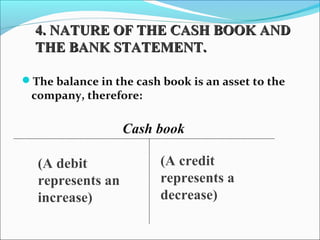

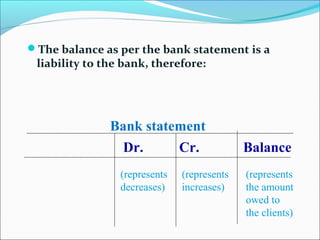

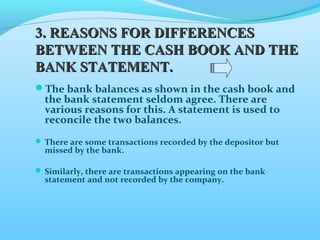

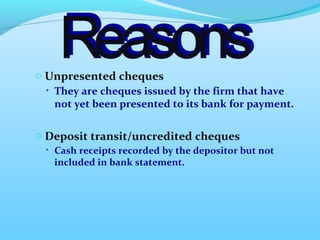

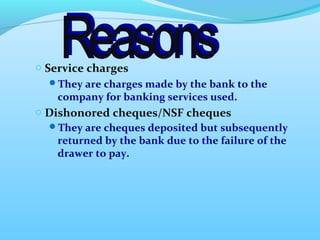

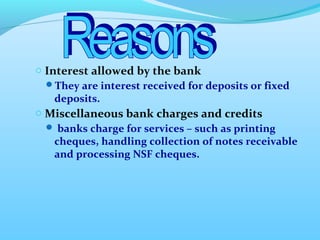

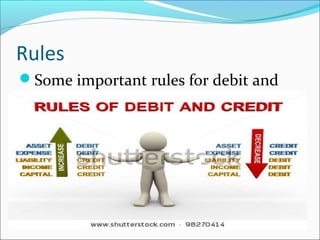

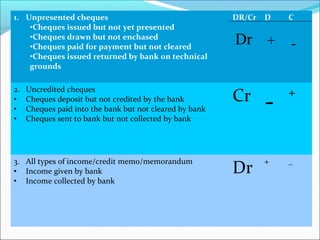

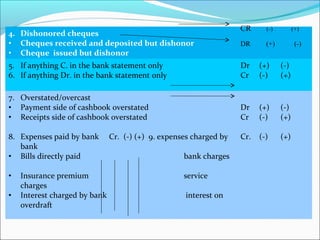

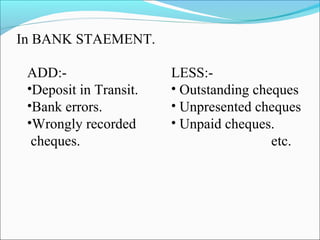

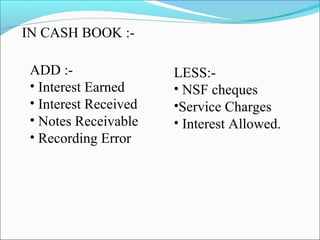

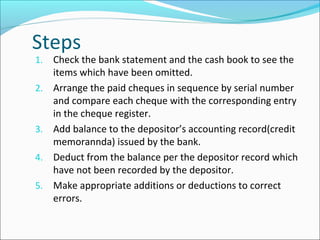

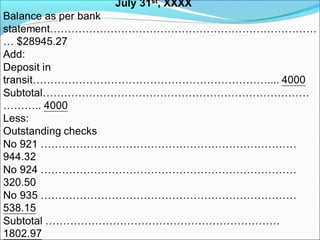

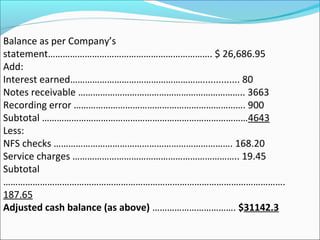

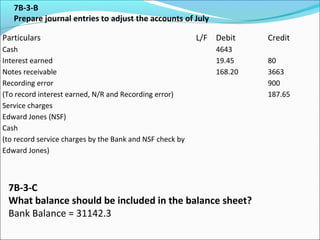

This document discusses bank reconciliation statements. It defines a bank reconciliation statement as a schedule that reconciles any differences between the bank balance shown on the bank statement and the cash book. The document outlines reasons for differences between the two balances, including unpresented checks, uncredited deposits, and bank charges. It provides rules for debiting and crediting items in a bank reconciliation statement and steps to prepare the reconciliation, including identifying omitted transactions and adjusting entries to make the balances agree.