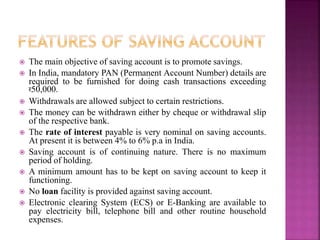

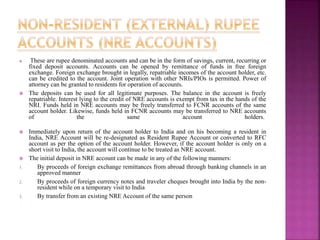

Commercial banks rely mainly on deposits to fund their operations. They accept various deposit types like current accounts, savings accounts, fixed deposits, and recurring deposits. Current accounts are meant for businesses and offer chequebook facilities and overdrafts but no interest. Savings accounts encourage personal savings and offer modest interest rates. Fixed deposits allow higher interest for locking away funds longer, while recurring deposits build savings with regular installments. Non-resident accounts serve Indian citizens living abroad.