This document discusses key concepts in bank management including:

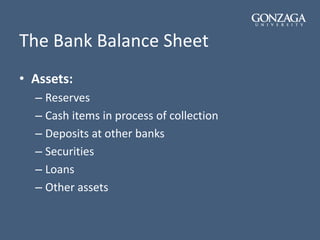

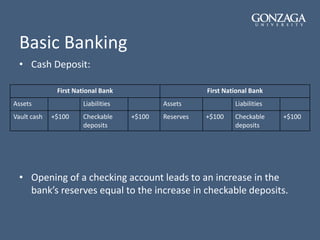

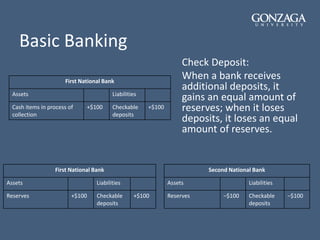

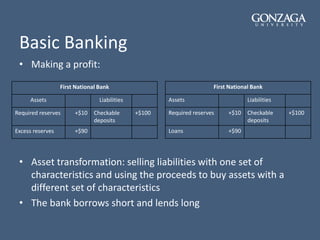

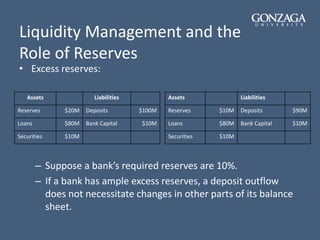

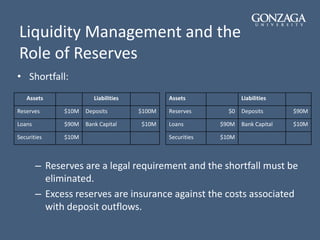

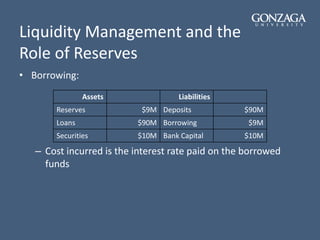

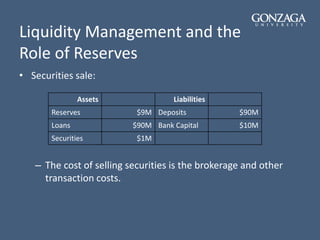

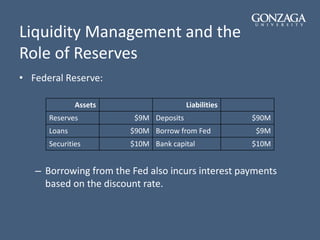

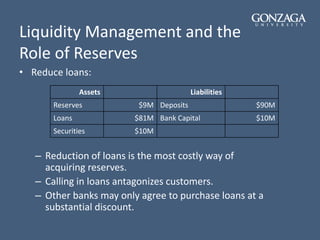

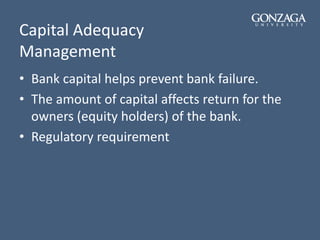

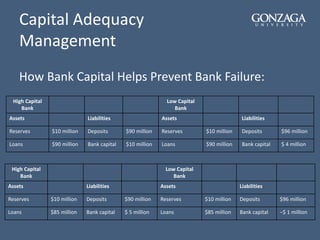

- The features of a bank balance sheet including assets like loans and securities, and liabilities like deposits and capital.

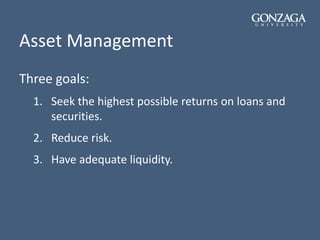

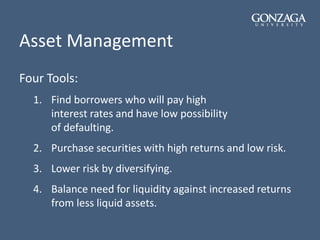

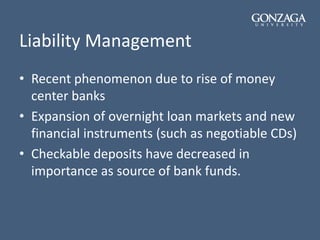

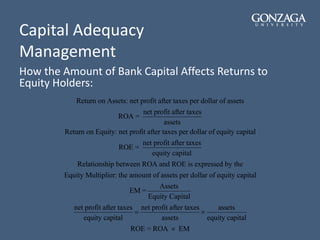

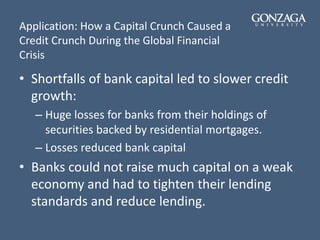

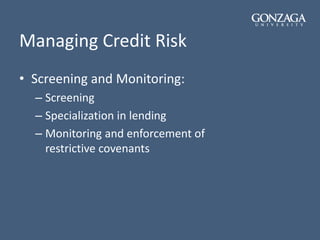

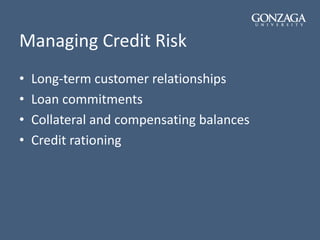

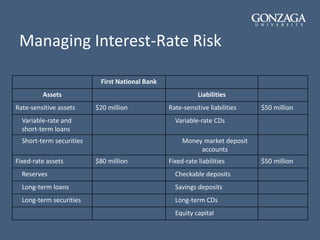

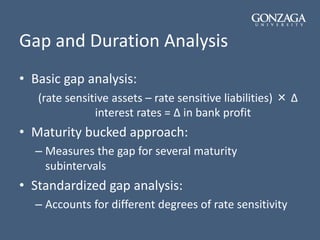

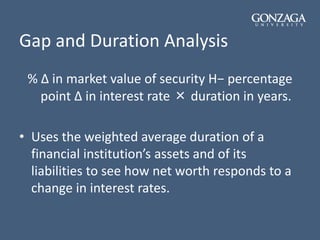

- How banks attempt to maximize profits through asset and liability management, managing liquidity, credit risk, and interest rate risk.

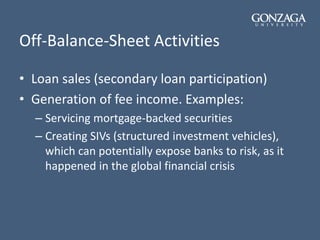

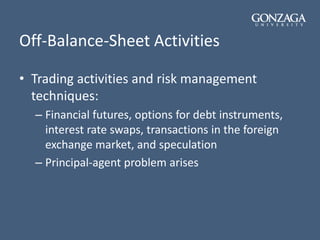

- Off-balance sheet activities allow banks to generate fee income but also expose them to additional risks if not properly controlled.