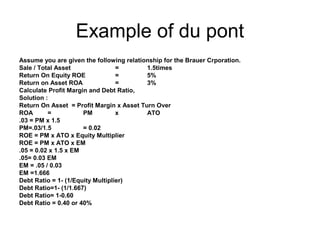

This document discusses various financial ratios and benchmarks that can be used to analyze a company's financial performance. It provides an example calculation of profit margin and debt ratio using the DuPont analysis method. It also discusses benchmarking against peer companies or industry averages to establish performance standards for comparison. Finally, it notes some limitations and problems with relying solely on ratio analysis to evaluate a company's financial health.