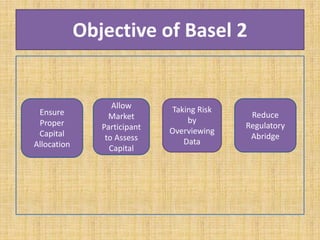

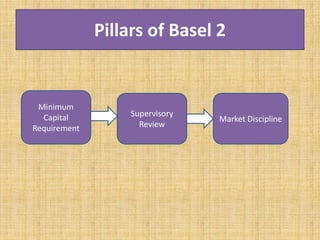

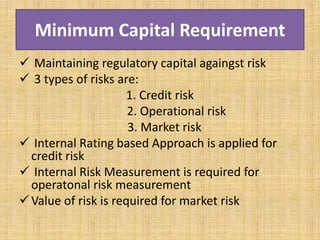

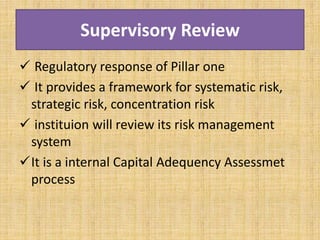

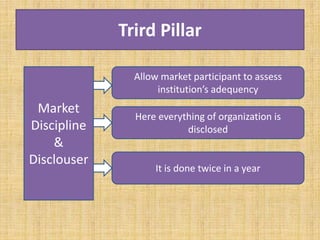

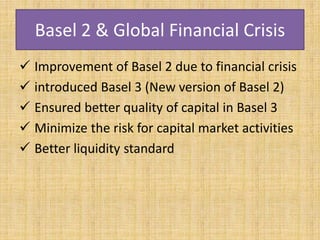

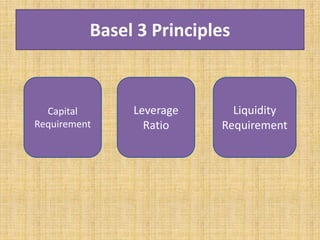

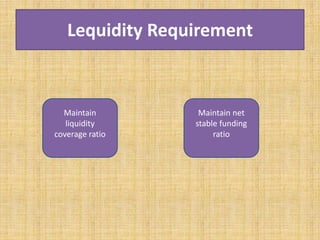

Basel 2 and 3 are international banking standards that establish capital reserve and liquidity requirements. Basel 2 was published in 2008 in response to bank failures, while Basel 3 was agreed in 2010-2011 to further strengthen regulations after the 2008 financial crisis. The goals are to reduce bank leverage and increase liquidity to minimize risks of future crises. Basel 2 and 3 implement three pillars - minimum capital requirements, supervisory review, and market discipline through disclosure. Basel 3 specifically focuses on bank reserves, risk sensitivity, and liquidity through ratios like the liquidity coverage ratio and net stable funding ratio.