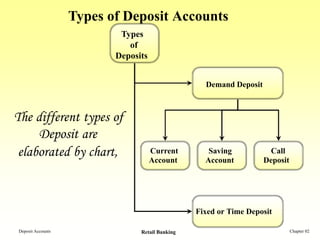

This document discusses the various types of deposit accounts offered by banks, highlighting their importance in the banking sector. It categorizes deposits into demand deposits—such as current accounts, savings accounts, and call deposits—and fixed deposits, which require a specified period before withdrawal. The relationship between banks and customers begins with the opening of a deposit account, reflecting the banks' role in fulfilling customers' financial needs.