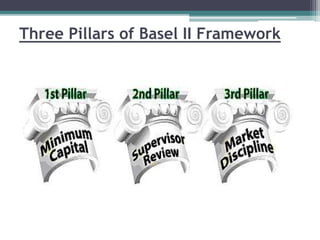

The document discusses the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision. It outlines Basel I, introduced in 1988, which focused on credit risk. Basel II, introduced in 2004, takes a three pillar approach focusing on minimum capital requirements, supervisory review, and market discipline. It aims to make capital requirements more risk sensitive. Some benefits of Basel II include improved risk management and efficiency, while challenges include lack of historical data and difficulty accounting for diversity across countries.