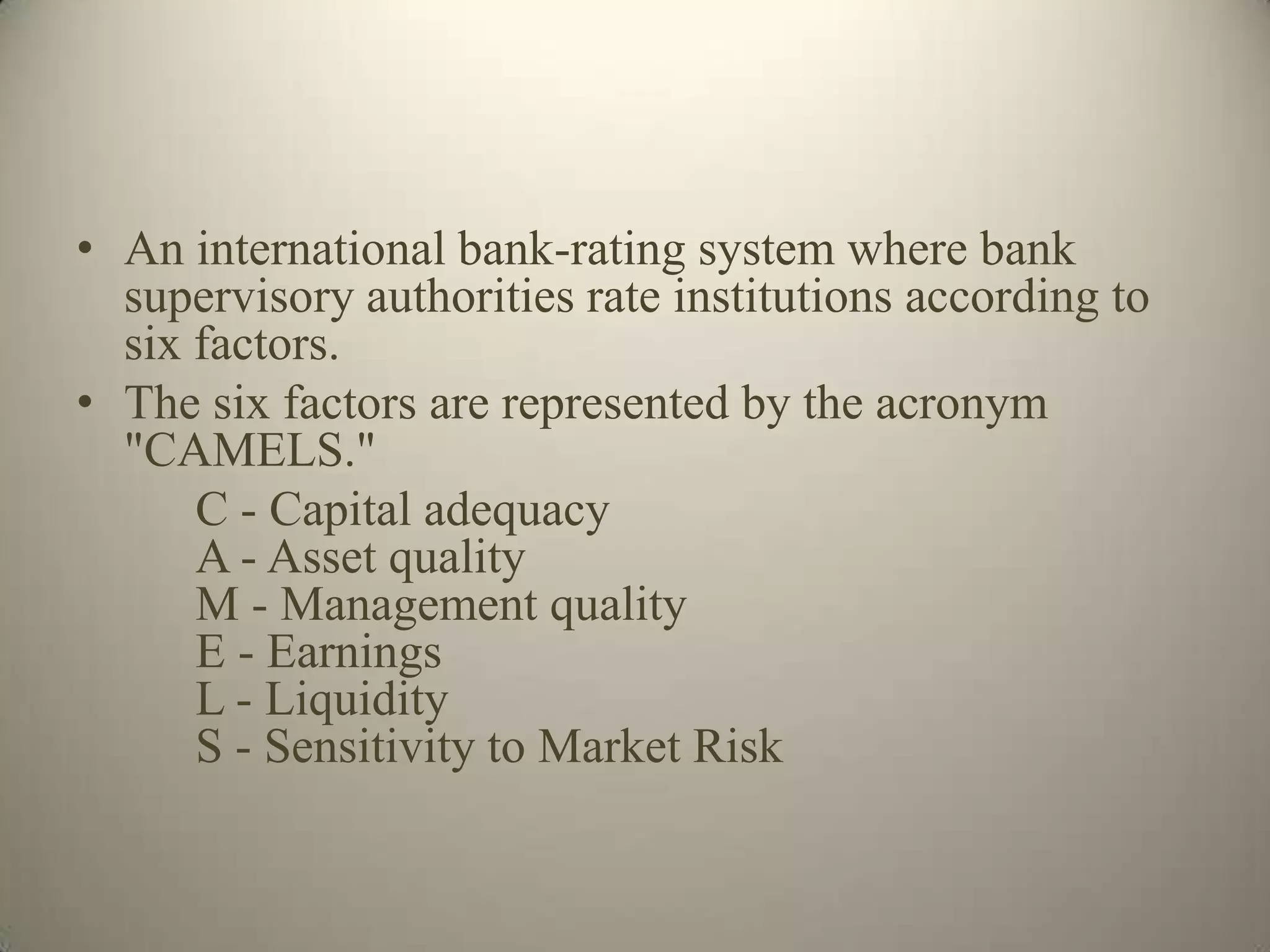

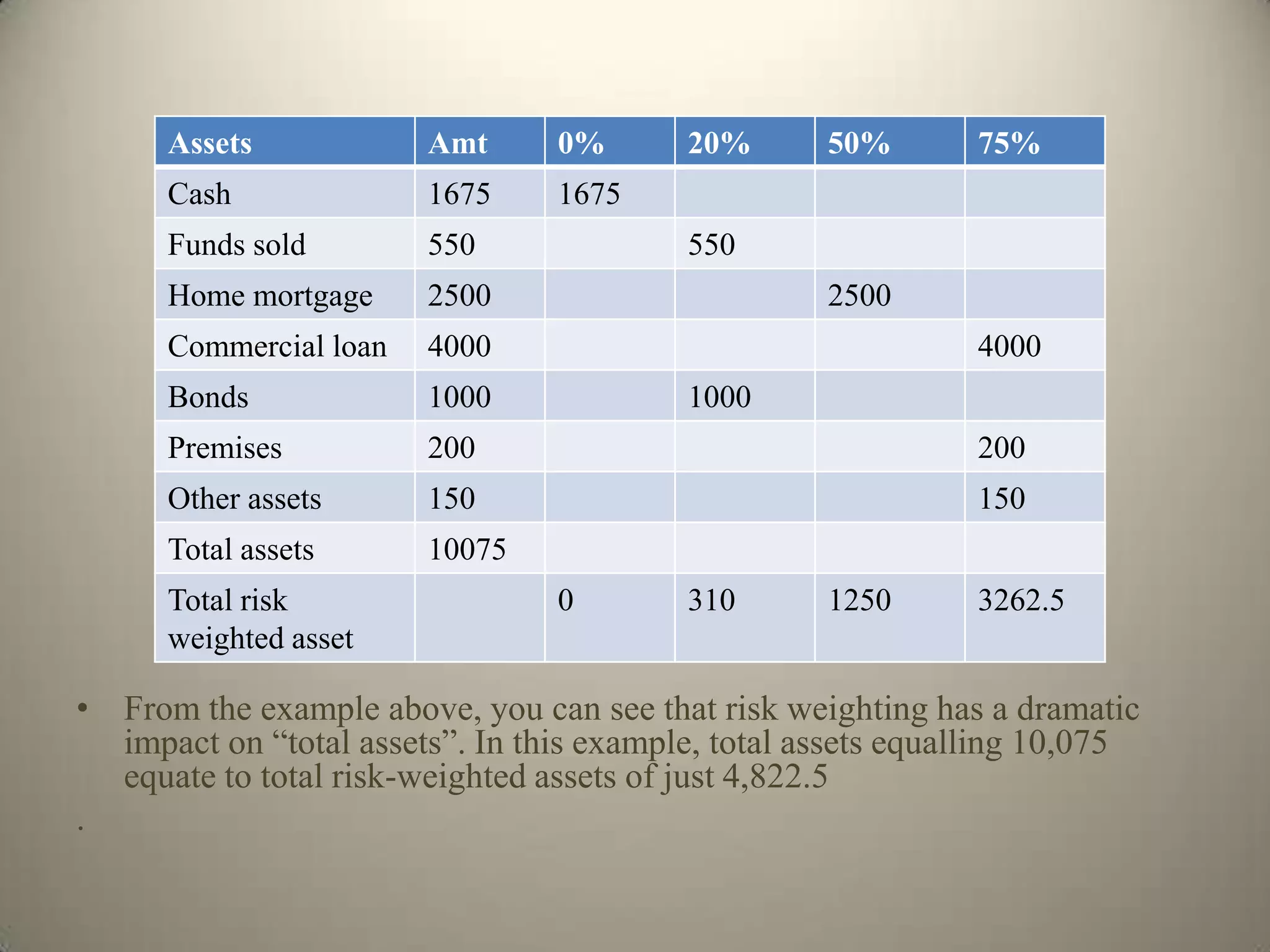

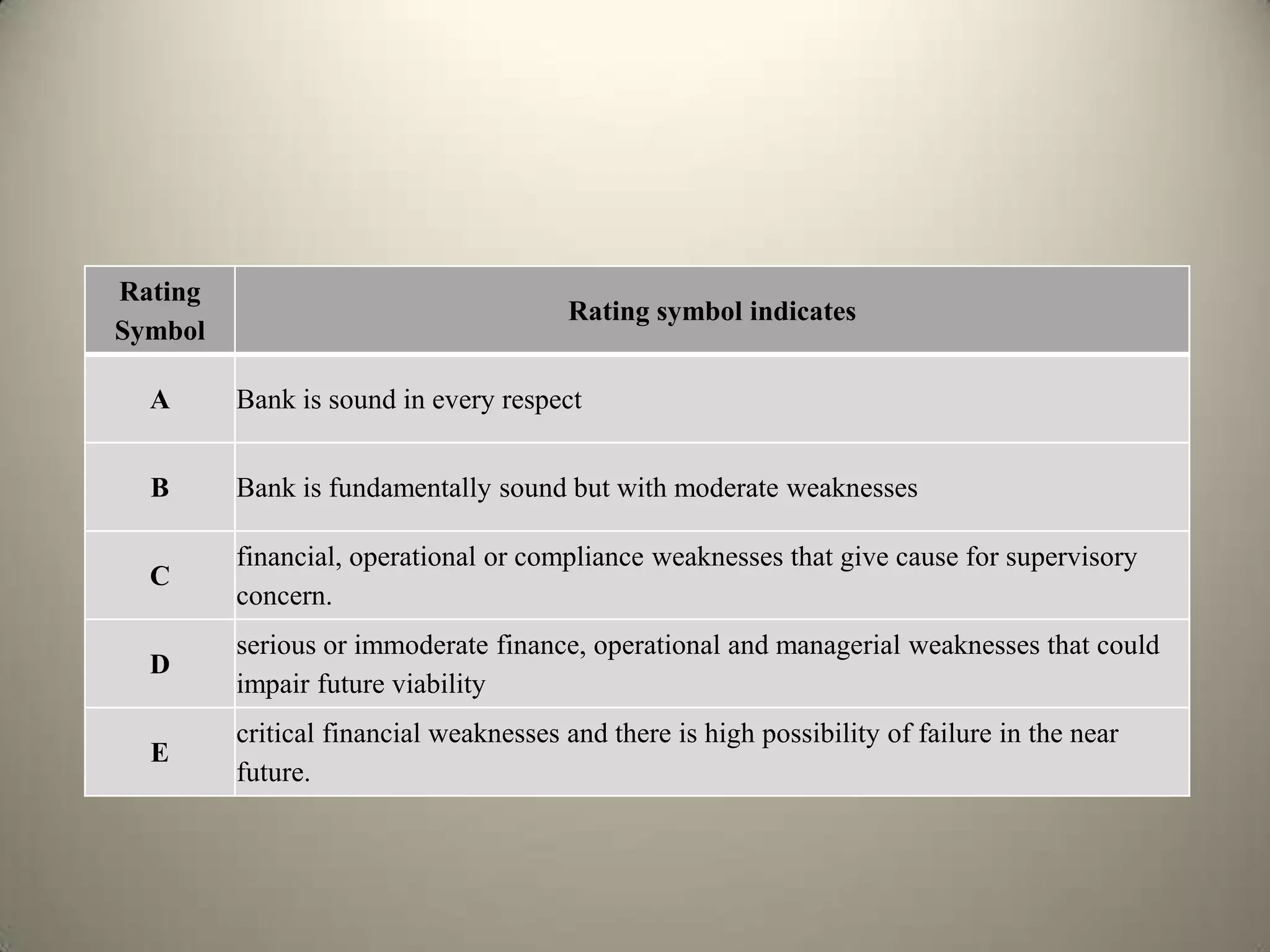

The CAMELS approach is used internationally to evaluate bank risk across six key factors: Capital adequacy, Asset quality, Management quality, Earnings, Liquidity, and Sensitivity to market risk. Ratings are assigned on a scale of A to E based on an assessment of each factor, with A indicating a sound bank and E indicating a bank with critical weaknesses and high risk of failure. The document provides details on how each CAMELS factor is evaluated.