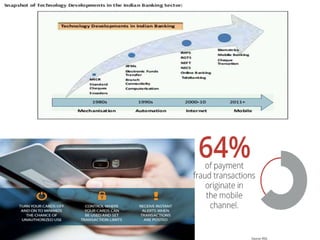

The document provides an overview of internet banking, its history, services, types, advantages, and disadvantages. It outlines the functionalities offered by banks, including fund transfers, bill payments, and security measures like OTPs. Additionally, it highlights operational issues such as technology and security risks, while explaining the categorization of internet banking into information-only, electronic information transfer, and fully electronic transactional systems.