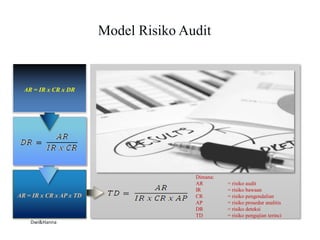

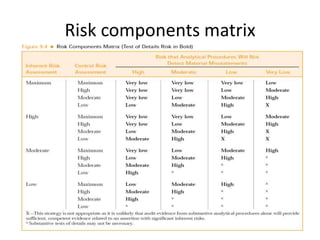

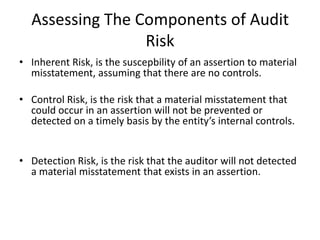

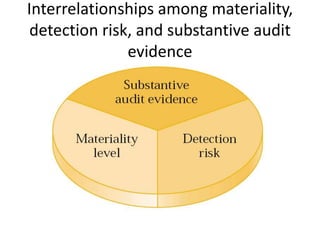

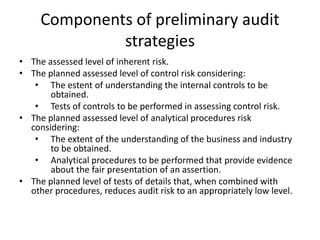

This document discusses audit risk and its components. It defines audit risk as the inverse of reasonable assurance, usually set at 1% if 99% certainty is desired. Audit risk is determined by inherent risk, control risk, and detection risk. The document outlines procedures for assessing fraud risk, including making inquiries of management, performing analytical procedures, examining unusual relationships, and brainstorming among audit team members. It also discusses the interrelationships between materiality, detection risk, and substantive audit evidence in the audit process.