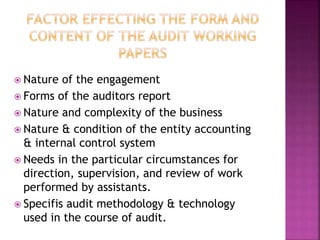

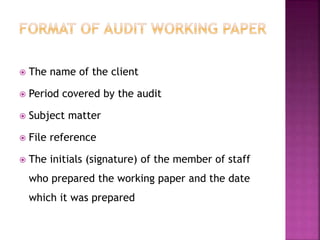

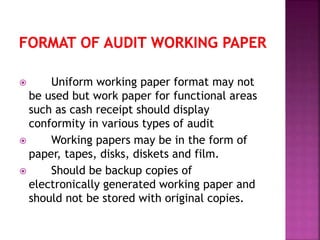

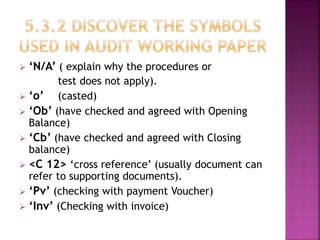

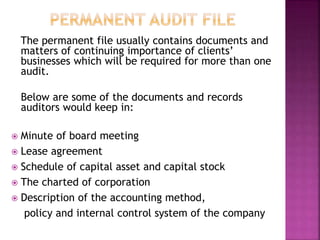

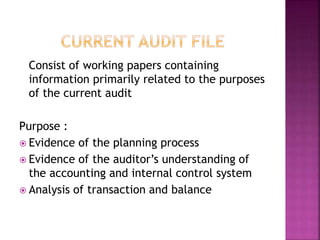

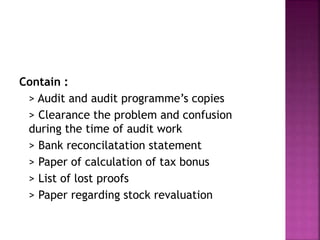

The document discusses audit documentation and working papers. It defines audit documentation as evidence of the auditor's work, including the basis for conclusions and compliance with standards. It notes that audit documentation provides evidence of planning and performance. It also defines internal and external documentation. The document then discusses the purpose and contents of audit working papers, including planning, supervision, and supporting the auditor's opinion. It provides examples of common working paper components and formatting conventions.