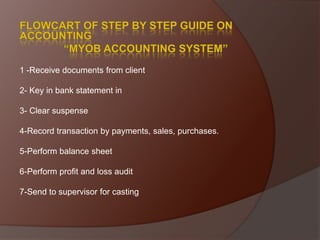

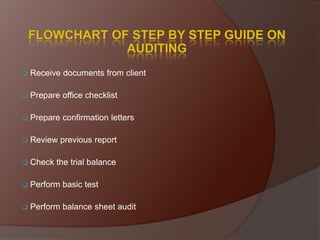

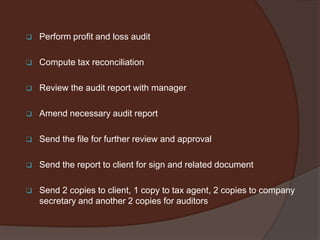

Nur Dalila completed her practicum from June to November 2013 at AJ Isma & Partners. She was attached to the accounting department where she performed tasks like maintaining accounts using MYOB software, updating client accounts, and preparing financial statements. She also assisted in the auditing department by filling audit checklists, preparing working papers and draft audit reports. Additional administrative duties included courier runs, phone reception, and office cleaning. The practicum provided hands-on experience in accounting and auditing skills as well as professional work experience.