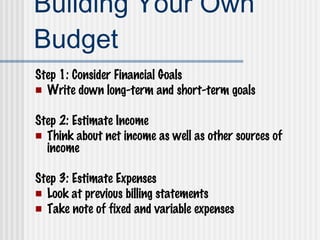

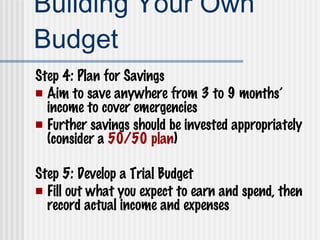

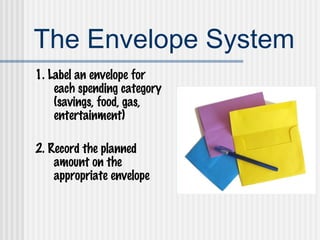

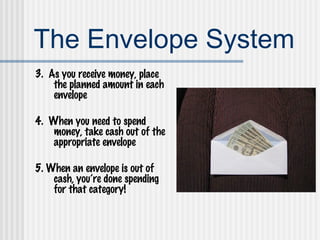

The document discusses budgeting and saving for teenagers. It provides statistics that on average teenagers earn $80 per week from a job paying $5.70 per hour working 15 hours. Teenagers spend over $155 billion annually, with girls spending $91 per week and boys $87. Having a budget helps manage income and expenses to avoid debt and save for goals. The document recommends estimating income and expenses, planning for savings and emergencies, and using the envelope system to manage spending categories.