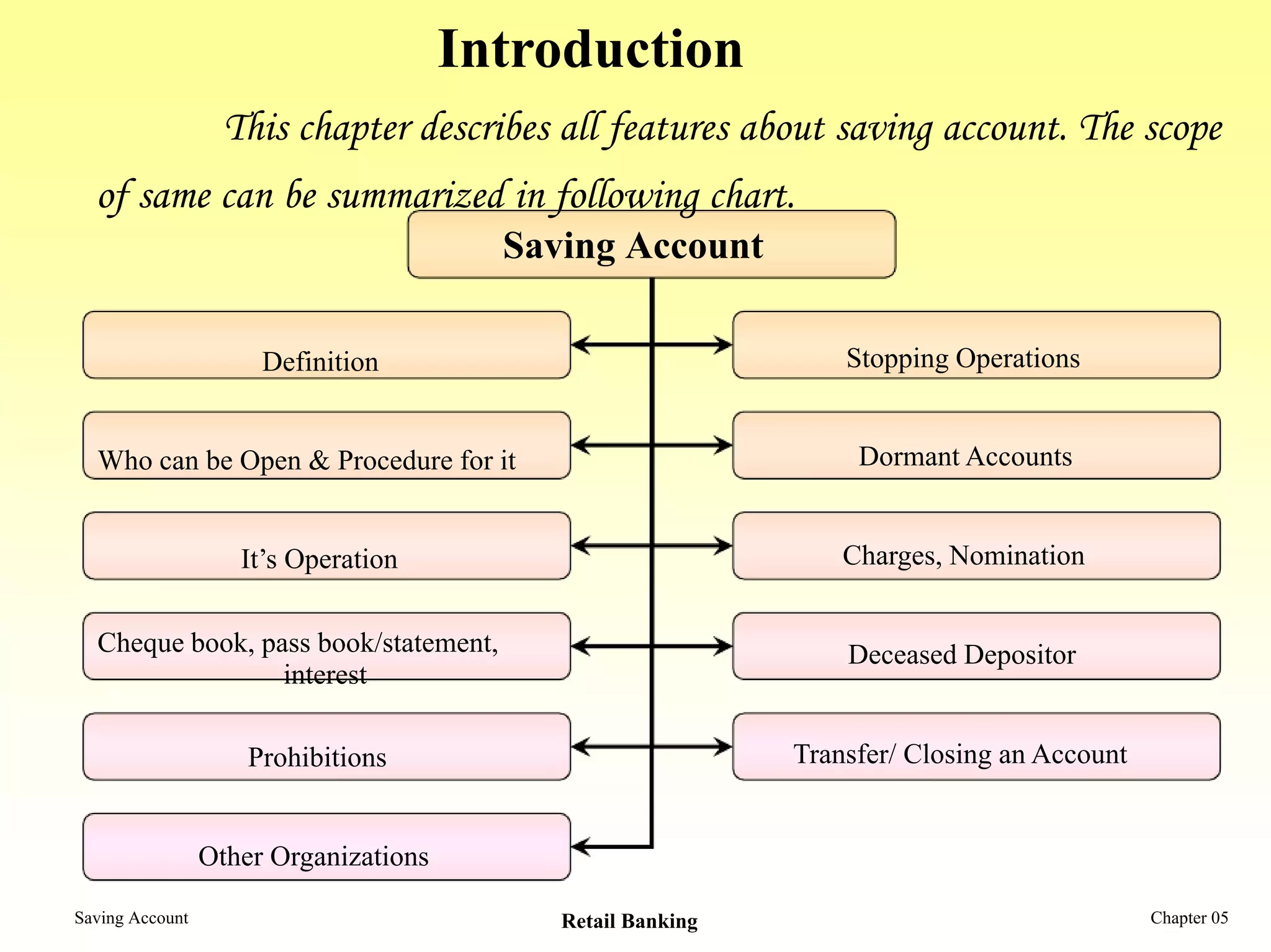

This document provides a comprehensive overview of savings accounts in retail banking, covering their definition, eligibility, operational procedures, and associated features such as interest rates and nomination processes. It outlines who can open an account, the procedures involved, the rules regarding dormant accounts, and conditions for closing accounts. Additionally, it discusses the treatment of deceased depositors and relevant regulations and prohibitions governing savings accounts.