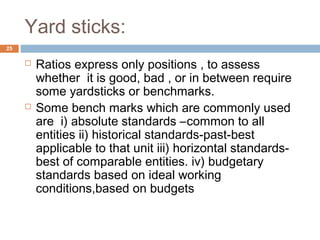

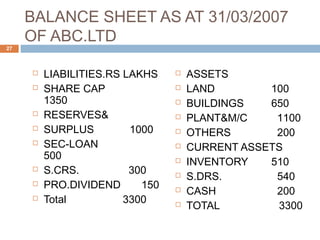

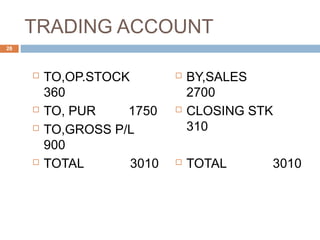

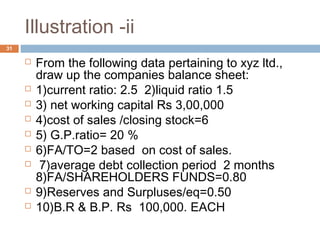

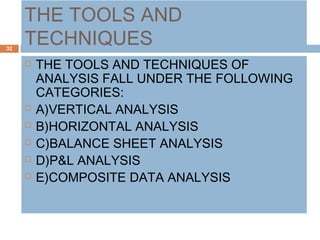

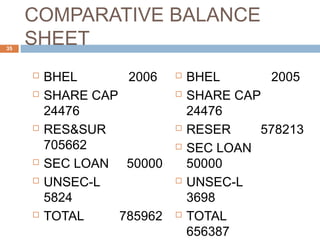

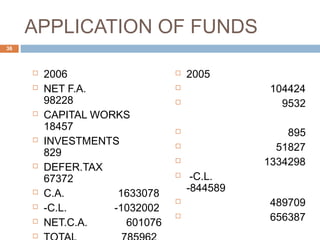

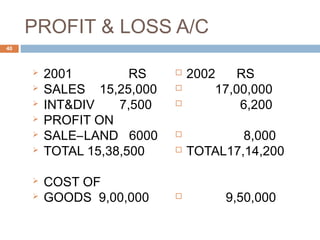

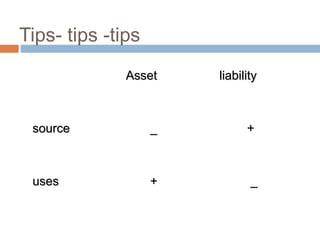

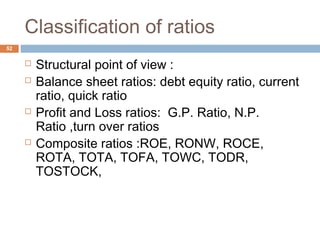

This document provides an introduction to a course on financial management. It outlines the syllabus which will cover topics such as financial statements, ratio analysis, working capital management, time value of money, capital budgeting, and cost of capital. The document explains what will be included in each section of the syllabus. It also presents some introductory information on key financial concepts like the balance sheet, income statement, assets, liabilities, and cash flow statements. Rules for the course emphasize the importance of group work and that the lecturer acts as a facilitator rather than teacher.