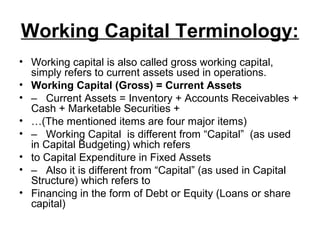

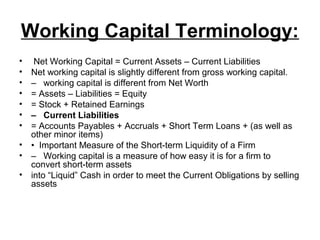

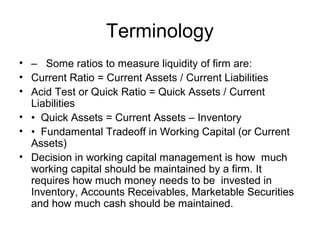

- Working capital management focuses on a company's current assets and current liabilities. It aims to optimize the amount of funds tied up in short-term assets to balance liquidity needs with reducing opportunity costs.

- Key components of working capital include cash, inventory, accounts receivable, and accounts payable. Companies must determine the optimal level of each based on their sales levels and growth strategies.

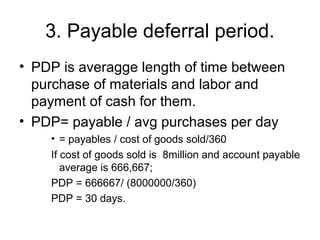

- There are three main approaches to working capital management: relaxed, moderate, and restricted. The cash conversion cycle model also examines how long it takes for a company to convert cash outflows on inventory into cash inflows from sales.