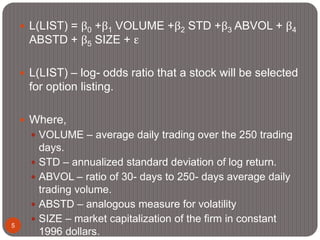

The document examines the characteristics that led to stocks being selected for option listing by exchanges from 1973 to 1996. A logit model was used to analyze how trading volume, volatility, and market capitalization related to the probability of option listing. The analysis found that exchanges were more likely to list options on stocks with higher trading volume and volatility. However, volatility became less important over time as the option markets matured. The same factors that predicted listing also predicted trading volume after listing.