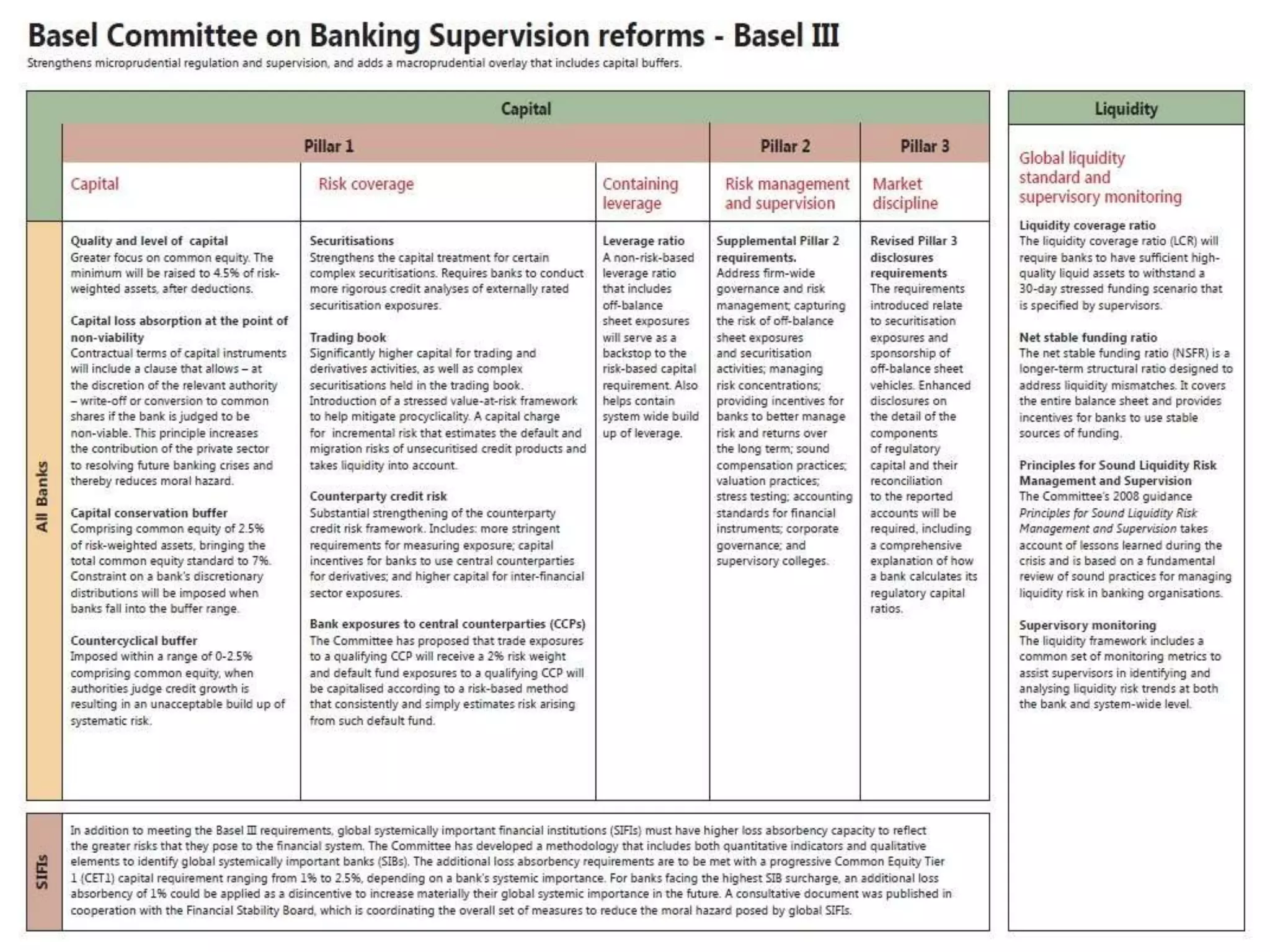

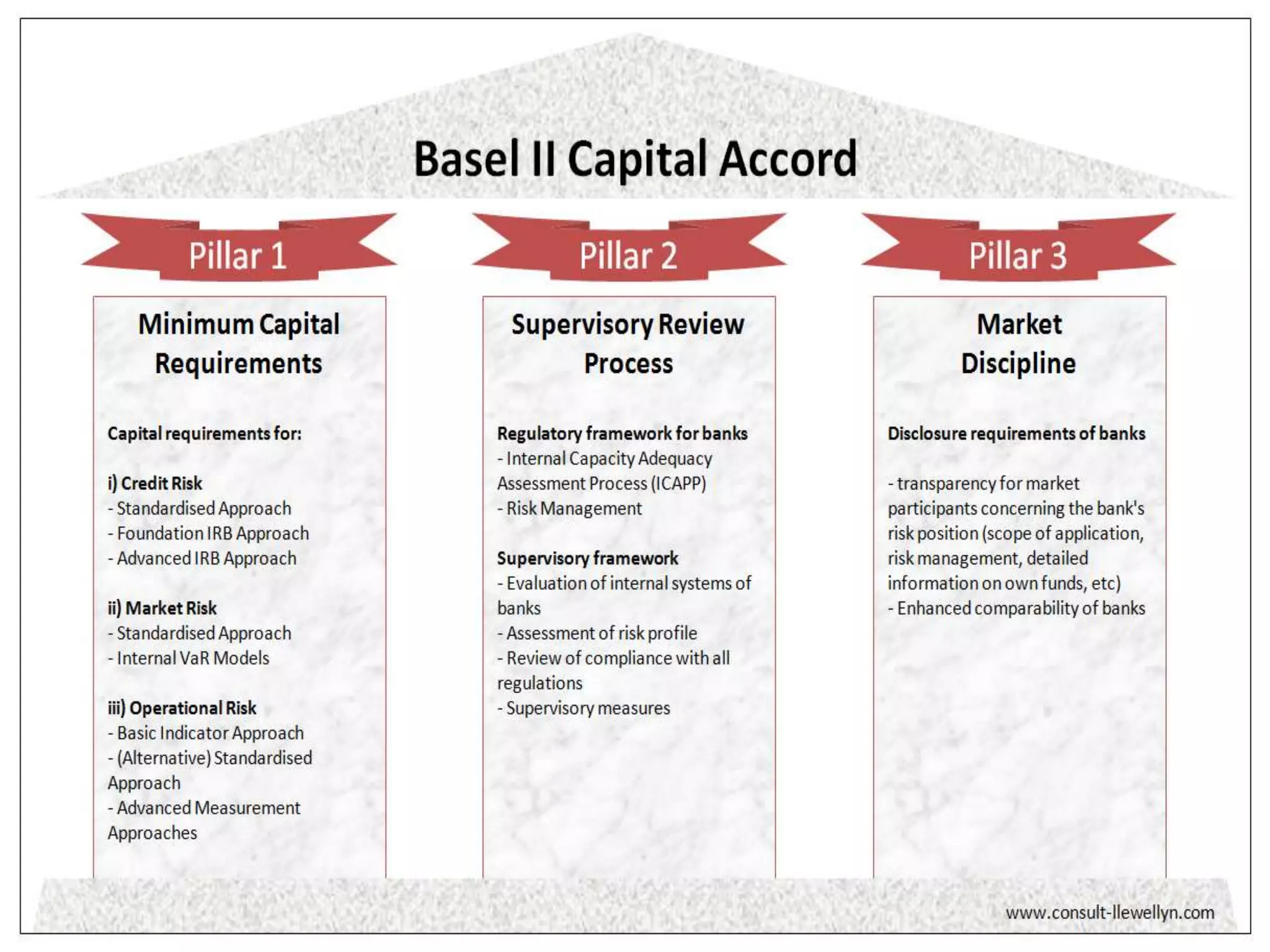

Basel III is a global regulatory framework that aims to strengthen bank capital requirements and introduces new regulatory requirements on bank liquidity and leverage. The document outlines the key elements of Basel III including the three pillars of capital adequacy, supervisory review, and market discipline. It discusses the challenges Indian banks may face in implementing the new capital, leverage, and liquidity requirements and how this may impact their profitability. The higher capital requirements under Basel III will be difficult for Indian banks, especially public sector banks, to meet and may require raising over 1.5 trillion rupees in additional capital.