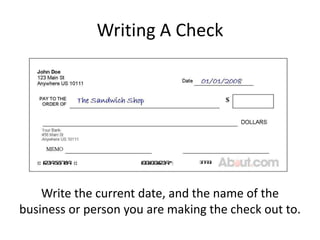

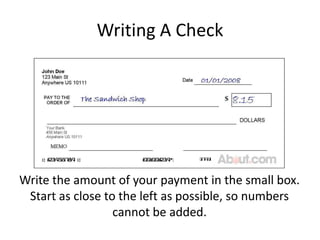

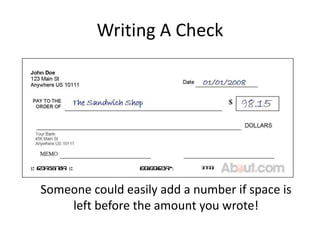

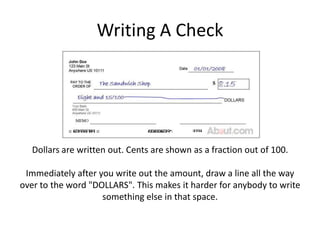

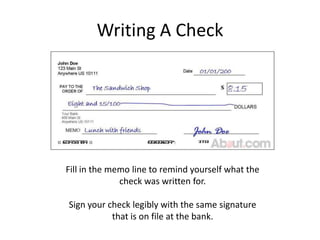

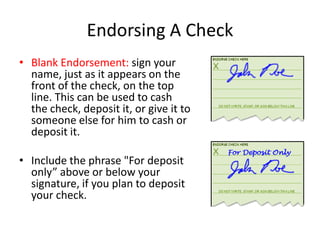

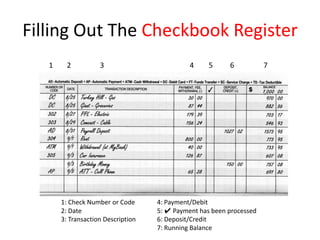

Banks are for-profit institutions that earn money through services like savings accounts and loans, while credit unions are non-profit cooperatives owned by members. Savings accounts provide interest income and have an annual percentage rate typically around 1-2%. Compound interest is better than simple interest since it earns interest on both the principal and accumulated interest over time. Certificates of deposit offer higher interest rates than savings accounts but may charge penalties for early withdrawals. Checking accounts allow purchases, payments and cash withdrawals, while overdraft protection can cover purchases made with insufficient funds for a fee. Proper check writing and endorsement procedures help prevent fraud. Maintaining an accurate check register is important for tracking account balances and transactions.