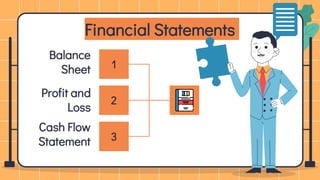

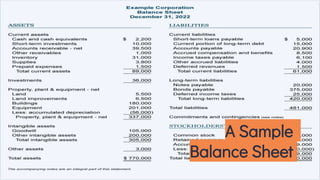

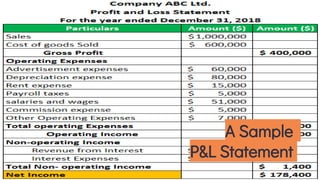

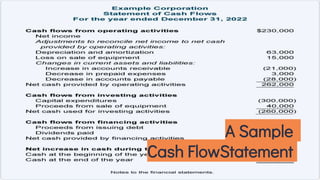

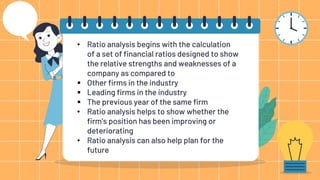

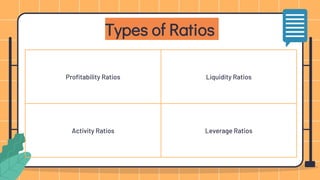

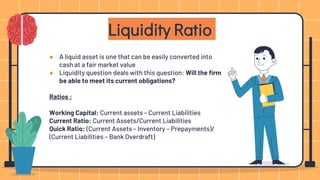

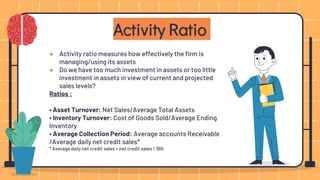

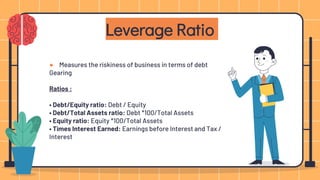

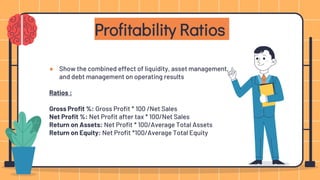

This document summarizes a workshop on financial statement analysis. It outlines the key topics to be covered, including an overview of financial statements like the income statement, balance sheet, and cash flow statement. It will discuss how to analyze these statements, including through the use of ratios, in order to evaluate a company's performance and identify strengths and weaknesses. The workshop will address how to properly interpret financial data and ratios, and limitations to consider, such as differences in accounting treatments between companies.