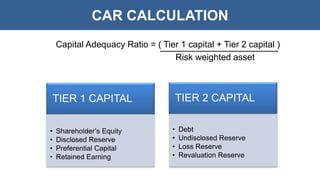

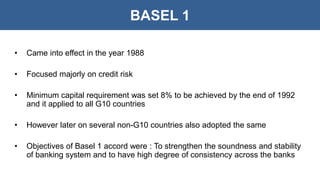

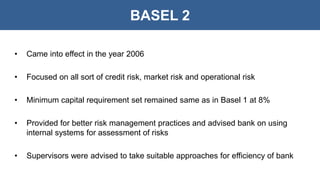

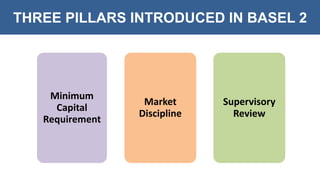

The document discusses the Basel norms developed by the Basel Committee to establish standardized prudential norms for capital adequacy in banks. It outlines the evolution from Basel 1, which focused on credit risk and set a minimum capital requirement of 8%, to Basel 2 and Basel 3, which expanded risk management practices and increased the minimum capital requirement to 9%. Key concepts include the capital adequacy ratio and the classification of loan assets for non-performing asset management.