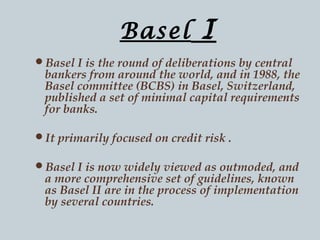

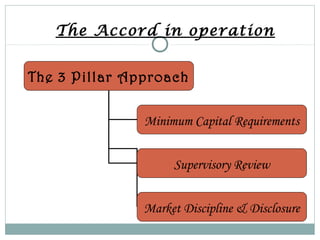

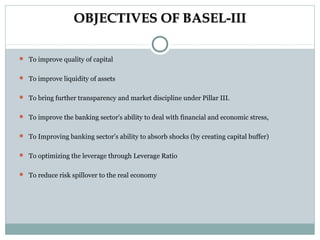

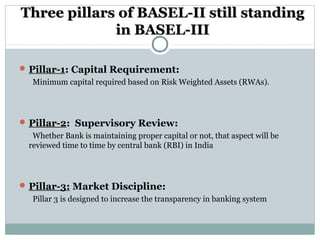

The Basel Committee was formed by central bank governors of G10 countries to enhance banking supervision worldwide. It is best known for its capital adequacy standards. Basel I (1988) focused on credit risk capital requirements. Basel II (2004) added operational risk and market risk requirements, and introduced three pillars for minimum capital standards, supervisory review, and market discipline. Basel III (2010) was introduced after the 2008 crisis to strengthen banks' capital reserves and introduce leverage ratios and liquidity requirements to improve financial stability. The three pillars of Basel II were retained in Basel III to balance bank stability and transparency.

![HISTORY OF BASEL COMMITTIEES

Basel I: the Basel Capital Accord, introduced in 1988 and focuses on

Capital adequacy of financial institutions.

Basel II: the New Capital Framework, issued in 2004, focuses on following

three main pillars

Minimum capital Standard [Minimum CAR ]

Supervisory review and

[Review by central Bank RBI, on time to time]

Market discipline,

[Review by market, stake holders, customer, share holder, gvt etc]

Basel III: Basel III released in December, 2010, (implementation till March 31, 2018)"Basel

III" is a comprehensive set of reform measures in,

regulation,

supervision &

risk management of the banking sector.](https://image.slidesharecdn.com/baselcommittee-140211110815-phpapp02/85/Basel-committee-3-320.jpg)