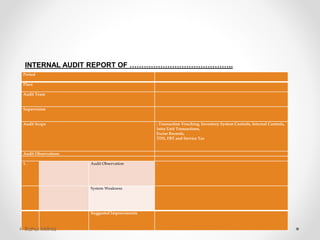

The document discusses internal audit, providing definitions, objectives, principles and need. It defines internal audit as an independent function that appraises an entity's operations to strengthen governance and risk management. The scope of internal audit includes reviewing accounting and controls, ensuring efficiency and compliance. It is needed due to increased business size, regulations, and technology usage. Internal audit adds value through risk management, assurance, compliance and fraud prevention. Key principles are integrity, objectivity, independence and professional care. The Companies Act 2013 requires certain public and private companies to appoint internal auditors.