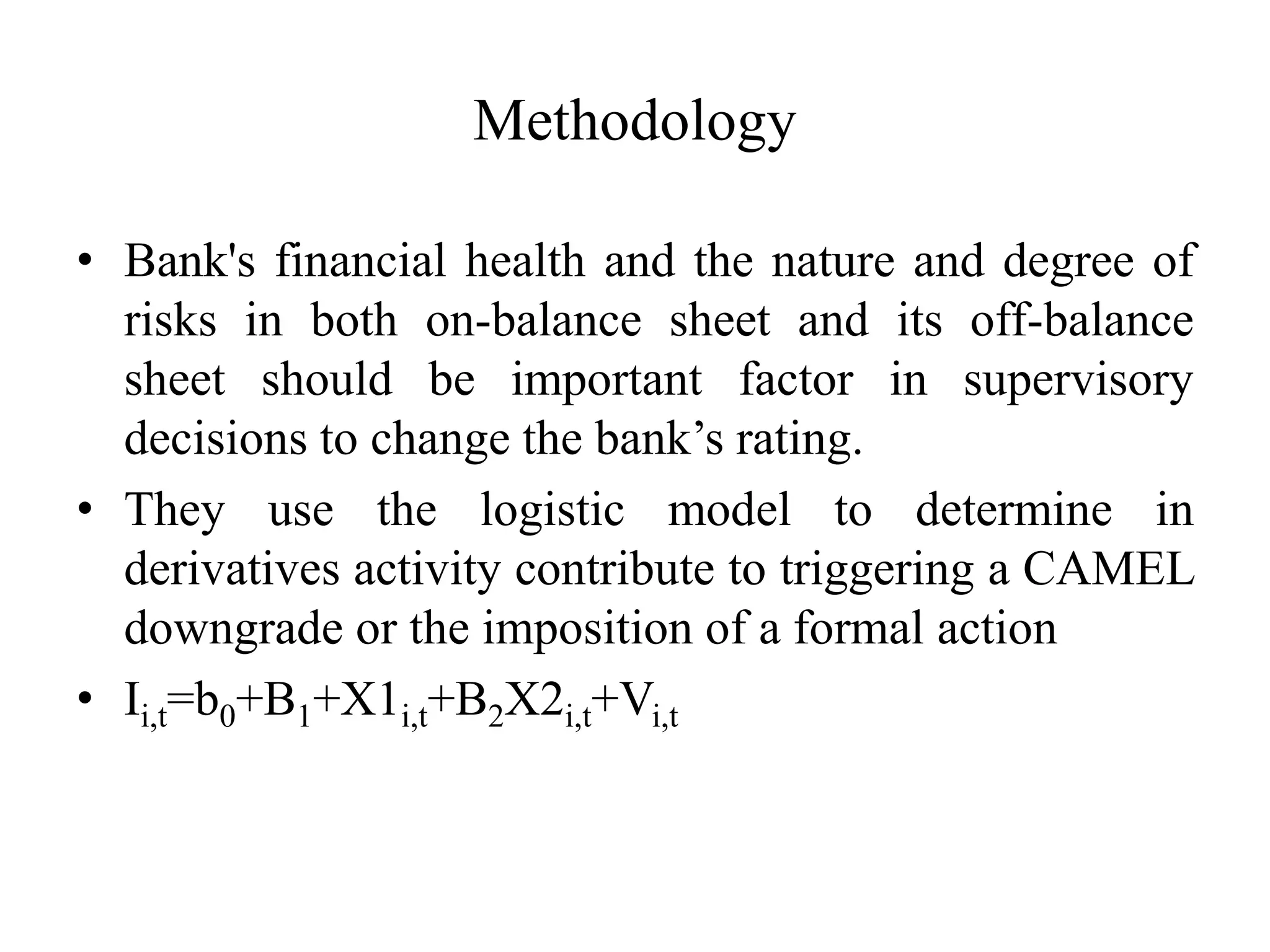

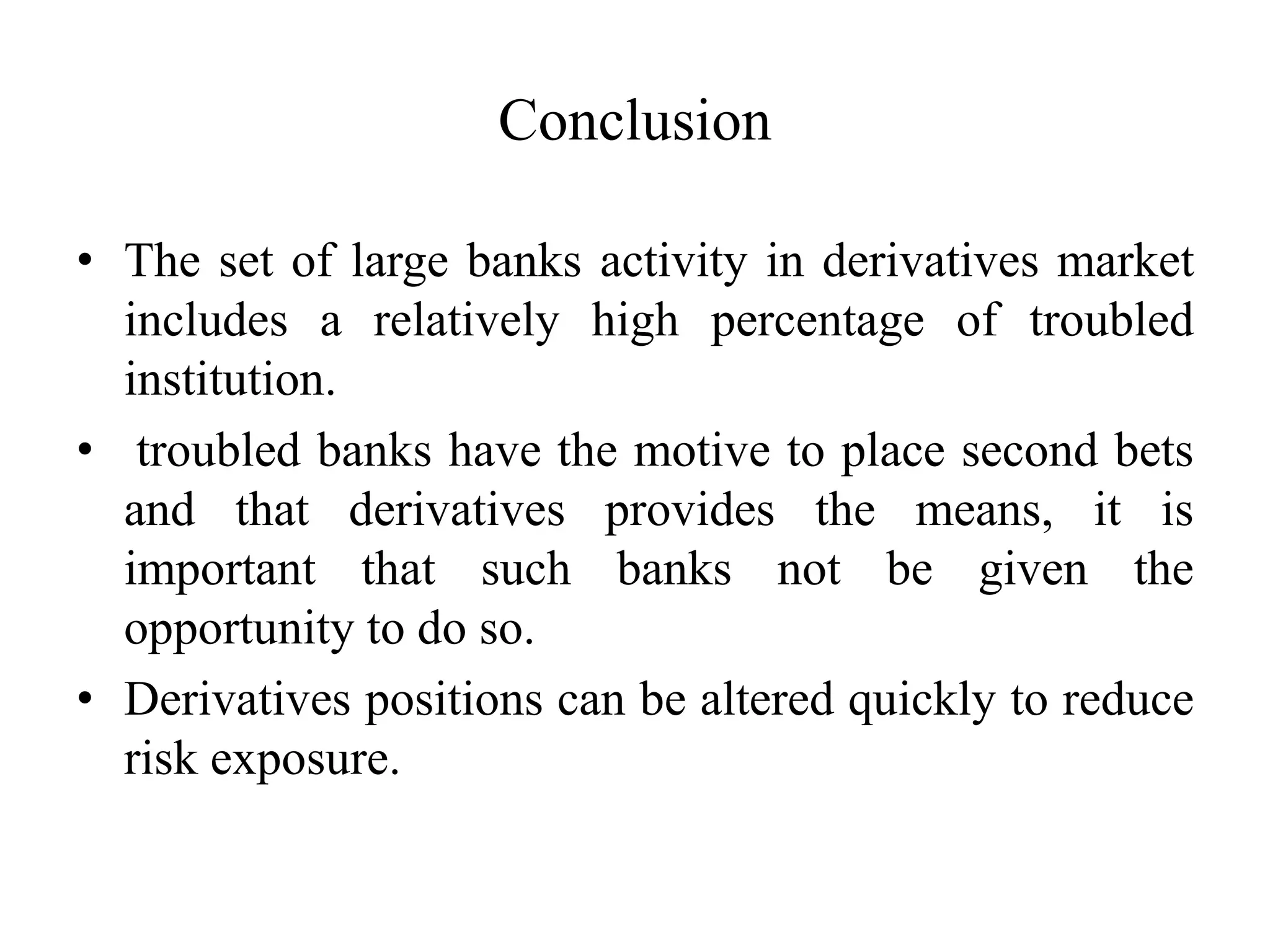

This document discusses derivative activity at troubled banks and regulatory oversight. It finds that while derivatives are important for hedging risks, troubled banks engage in higher levels of derivative activity which could enable speculative "second bets." However, the analysis found no evidence that derivative activity alone leads to regulatory actions, which instead focus on problems like poor lending. The document calls for regulators to more closely monitor derivative use at troubled banks to limit speculative behavior.